USD Analysis (DXY)

- Better economic data adds to the concerns of recent dollar drivers

- US Treasury yields rose as interest rate forecasts anticipate an outside opportunity for another 25 basis point hike from the Federal Reserve

- DXY easily breached 103.0, eyeing March high near 105.65

- The analysis in this article is used chart patterns and key Support and resistance levels. For more information visit our comprehensive website Educational library

Recommended by Richard Snow

Get free forecasts in US dollars

Initial jobless claims print easily better after last week’s larger print

Last week’s Initial Jobless Claims raised many eyebrows after reaching 264K, suggesting that more tightening financial conditions are beginning to weigh on the labor market, reducing chances of another rate hike from the Fed. However, this week’s print came in at 242K, short of the consensus of 254K. Meanwhile, the Philadelphia Manufacturing Index came in the least followed at -10.4 vs. forecasts of -19.8. The health of the manufacturing sector appears to have taken a sharp downward turn after the New York Empire State Index fell unexpectedly to 031.8 in May from 10.8 in April.

Customize and filter live economic data via DailyFX Economic calendar

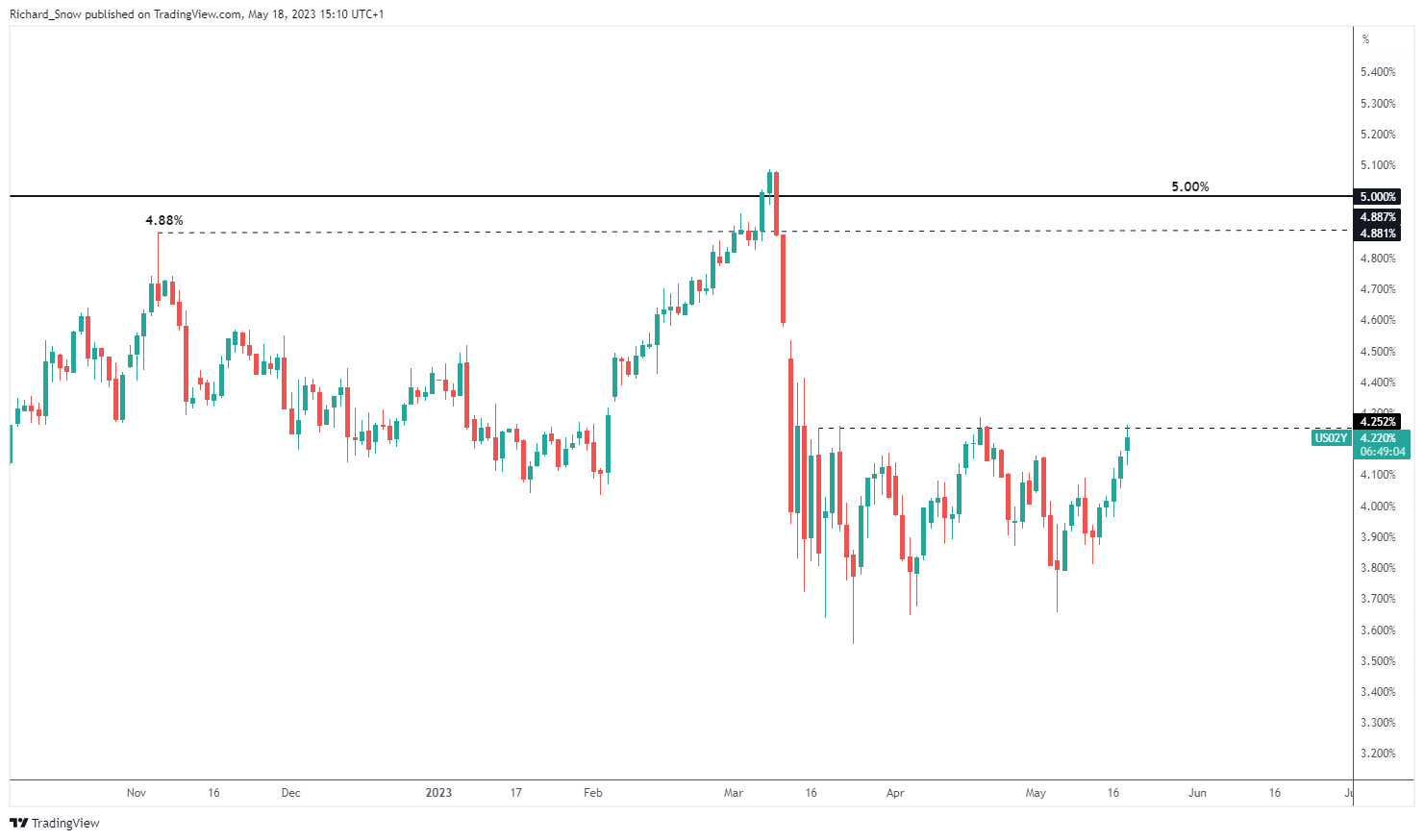

US yields helped the dollar’s bullish momentum

The more interest rate sensitive 10-year Treasury yields continued to rise in the early US session, helping the dollar (DXY) rally.

Daily chart of the two-year US Treasury yield

Source: TradingView, prepared by Richard Snow

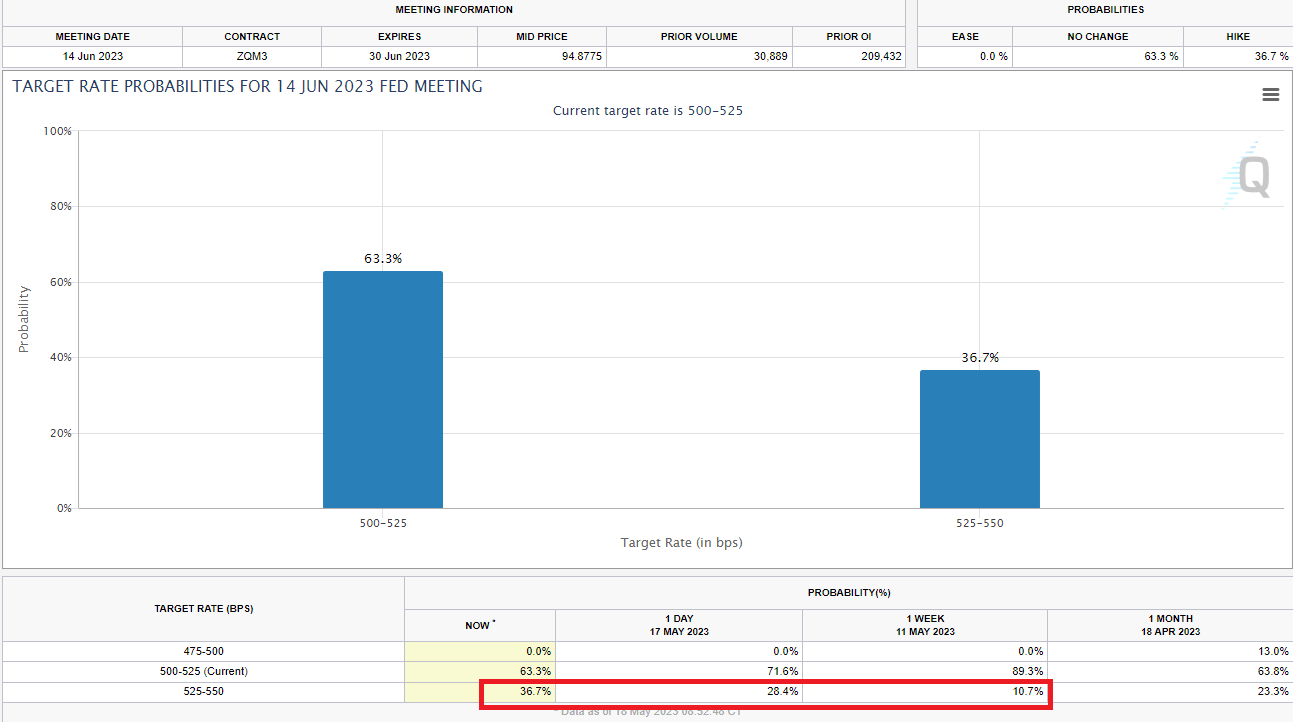

With the ebbs and flows of fundamental data, we are likely to see mixed market reactions, however, the dollar’s recent trend has been one-sided. At first, the dollar seemed to be driven by uncertainty about a default in the US due to the failure to agree to raise the debt ceiling. Now, the dollar price appears to be more likely for another 25 basis point hike as FedWatch tool reveals below. Markets now expect a 36% chance that we will get another hike in June, compared to just 10% a week ago.

CME FedWatch tool

Source: CME FedWatch Tool, prepared by CME FedWatch Tool Richard Snow

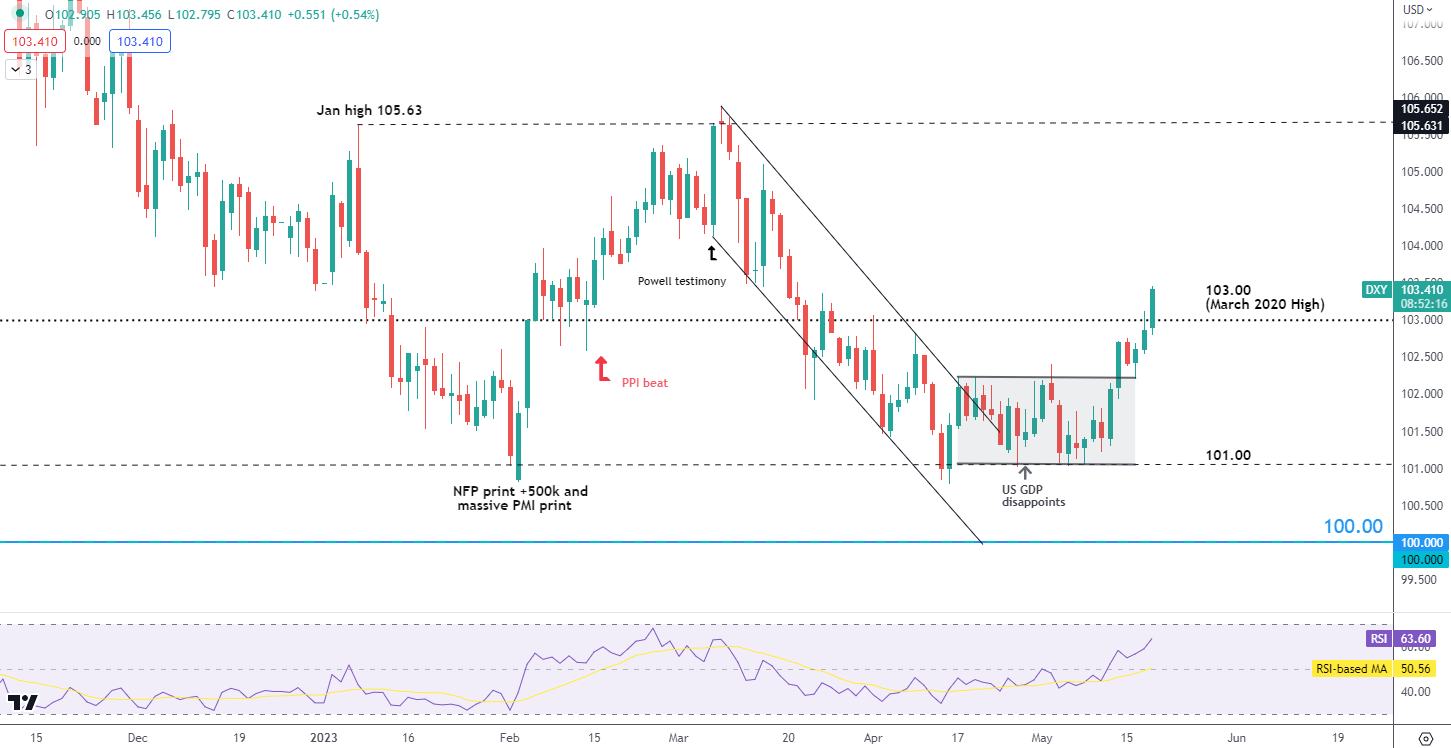

DXY Technical Analysis

The basket of the US dollar has been rising since the latter stages of last week and has not looked back. After breaking out of the horizontal channel, the index made an attempt to trade above 103.00 – a level that has come into play several times in 2023. Today’s continued bullish momentum has sent DXY above 103, showing few signs of abating.

Should DXY close above 103, that would highlight the January and March peaks which appear within striking distance at 105.65 and 105.88 respectively. If DXY closes above 103, then naturally it becomes relevant as the nearest support level followed by the upper bound of the horizontal channel, around 102.25 and then flat 101.00. The huge momentum of the current move may soon overheat the market – the RSI can be used as a gauge for this.

USD Basket Daily Chart (DXY)

Source: TradingView, prepared by Richard Snow

– Posted by Richard Snow for DailyFX.com

Connect with Richard and follow him on Twitter: @employee