EUR/USD analysis and talking points

- The Euro’s strength appears to be fading as we enter another week with more questions than answers.

- The US Consumer Price Index is the focus for this week. Will Inflation Support Premium Non-Farm Payrolls?

- The daily chart could be on the brink of a rising wedge breakout.

Recommended by Warren Vinkitas

Get your free EUR forecast

Fundamental Outlook for the EUR: Childish

The euro almost rose 3% against the US dollar year-to-date with a strong push from the hawkish European Central Bank and the relatively less aggressive Federal Reserve. Things changed last Friday when the US Nonfarm Payrolls (NFP) report once again boosted the tight US labor market along with higher earnings numbers. Potential pivotal talk from market participants was suppressed giving the upcoming inflation data (see economic calendar below) more focus.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

German inflation will start the week as a measure of the Eurozone’s largest European economy. Forecasts are expected to come in slightly lower than the March reading. The focal point will certainly be on the US and whether or not inflationary pressures remain. Such a situation would support the US dollar and possibly create more concerns about the ongoing banking crisis. Fears of economic recession and slowing global economic growth will arise and may play into the safe-haven appeal of the dollar. In summary, the week’s actions will be dominated by the US CPI report as Michigan PPI and Consumer Confidence round out the EUR/USD trading week.

Economic calendar for EUR/USD

source: DailyFX Economic Calendar

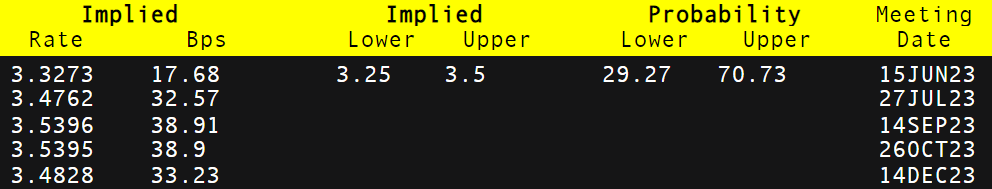

Looking at the ECB money market rates below, markets have revised their forecasts down from approx 70 bits per second By the end of the year to 33bps at present. I think this reflects the uncertain global economic conditions as well as the volatility of the Euro which may end its bullish run.

ECB interest rate prospects

Source: Refinitiv

Technical Analysis

Introduction to technical analysis

Candlestick patterns

Recommended by Warren Vinkitas

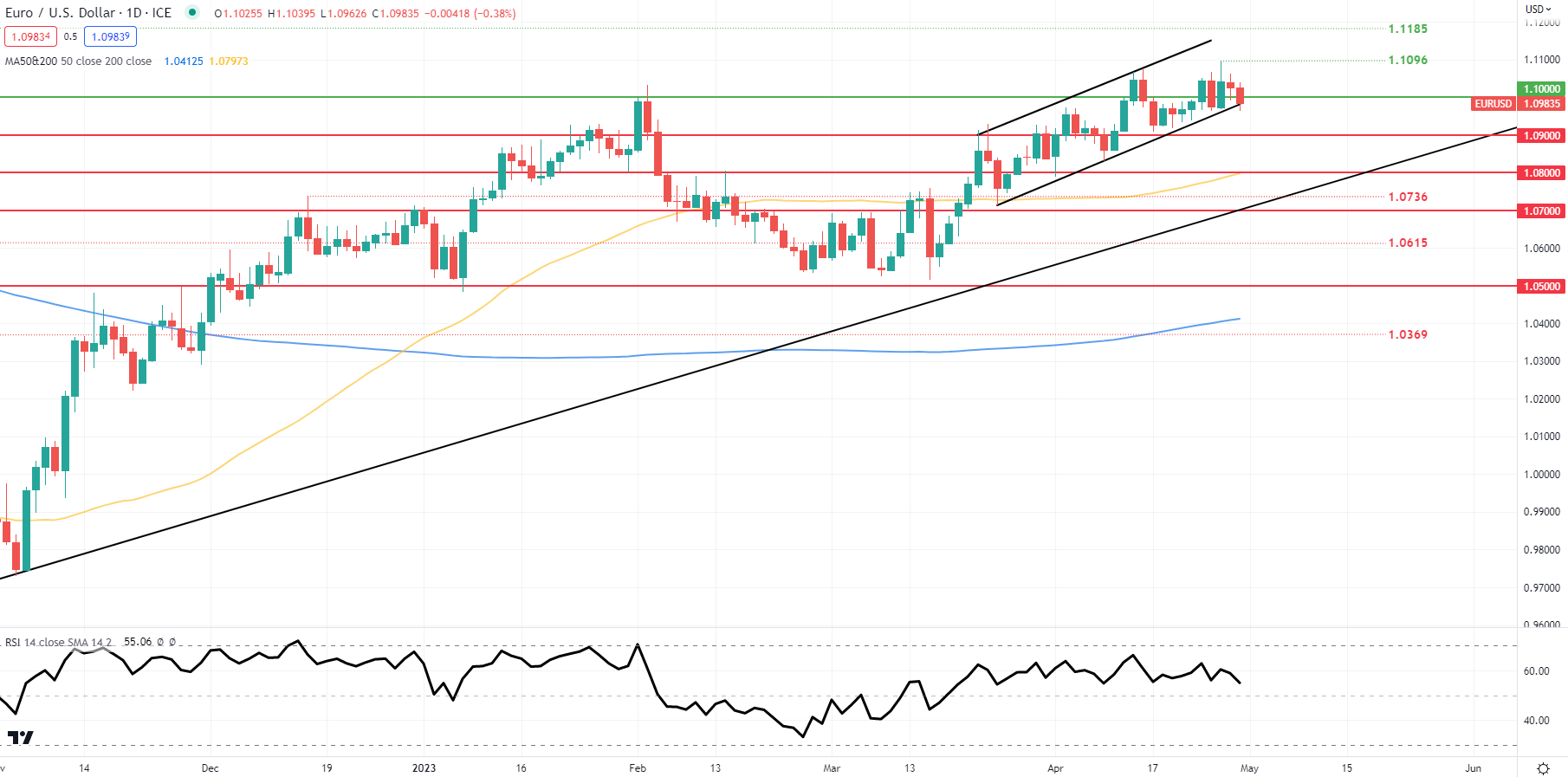

EUR/USD daily chart

Chart created by Warren VenkitasI.G

EUR/USD daily price action shows that the pair is trading within a rising wedge chart pattern (black), now testing wedge support and trading below 1.1000 Psychological dealing. The bullish momentum has been fading lately as indicated by the falling RSI reading despite EUR/USD’s higher gains. This is known as a bearish/negative divergence and often indicates an impending downtrend. This view will be invalidated if prices break out and close above wedge resistance in conjunction with the 1,1096 swing high.

resistance levels:

- 1.1185

- 1.1096 / wedge resistance

- 1.1000

Support levels:

IG Customer Sense Data: Mixed

The IGCS shows that retailers are currently on board short On EUR/USD, with 57% of traders who hold short positions (as of this writing). At DailyFX, we usually take a view contrarian to crowd sentiment but due to the recent changes in long and short positions, we come to a cautious short-term stance.

Contact and follow up@tweet

Comments are closed.