The Federal Reserve pivoted toward reversing the steepest interest-rate hikes in a generation after containing an inflation surge so far without a recession or a significant cost to employment.

Article content

(Bloomberg) — The Federal Reserve pivoted toward reversing the steepest interest-rate hikes in a generation after containing an inflation surge so far without a recession or a significant cost to employment.

While Chair Jerome Powell said Wednesday policymakers are prepared to resume rate increases should price pressures return, he and his colleagues issued forecasts showing that a series of cuts would be likely next year. Powell said the topic came up at their meeting, where the Fed decided to keep rates at a 22-year high for a third straight time.

Advertisement 2

Article content

Article content

Moreover, Powell’s lack of pushback during his press conference against growing investor expectations for 2024 rate cuts helped spark a massive rally in Treasuries and sent the Dow Jones Industrial Average of stocks to a record high.

Less than two weeks after saying it would be “premature” to speculate on the timing of rate cuts, Powell said officials were starting to turn to that question.

“That begins to come into view and is clearly a topic of discussion out in the world and also a discussion for us at our meeting today,” Powell said.

Officials decided unanimously to leave the target range for their benchmark federal funds rate at 5.25% to 5.5%, the highest since 2001. Policymakers penciled in no further interest-rate hikes in their projections for the first time since March 2021, based on the median estimate.

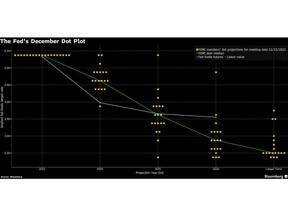

Updated quarterly forecasts showed Fed officials expect to lower rates by 75 basis points next year, a sharper pace of cuts than indicated in September. While the median expectation for the federal funds rate at the end of 2024 was 4.6%, individuals’ expectations varied widely.

Article content

Advertisement 3

Article content

“His presser certainly had a tone of finality to it,” said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics. “He and the whole FOMC saw no need to push back with the dots against the market suspicion of earlier and deeper easing.”

A tweak to the Fed’s post-meeting statement on Wednesday also highlighted the shift in tone, with officials noting they will monitor a range of data and developments to see if “any” additional policy firming is appropriate. That word was not present in the November statement from the US central bank’s policy-setting Federal Open Market Committee.

In another shift, the committee also acknowledged that inflation “has eased over the past year but remains elevated.” In addition, most participants now see the risks to price growth as broadly balanced.

“There’s technically the hiking bias in the statement and he’s still talking like that but no one believes that,” said Veronica Clark, an economist at Citigroup Inc. “We all know the next step is cuts and he confirmed that.”

Federal funds futures markets are now pricing in six rate cuts for next year, up from four earlier this week, and traders have fully priced in a rate cut at the Fed’s March meeting.

Advertisement 4

Article content

For months, Powell has made reducing inflation his singular mission, and he warned that quashing it would require “some pain.” The deceleration in price increases has been mostly pain-free for workers, although the sought-after “soft landing” in the economy remains far from assured.

“It’s really good to see the progress that we’re making,” Powell said at his press conference. “We just need to see more.”

While economic data in recent months has generally aligned with what the Fed would like to see — a cooling in both inflation and the labor market — figures released in the past week or so have painted more of a mixed picture.

Job openings fell, but so did unemployment. Underlying consumer price growth accelerated from the prior month, but a pullback in certain producer prices should mean a subdued print for the Fed’s preferred inflation gauge next week.

What Bloomberg Economics Says…

“The FOMC showed a surprising willingness to endorse market pricing of rate cuts. The forecast in the latest SEP reflects a total embrace of the soft-landing scenario.”

— Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou, economists

Advertisement 5

Article content

To read the full note, click here

Powell was more explicit Wednesday that policymakers must balance risks to both of their mandates — to achieve maximum employment and stable prices.

“We are aware of the risk that we would hang on too long,” Powell said, of keeping rates too high. “We know that is a risk and we are very focused on not making that mistake.”

Inflation Forecasts

The updated projections also showed lower inflation forecasts for this year and next, with the Fed’s preferred price gauge excluding food and energy now seen increasing 2.4% in 2024. Policymakers lowered their forecast for economic growth slightly for next year while keeping unemployment projections unchanged.

Policymakers anticipate further reductions in the fed funds rate to end 2025 at 3.6%, according to the median estimate of 19 officials.

The projections suggest policymakers have more confidence in the inflation path, economist Omair Sharif said in a note to clients. In September, nine of 19 officials anticipated the federal funds rates would dip below 5% by the end of 2024. On Wednesday, all but two 16 officials were below 5%.

“There is no question that they are excited about the fact that inflation has come down,” said Diane Swonk, the chief economist at KPMG LLP, in a Bloomberg Television interview.

—With assistance from Steve Matthews.

Article content