EUR/USD Rate, Charts and Analysis:

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

Most read: Debt Ceiling Blues, Part 79. What Happens If the US Defaults?

The EUR did not enjoy its most productive week as losses continued against the USD while it oscillated between losses and gains against the Pound. However, the EUR/USD remained the interest pair, experiencing a fourth week of losses against the greenback in a row.

European Central Bank policymakers maintained their upbeat statements throughout most of the week, but failed to provide any significant support for the EUR. This may lie in the fact that markets are already viewing the ECB as the more hawkish central bank going forward. Markets seem to have really caught up with the recent tightening of policy makers at the European Central Bank with a major shake-up needed to get the bulls back.

Meanwhile, the USD rally continues as agreement on the US debt ceiling remains elusive as we head into the new week. However, US Treasury Secretary Yellen revised the date she believes the US can default to as early as June 5 without increasing the debt ceiling, the previous date being June 1. The Treasury Department will make more than $130 billion in scheduled payments in the first two days of June, including payments to veterans, Social Security and Medicare recipients. The new date gives negotiators more time, but the longer that time goes on, the more volatility we may see in the markets.

Recommended by Zain Fouda

How to trade EUR/USD

Better-than-expected US PCE data on Friday further supported the US dollar as we saw a hawkish re-pricing of prospects for a June Fed rate hike. Markets are now putting the chance of a 71% chance of a 25bp hike from the Fed in June, up from 17% last week.

Source: CME FedWatch

Euro Consumer Price Index, Non-Agricultural, and US Debt Ceiling

Heading into the new week, we have some Eurozone data with the flash CPI release of particular importance. However, even with the surprise CPI release, I don’t expect any fundamental change in the outlook for the EUR.

Next week promises to be dominated once again by the US dollar debt ceiling narrative. This will be coupled with the non-farm payrolls report on Friday which will undoubtedly be significant after the strong PCE data. However, an agreement on the debt ceiling could see the dollar continue its long-term downtrend since it peaked in September 2022.

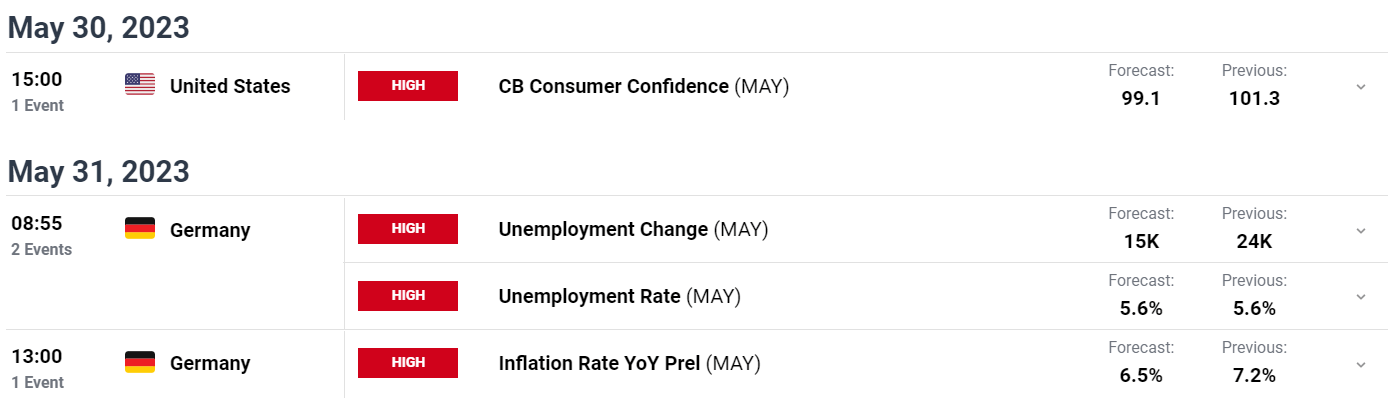

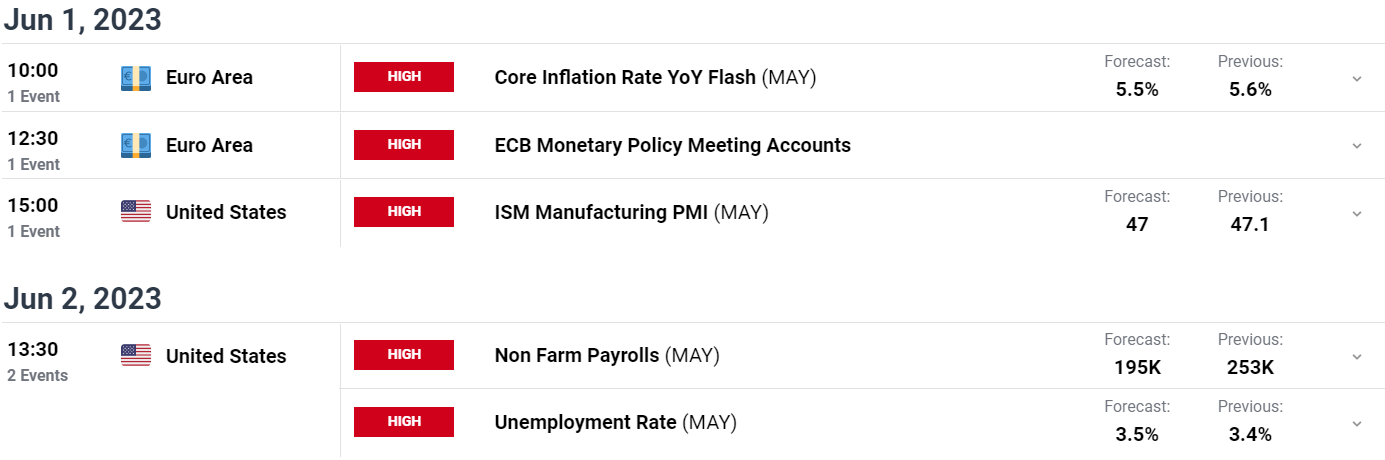

Economic calendar for the next week

Next week on the calendar is still busy with a number of “high” rated data releases, and a bunch of “medium” rated data releases are expected.

Here are some of the major high-risk events that are “rated” for the coming week in the economic calendar:

For all the economic data and events that move the market, see DailyFX calendar

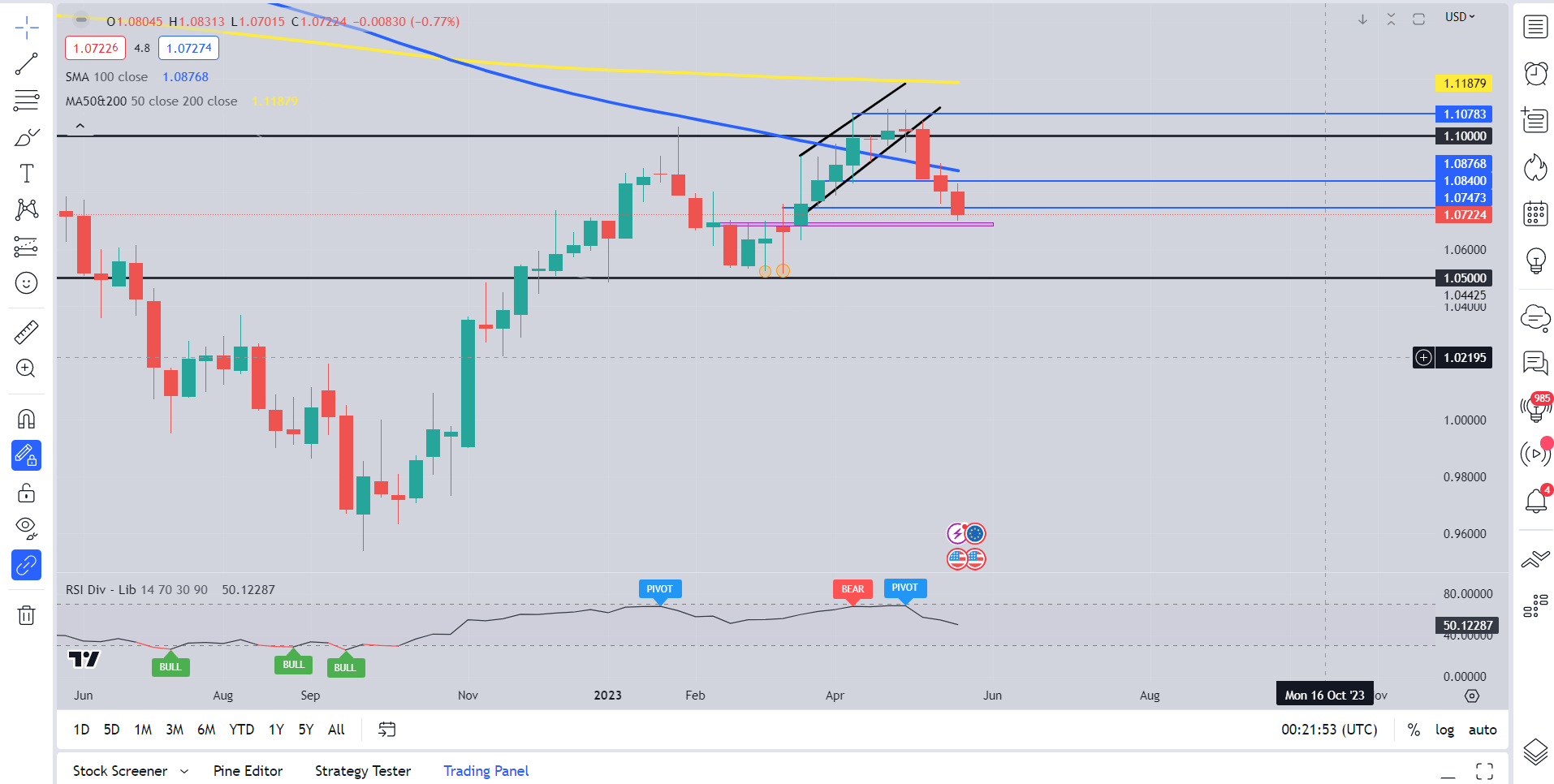

artistic look

The EUR/USD weekly chart is above and we can see that the price has fallen to a major support level. The 1.0700 level is where the previous breakout took place in early March before EUR/USD climbed to its highest level since the beginning of the year.

EUR/USD Weekly Chart – May 26, 2023

Source: TradingView

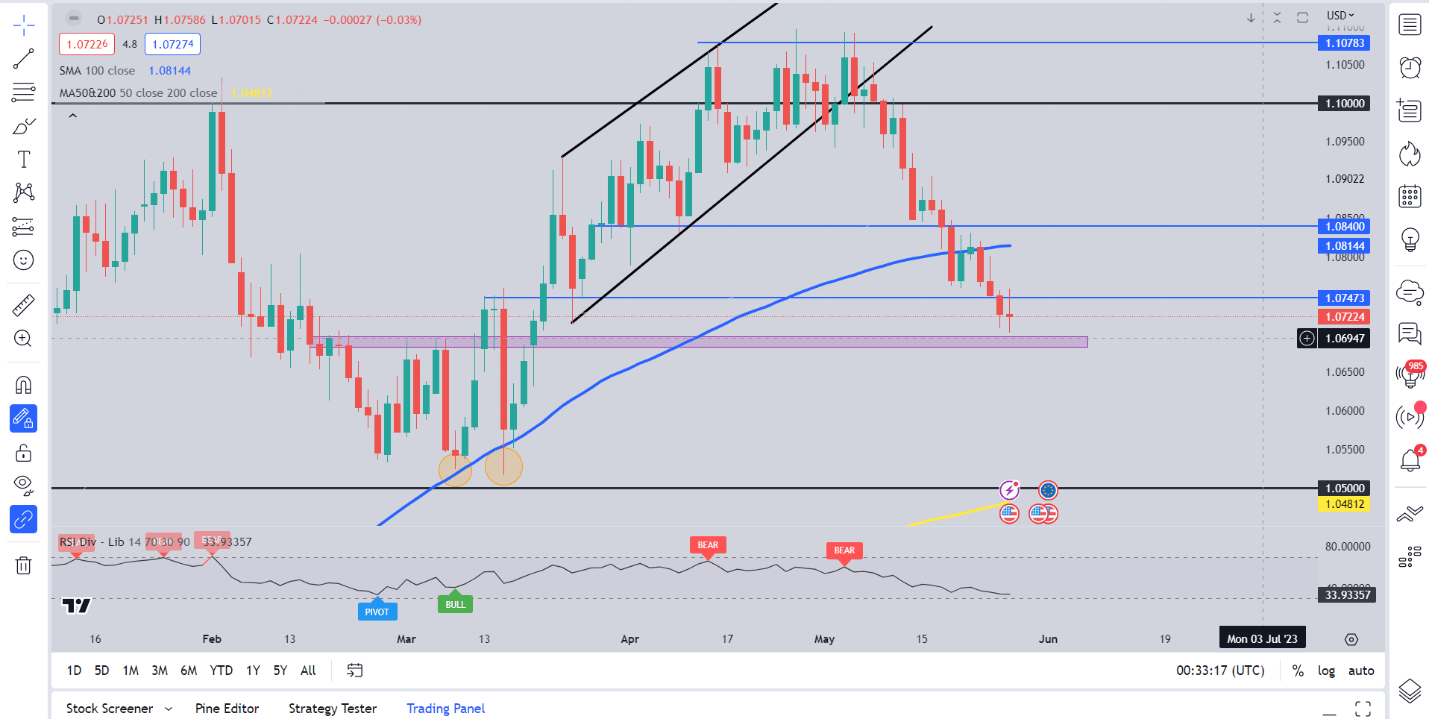

Slope to the daily time frame and we can see that the indecision around the 1.0700 mark has already begun. Friday candle closes as a doji indicating the possibility of recovery as the new week approaches. Monday is of course a Bank Holiday as liquidity and volatility are expected to be low barring any surprises on the debt ceiling deal.

Breaking the key level of 1.0700 could open a retest of 1.0600 before focus shifts towards the psychological mark of 1.0500. A push higher from here has the tough task of breaking the resistance and the 100-day moving average around 1.0800. The 100 day EMA could prove stubborn as EURUSD has been stuck above the EMA since November 2022. A break of the 1.0800 handle brings focus on 1.0900 and possibly the psychological level of 1.1000. Undoubtedly, an interesting week ahead for the EUR and EURUSD in particular.

euro/American dollar Daily chart – May 26, 2023

Source: TradingView

Written by: Zain Fouda, market writer for DailyFX.com

Connect with Zain and follow her on Twitter: @employee