Ethereum is going through a critical phase after failing to breach the $2,500 level yesterday, leaving investors unsure about its next move. As the broader cryptocurrency market expects a rally, Ethereum traders are closely monitoring signs of strength within the network. Despite recent price struggles, there are promising signs from blockchain.

Key data from IntoTheBlock indicates growing demand for ETH stakes, reflecting long-term confidence in the future of the network. This increase in staking activity indicates that investors remain optimistic about Ethereum’s potential, especially with upcoming developments such as staking rewards and the network modernization.

However, recent price action has raised concerns, with many expecting ETH to rise now, especially after a period of positive sentiment across the market.

With the cryptocurrency market poised for a potential rally, Ethereum’s next moves could set the tone for broader market performance. Investors are now watching closely to see if ETH can regain momentum or if it will continue to struggle at current resistance levels. The coming days will be pivotal in determining whether ETH is able to breakout and start a sustainable upward trend.

Ethereum staking indicates long-term trust

Ethereum is trading below a key resistance level as the broader cryptocurrency market prepares for a potential rally in the coming weeks. Market sentiment has been increasingly bullish, with investors anticipating Ethereum to play a decisive role in the next upward move.

according to Key data from IntoTheBlock28.9% of all ETH is now staked, which is a significant increase from the 23.8% recorded in January. This increase in staking activity is a clear indicator of growing long-term trust in the Ethereum network.

Interestingly, over 15.3% of Ethereum has been staked for more than three years, showing that many investors are committed to holding their ETH for the long term. This strong signing activity reinforces the narrative that ETH is viewed as a valuable asset in the evolving cryptocurrency landscape and that many investors are betting on its long-term success.

The recent increase in staking and upcoming Ethereum network upgrades suggest that ETH is well positioned for a potential upside. As market fundamentals continue to improve, the entire cryptocurrency market appears poised to rise, and ETH could lead the charge. If ETH breaks above resistance levels, momentum could lead to a significant upward move in the coming weeks.

Supply levels for testing ETH

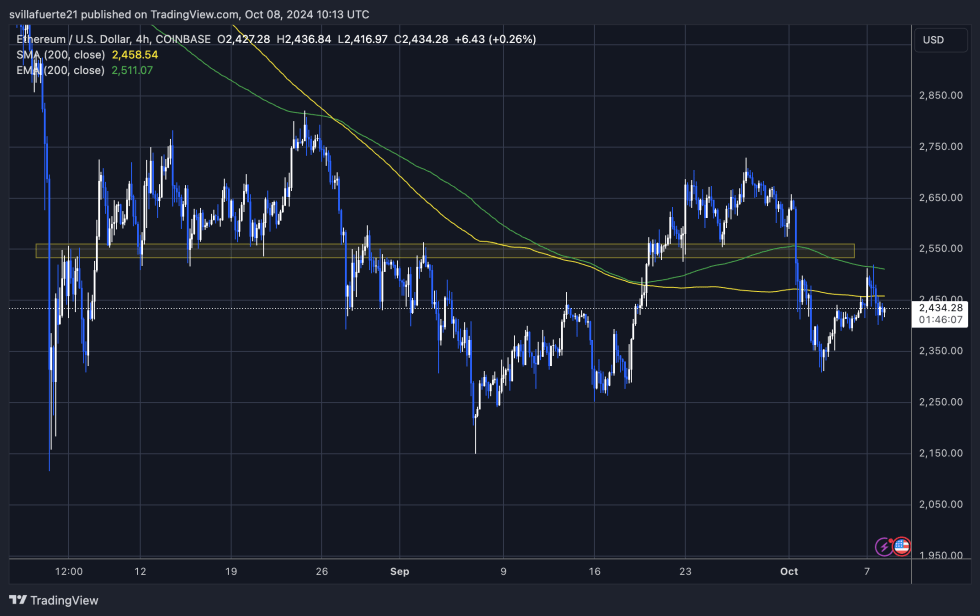

Ethereum is trading at $2,434 after failing to break above the 4-hour moving average (MA) at $2,458. This technical level has been an important resistance point, and the bulls need to reclaim it to maintain bullish momentum.

The main target for Ethereum price action is to break above the 200 MA over 4 hours and break above the 200 Exponential Moving Average (EMA) at $2,511. Doing so would strengthen the bullish case and open the door to a potential rally.

However, if ETH continues to struggle and fails to clear these critical resistance levels, a deeper bounce could be on the horizon. In such a scenario, the next important demand zone is around $2,150, which could provide a solid foundation for a potential recovery.

With Ethereum investors watching these levels closely, price action in the coming days will be crucial in determining whether Ethereum can regain its upward momentum or face further downside risks. Bulls must reclaim key technical indicators or risk losing control of the trend, leading to a retest of lower support areas.

Featured image by Dall-E, chart from TradingView

Comments are closed, but trackbacks and pingbacks are open.