This article is exclusively devoted to scrutinizing the fundamental profile of the euro. For a detailed look at the common currency’s technical outlook and price action signals, download the complete Q1 forecast.

Recommended by Richard Snow

Get Your Free EUR Forecast

Euro Poised for a Mixed First Quarter

The euro is likely to exhibit mixed fortunes in Q1 of 2024 as the currency appears on track to register gains against the US dollar but could lose out against sterling and particularly against the yen. Economic data provides green shoots of hope into 2024 if the EU can avoid a recession like it has during 2023, albeit only just.

Does the Recent Lift in EU Data Suggest the Worst Is Behind Us?

Sentiment and hard data show early signs of progress after rising off their respective lows. One of the most shocking data prints on the continent in 2023 was the German manufacturing PMI numbers which lead the rest of Europe on the way down. The data print is watched closely as Germany is the economic powerhouse of Europe so if the German economy is struggling, then it is likely the rest of the EU is struggling too.

However, German manufacturing PMI data – while still deep in contraction – has shown signs of improvement, recovering from a low of 38.8. Other surveys like the ZEW economic sentiment index measures experts’ opinions on the direction of the European economy over the next six months and has also risen off its pessimistic low back in September 2023. Furthermore, the economic surprise index has also lifted off basement levels, suggesting the EU may enjoy a period of relative stability if it can avoid a recession.

The December 2023 ECB staff forecasts point to a 0.8% GDP growth rate in 2024, however, we could still have two successive quarters of negative growth in that time. Another possibility is that the EU is already in recession as we await Q4 GDP results after a 0.1% contraction in Q3.

Graph Showing the Recent Uptick in EU Data Alongside EUR/USD (Blue)

Source: Refinitiv, Prepared by Richard Snow

Smart Money Reveals Slight Euro Optimism Ahead of Q1 2024

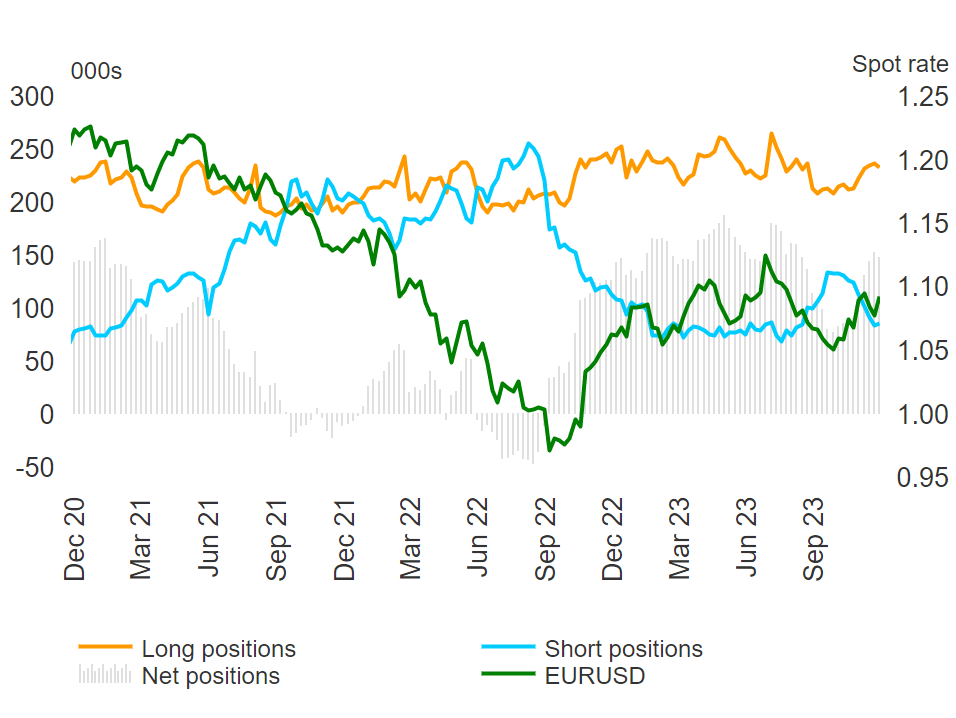

According to the latest Commitment of Traders (CoT) report from the Commodity Futures Trading Commission (CFTC), hedge funds and other large financial institutions hardly reduced their euro longs over 2H 2023 while recent shorts have been pared back. The ascending histograms reveal the rising optimism around the euro as prospects of deep rate cuts in the US continue to get priced in by the market, propping up EUR/USD prospects.

Interested in learning how retail positioning can offer clues about EUR/USD’s directional bias? Our sentiment guide has all the answers you are looking for. Request a free copy now!

| Change in | Longs | Shorts | OI |

| Daily | -15% | -13% | -14% |

| Weekly | 31% | -24% | -4% |

Long and Short Euro Positions According to CoT Report 15/12/2023

Source: Refinitiv, Prepared by Richard Snow

At the final central bank meeting for 2023, ECB President Christine Lagarde presented a much sterner front on monetary policy than her counterpart, and Fed Chair, Jerome Powell. Lagarde mentioned that rate cuts were not even discussed and that rates may plateau in the interim, a sentiment echoed by the ECB’s Muller and Villeroy shortly after the ECB meeting. The latest ECB forecasts suggest that inflation is only likely to return to 2% after 2025 and the governing council anticipates an uptick in inflation in the short term – potentially providing a tailwind for the euro in Q1.

Looking for new strategies for 2024? Explore the top trading ideas developed by DailyFX’s team of experts

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

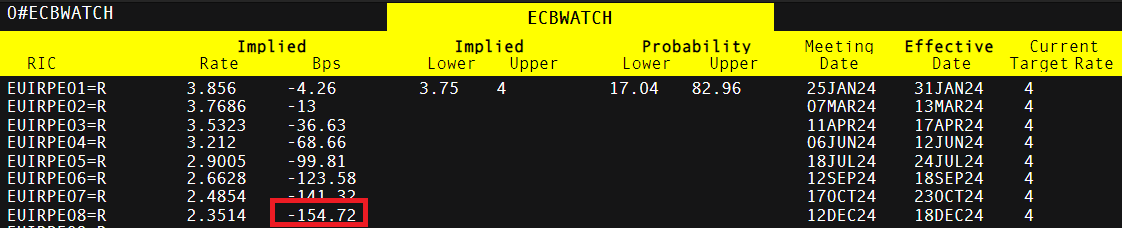

Risks Stack up: Inflation, Growth, and Interest Rate Expectations

Markets are expecting the ECB to cut interest rates at a similar pace and magnitude as the Fed in 2024, and should this materialise, the euro would be set to weaken across the board. Currently the market expects 150 basis points of cuts in 2024. Economic growth has really been at the heart of Europe’s problems with China’s economic woes not helping the situation. In the event the economic situation in Europe deteriorates rapidly, the ECB may have to institute those much-anticipated rate cuts instead of enjoying the ‘plateau’ where rates are expected to remain at elevated levels for some time.

Implied Basis Point (bps) Cuts Derived from Overnight Interest Swaps

Source: Refinitiv, Prepared by Richard Snow

Powell acknowledged the degree to which tight financial conditions has weighed on price pressures, stating that this will continue to weigh on activity. It is very much a case of who will blink first and if you look at the data, the EU is more likely to succumb to economic headwinds than the US. This could see the euro hand back gains achieved towards the end of 2023.

Another concern is inflation where the ECB anticipate an uptick over the short term and the Fed stress that they cannot rule out another hike in response to lingering price pressures, although by their own admission, it is likely that the US is near or at peak rates.