This article is also available in Spanish.

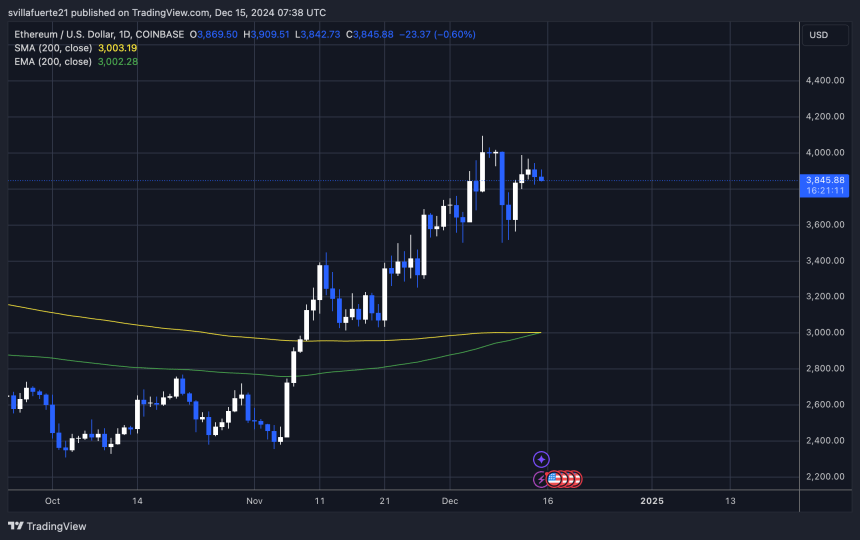

Ethereum is making another attempt to break the $4,000 level as it approaches all-time highs. Despite its strong fundamentals, doubts remain in the market regarding Ethereum’s performance this cycle, with some predicting it will underperform amid intense competition from other blockchain ecosystems. However, Ethereum’s recent price action suggests that it is building momentum, keeping investors on their toes for a potential breakout.

Related reading

Senior Analyst Karl Rohnfelt recently shared a technical analysis, noting that Ethereum faced strong resistance near the $4,000 mark and is now consolidating within a symmetrical triangle on the hourly chart. This pattern is often preceded by a decisive move, leaving traders speculating whether ETH will break new highs or face a temporary pullback.

Ethereum’s performance at this key level is likely to shape market sentiment in the coming weeks. A break above $4,000 could pave the way for a rally towards an all-time high, reigniting investor confidence. On the other hand, failure to remove this resistance may validate bearish fears and lead to a bounce. With ETH still at a critical juncture, all eyes are on its ability to navigate this pivotal area and deliver the next major move.

Ethereum is preparing to move

Ethereum is facing significant resistance above the $4,100 level, leaving the market in a state of suspense as traders anticipate its next move. With prices consolidating and showing signs of tension, Ethereum appears poised to make a decisive move in the coming days. The crucial question remains: Will the price rise or is a decline imminent?

Runefeld He shared his thoughts about XNoting that Ethereum is currently trading within a symmetrical triangle on the hourly chart – a pattern known to indicate potential breakouts or breakdowns. According to Ronfelt, the immediate future of Ethereum depends on two main levels.

A break above $4,100 would confirm the upward trajectory, potentially pushing ETH towards new highs. Conversely, a breakdown below $3,675 would signal bearish sentiment, opening the door for a deeper correction.

Related reading

Roonevelt stresses the importance of these levels, noting that the symmetrical triangle indicates mounting pressure that could soon lead to major volatility. As Ethereum maintains its position near critical resistance, the next few days will be pivotal for determining the market direction.

Technical levels of viewing

Ethereum (ETH) is currently trading at $3,840 after failing to break the critical $4,000 resistance level. While the price remains strong and within the range of this key level, it needs to break above $4,000 to confirm the continuation of its uptrend. Without a decisive breakout, ETH risks losing momentum, leaving traders and investors wary about the next move.

The $4,000 level has proven to be a significant psychological and technical barrier for Ethereum, as multiple attempts to break it have been met with selling pressure. A successful breakout of this resistance will likely pave the way for ETH to target higher levels, which could push towards the yearly high at $4,100 and beyond.

Related reading

However, if Ethereum fails to overcome this hurdle, the market may see a bounce back to lower demand areas. The $3,500 area is emerging as an important support level that traders are closely monitoring. A decline to this level could provide a strong basis for a bounce, but losing this support could signal a shift toward bearish sentiment.

Featured image by Dall-E, chart from TradingView

Comments are closed, but trackbacks and pingbacks are open.