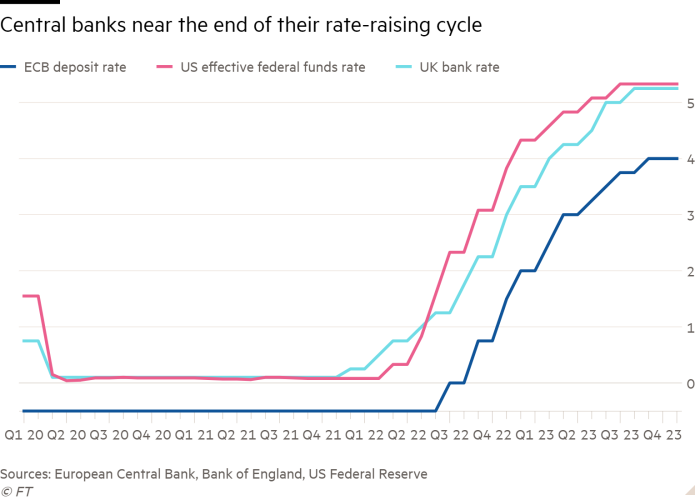

Europe’s top central bankers insisted on Thursday it was too soon to let down their guard against high inflation despite an extraordinary volte-face hours before by Jay Powell, chair of the US Federal Reserve.

While the European Central Bank and the Bank of England appear determined to push back against rate-cutting speculation, their protests risk being drowned out as investors bet they will follow the Fed in signalling cuts to borrowing costs in 2024.

“Major central banks can deviate from the Fed in principle, but doing so in a significant way for an extended period historically has been difficult to do,” said Nathan Sheets, a former US Treasury official who now heads global macroeconomic research at PGIM Fixed Income.

“What the Fed is doing is setting the tone and if you have the Fed shifting more dovish, it’s going to be harder for other major central banks to remain as hawkish as they have been.”

The Fed’s shift landed with a bang on Wednesday, sparking a sharp surge in stocks and bonds as investors cheered the prospects of an earlier move to lower borrowing costs.

The dovishness of Powell’s comments caught many members of the ECB governing council off guard as they gathered in Frankfurt on Thursday, according to one person involved in the discussions. “It was surprising for a lot of us,” said the person, adding that by lowering global bond yields, the Fed’s pivot could slow the pace at which inflation falls. “It makes life more difficult.”

Heading into the final policy meeting of the year, the US central bank was broadly expected to hold firm on its longstanding message that talk of rate cuts was premature given the uncertain economic outlook.

That changed when Powell signalled that he could next year consider rate cuts because the Fed had squeezed the world’s largest economy enough to bring back inflation towards its 2 per cent target.

Most Fed policymakers pencilled in 0.75 percentage points worth of cuts in 2024 and another full percentage point in 2025 to reflect the expectation of a sharper drop in inflation over the next two years.

“Powell and his colleagues’ objective is to prevent a gathering slowdown from developing into a recession,” economists at Citigroup said. “Easier financial conditions reduce — but do not remove — the substantial downside risks to growth at the cost of raising upside risk to inflation.”

Unveiling their rate decisions a day later, the ECB and the BoE made clear they were nowhere near as confident that persistent inflation has been vanquished. Both central banks suggested they wanted more evidence of cooling jobs markets and easing price pressures before considering a policy shift.

The BoE was particularly gloomy about inflation, even as it predicted flat growth in the fourth quarter, stressing that the UK was facing higher levels of services inflation and wages than the US and the eurozone. With inflation risks to the “upside”, the Monetary Policy Committee remained willing to lift rates further, it said.

“The bank does not appear to have taken any comfort from subsiding price pressures in the US and the eurozone,” said Ruth Gregory of Capital Economics, adding that the BoE’s statement “suggests it is happy to cut interest rates after the Fed and the ECB”.

ECB president Christine Lagarde fended off questions on how soon the ECB would relent, insisting there was a “plateau” between the last increase in September and the first cut and that policymakers would not jump immediately from one to the other.

But that is a message financial markets are apt to disregard. After the ECB’s decision, swaps markets were still pricing in around six quarter-point rate cuts for both the Fed and the ECB next year, and at least four from the BoE.

If the Fed were to start cutting rates, it would increase pressure for ECB rate-setters to follow suit by pushing up the value of the euro against the dollar, hitting the competitiveness of exports and lowering import prices in the single-currency zone.

On the other hand, a continued rally in bond markets in the build-up to a Fed rate cut would loosen financial conditions, boosting eurozone growth and prices and making inflation more persistent.

“I don’t think that just because the Fed cuts that would force the ECB to follow,” said Dirk Schumacher, a former ECB economist now at French bank Natixis. “The ECB has more inertia in both directions than the Fed — it was slower to react when inflation was on the way up and now they want to be sure they have done enough to bring it down.”

While the Fed’s mandate covers both inflation and employment, the ECB is solely focused on price stability, giving it less leeway to cut rates to support the economy. “The Fed has a higher sensitivity to growth, and growth is slowing in the US,” said Schumacher.

Martin Wolburg, senior economist at Generali Investments, said he expected the ECB to be deliberately cautious on rate cuts, which was why he thought Lagarde had “wanted to pour some water into the wine of rate cut speculation”.

“They are waiting for further confirmation of inflation coming down, to see if any of the upside risks they have identified materialise and most importantly to see if wage agreements are not too strong,” Wolburg said. “It seems to me the majority of the governing council want to wait until the middle of next year.”

Lagarde told reporters a decision would be “data-dependent, not time-dependent”, reflecting an agreement by her fellow governing council members for them not to give any guidance on the timing of potential rate cuts.

“Absolutely no calendar guidance — that was the consensus,” said one participant.

“The ECB, even more than the Fed, has this fear that they don’t want to get it wrong on inflation again, having underestimated how high it would go, and this fear is almost certain to guarantee they will be behind the curve again,” said Carsten Brzeski, head of macro research at ING.

In the US, the primary concern is that by unleashing looser financial conditions, the Fed is undermining its own efforts to get price pressures under control as a lower cost of capital keeps business activity and hiring humming.

“As financial conditions ease, then the traction of monetary policy on the economy correspondingly diminishes,” said Sheets, the former US Treasury official. “The conditions that have been in place that have generated the slowing of the economy and the moderation of inflation start to fade.”