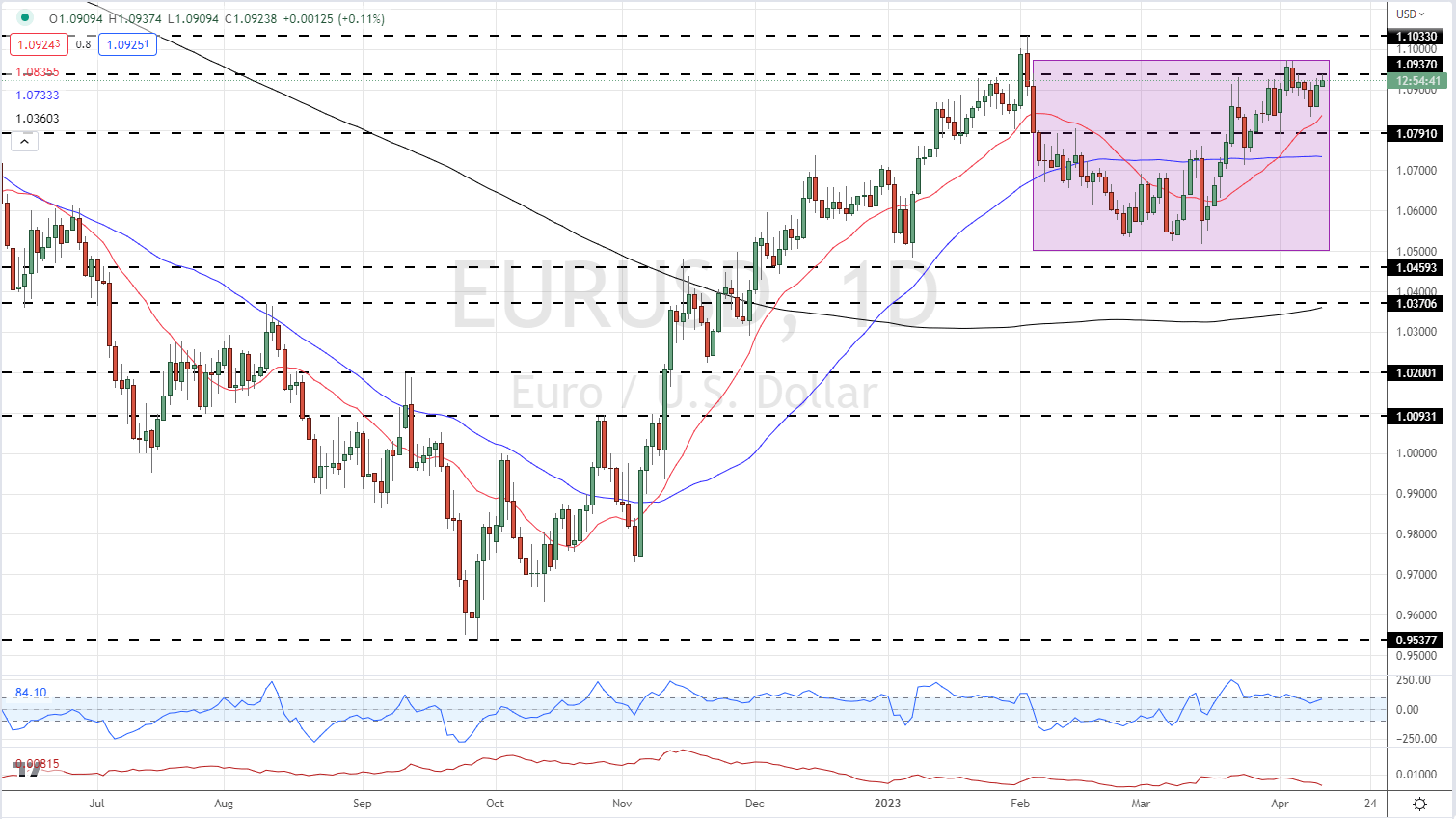

EUR/USD price chart and analysis

- EUR/USD is trapped in a narrow range.

- Inflation is expected to increase year on year in the United States.

Recommended by Nick Cooley

Get your free EUR forecast

The US Bureau of Labor Statistics (BLS) inflation report, due for release at 12:30 GMT, is expected to show a mixed set of inflation statistics for March. The core inflation rate is expected to decline from 6% in February to 5.2% in March, while the core reading – headlines minus energy and food – is expected to rise 0.1% to 5.6%.

Later in the session, minutes from the Fed’s policy meeting on March 22 will be released. At this meeting, the Fed raised interest rates by 25 basis points to a target rate of 4.75% to 5%, in line with market expectations, but scaled back its predominantly optimistic language. The Fed noted that if risks arise that could prevent them from achieving their targets, “the committee will be prepared to adjust the monetary policy stance as appropriate…”. While they still reaffirmed their commitment to reducing inflation to target, the Fed’s tone was softer than in previous press releases and perhaps a hint towards the central bank taking a more cautious approach to raising interest rates. Today’s FOMC meeting minutes will give the market more clarity on the central bank’s current thinking.

See all market-moving events and economic data releases in real time DailyFX calendar

the news

There is not much economic news in the Eurozone today to steer the single currency and this leaves the EUR/USD as an outbid by the US dollar. The pair is currently confined to a narrow range today – 1.0909/1.0937 – and little is expected before the US inflation release. The daily chart of the EUR/USD is showing some positive signs and indicates that a retest of the multi-month high at 1.1033 could occur unless the dollar raises a strong bid. All three moving averages support the move to the upside, while a basic continuation pattern and a handle have been formed over the past two months.

Trading with the cup and handle pattern

EUR/USD daily price chart – April 12, 2023

Chart via TradingView

|

change in |

Longs |

Shorts |

Hey |

| Daily | -1% | 13% | 7% |

| weekly | 20% | -6% | 3% |

Retail traders remain short in the EUR/USD

Retail trader data shows that 38.86% of traders are net long with the ratio of short to long traders at 1.57 to 1, the number of net long traders is down 13.46% from yesterday and 18.23% higher than last week, while the number of net long traders is Traders’ net short positions are 20.69% higher than yesterday, and 5.83% lower than last week.

We usually take a view contrarian to crowd sentiment, and the fact that traders are short of the position suggests that EUR/USD prices could continue to rise. Positioning is more net than yesterday but less net than last week. A mixture of current feelings and recent changes gives us More contrarian bias in EUR/USD trading.

what is your opinion of euro Upward or downward? You can let us know via the form at the end of this piece or you can contact the author via Twitter Hahahahaha.

Comments are closed.