ECB Governing Council member Pierre Funche still sees risks to consumer prices – including a weakening of the euro if monetary policy deviates too far from the US.

Article content

(Bloomberg) — European Central Bank Governing Council member Pierre Funche still sees risks to consumer prices — including a weaker euro if monetary policy deviates too far from the United States.

“There remain significant risks around the path of wage growth and inflation in wage-intensive services,” said the Belgian central bank governor, who urged caution even with the possibility of interest rate cuts starting this year. “Now is not the time to commit to a predetermined course of action.”

Advertisement 2

Article content

Article content

Speaking on Wednesday at the Central Banking Center in Frankfurt, Funch said that “one of the unknowns remains the role of the exchange rate and the risk of imported inflation.” He said that the divergence in economic conditions and policies in the eurozone and the United States “may lead to significant effects on the dollar’s exchange rate against the euro.”

ECB officials, including Wunsch, have indicated they will start cutting borrowing costs at their June meeting after a series of increases. What happens next is less clear and more controversial, with many analysts also speculating about how a potential delay in easing restrictions in the United States will affect the eurozone.

“While monetary policy tightening has been remarkably synchronized across the world, easing cycles seem unlikely to show similar synchronization,” Funsch said.

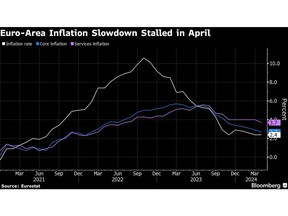

Although inflation in the 20-nation bloc stalled for the first time this year at 2.4% in April, the core measure that excludes volatile items including energy and food continued to decline. More importantly, services inflation slowed after remaining at 4% for five consecutive months.

Advertisement 3

Article content

Chief economist Philip Lane said on Monday that recent euro zone data made him more confident that inflation was returning to the 2% target – describing the easing of pressures on services as “an important initial step in the next phase of lowering inflation.”

“Although the outlook remains hazy, I see a path for interest rate cuts to begin this year,” Funch said. He said that at the June meeting “more will be learned” about the dynamics of wages and services. But he also reiterated that at some point the ECB must make a decision – even if uncertainty persists.

With “no sign of unwinding” of longer-term inflation expectations, “the costs of remaining tight for too long appear to outweigh the costs of premature easing,” he said. In mid-April, he told Bloomberg that the ECB's decisions would become tougher after the first two cuts.

Funch also called for tolerance for “some flexibility” in interpreting the 2% inflation target. “This is to avoid mistakes such as the decision to expand quantitative easing when inflation expectations were hovering around 1.8% in late 2021,” he said.

Article content