EUR/USD Forecast – Prices, Charts, and Analysis

- German 2023 GDP confirmed at -0.3%.

- The Euro is marginally higher as the US dollar takes a break.

Download our brand new Q1 2024 Euro Technical and Fundamental Forecast

Recommended by Nick Cawley

Get Your Free EUR Forecast

Price adjusted annual German GDP was 0.3% lower in 2023 than in the previous year as ‘overall economic development faltered in Germany in 2023 in an environment that continues to be marked by multiple crises’ according to German Federal Statistical Office, Destatis. German 2022 GDP was downgraded by 0.1% to 1.8%.

Recommended by Nick Cawley

How to Trade EUR/USD

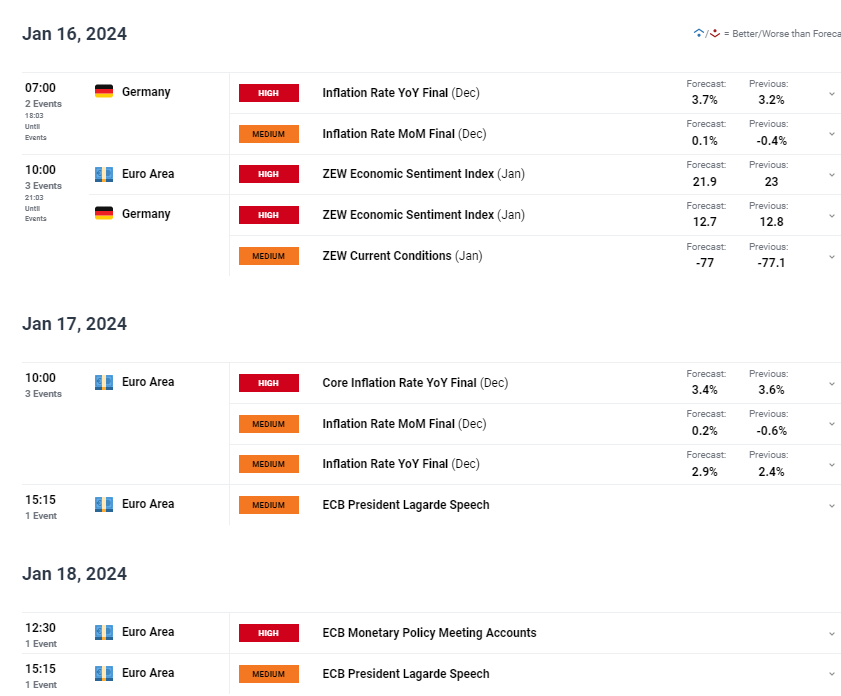

Ahead this week, final December German and Euro Area inflation and ZEW reports take center stage on the data calendar, followed by the minutes of the last ECB monetary policy meeting.

For all market-moving events and data releases, see the real-time DailyFX Calendar

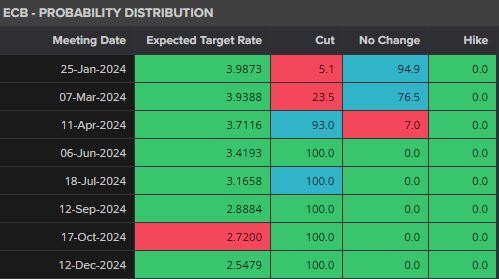

The Euro picked up a very small bid late morning after ECB governing council member Dr. Joachim Nagel said that it was ‘too early’ to talk about rate cuts, that inflation was still ‘too high’ and that markets are sometimes ‘over-optimistic’. Financial markets however continue to price in a series of ECB rate cuts this year with the first 25bp cut seen at the April meeting.

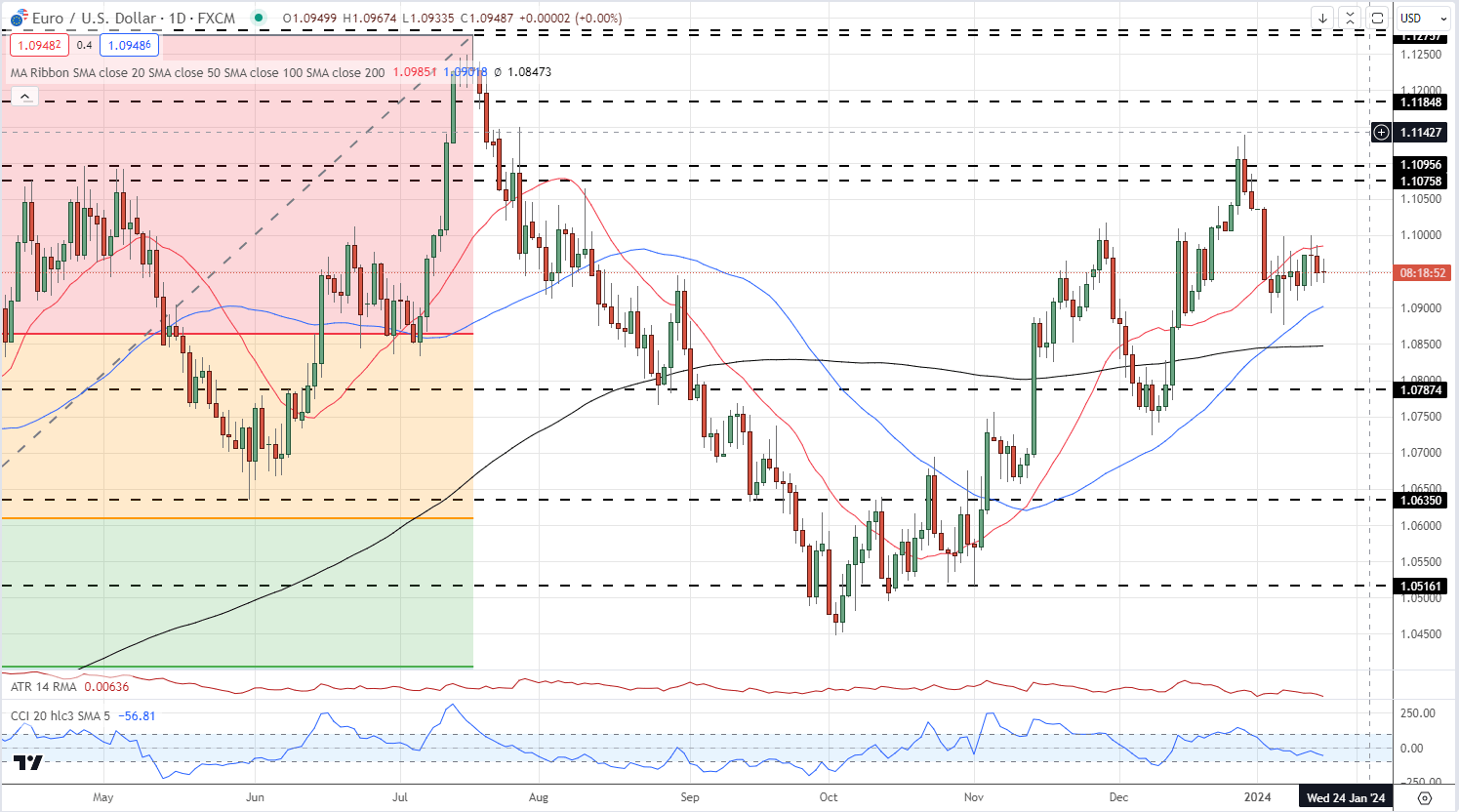

EUR/USD continues to trade in a tight range although biased towards the upside, The pair are supported by the short-dated 20-day simple moving average, while the 50-day sma is currently capping gains. In the short-term, 1.1000 will cap a further move higher, while the 50-day sma at 1.0902 is set to act as support ahead of 1.0900.

EUR/USD Daily Chart

Chart Using TradingView

IG retail trader data show 50.89% of traders are net-long with the ratio of traders long to short at 1.04 to 1.The number of traders net-long is 18.15% higher than yesterday and 6.47% higher than last week, while the number of traders net-short is 5.41% higher than yesterday and 5.41% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

To See What This Means for EUR/USD, Download the Full Report Below

| Change in | Longs | Shorts | OI |

| Daily | 13% | 13% | 13% |

| Weekly | -1% | -2% | -2% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.