Article by IG Senior Market Analyst Axel Rudolph

FTSE 100 indexAnd Dax 40And Standard & Poor’s 500 – analysis, the pricesand charts

FTSE 100 index Back to negative territory a year ago

The FTSE 100 is on track for the fifth straight day of losses. It has been falling since a five-week high last Friday and is expected to open lower with Asian indices lower as hawkish central banks weigh on sentiment. the map.

Only a bullish reversal and a rally above Wednesday’s low at 7518 could bring the 200 day simple moving average (SMA) at 7553 back. Staying below it, further decline is likely.

FTSE 100 daily price chart

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

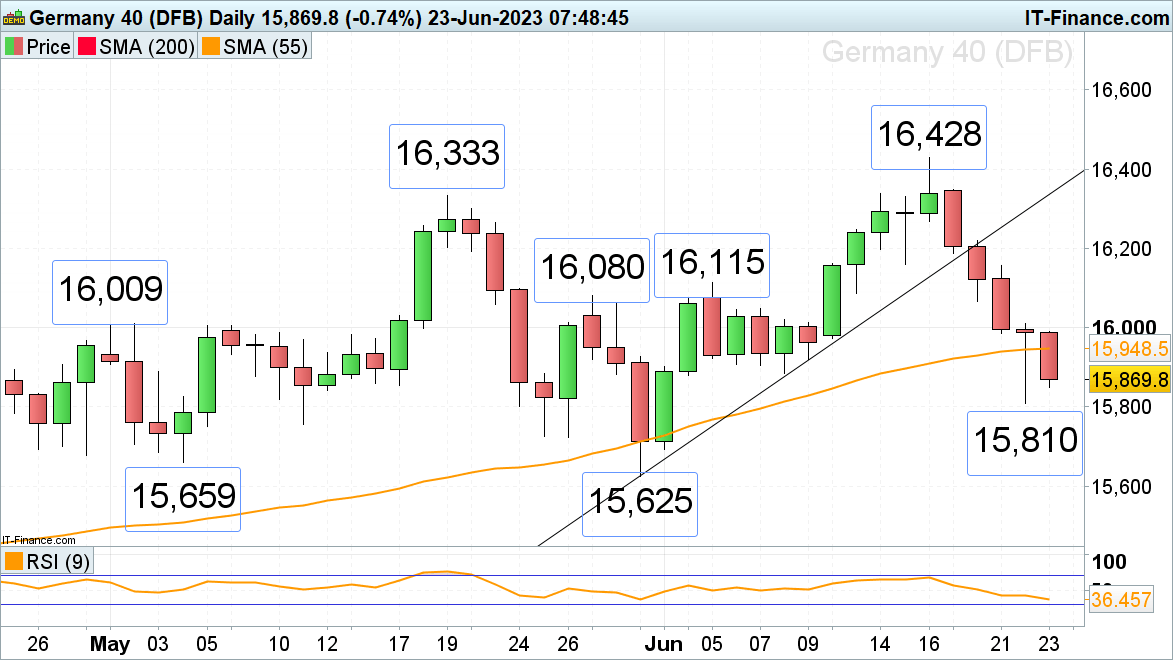

Dax 40 On track for a fifth day of losses

The DAX 40 retreated from a record high on Friday as investors feared the impact of higher interest rates on the economy. The index is on its way down for the fifth consecutive day and is approaching Thursday’s low at 15810. Sliding through it would push the May 26th low at 15,723 to the fore, below which is the key support between the May-June lows at 15659 to 15625.

Resistance can be seen above the 55-day simple moving average (SMA) at 15,948 at Wednesday’s low of 15,986.

DAX 40 daily price chart

Recommended by IG

Traits of successful traders

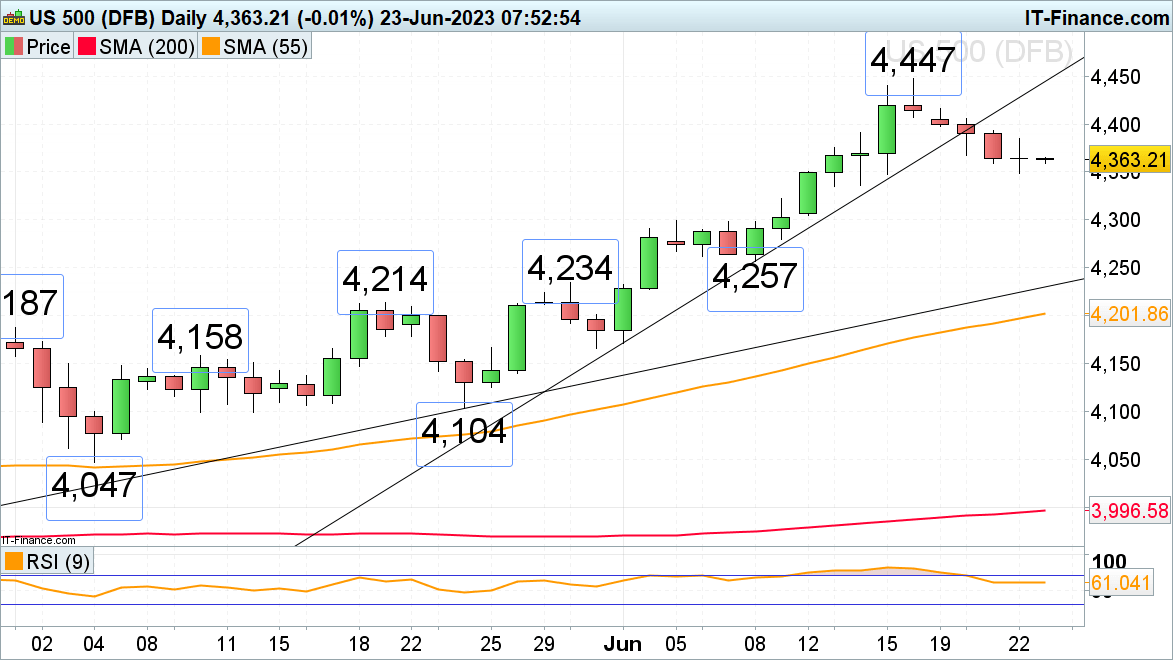

Standard & Poor’s 500 It continues to drift down

The S&P 500 has fallen from a 14-month high of 4,447 for the past five days in a row on risk-off sentiment.

A failure at Thursday’s low of 4349 would lead to a drop of 4336 in mid-June, which lies below the early June high of 4300.

Minor resistance is found around the minor psychological level of 4400 and at Tuesday’s high of 4405.