Article by IG Senior Market Analyst Axel Rudolph

FTSE 100, DAX 40, and S&P 500 prices, analysis, and charts

Recommended by IG

Traits of successful traders

FTSE 100 index to open up

The FTSE 100 continues to underperform its peers on concerns about the utility sector, with the potential demise of Thames Water, and rising UK yields weighing on the index. Against the backdrop of much stronger-than-expected US GDP data, at 2% in the first quarter of 2023 versus the expected 1.4%, and the results of successful stress tests for US banks, US indices helped Asian indices rise at the end of the month and quarter with European indices opening higher as well.

The UK blue-chip index is trying to end the quarter on a positive note and may revisit this week’s high of 7,518. Beyond that, there is the 200-day simple moving average (SMA) zigzagging at 7,561 which is unlikely to be reached. to him today, though. A drop through Thursday’s low of 7,459 would invalidate these short-term bullish expectations and instead suggest that the May low of 7,433 is back on the horizon.

Only a drop through this week’s low of 7,401 on a daily chart closing basis would have further negative repercussions as the March 24 low of 7,331 and also the March low of 7,204 are seen.

FTSE 100 daily price chart

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

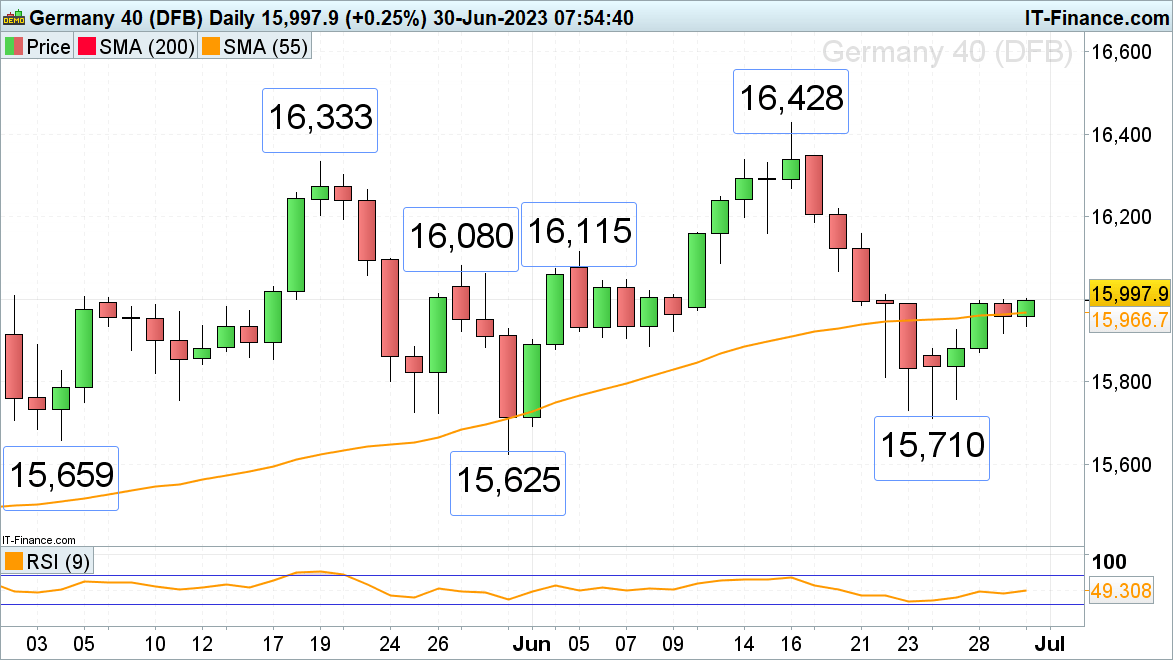

Dax 40 Pushes up at the end of the quarter

DAX 40 has been trying to break the small psychological barrier of 16,000 for the past 3 days but it might succeed in doing so today as the month and quarter end. In this case, highs could be reached in late May and early June at 16.80 to 16.115 but may be capped.

However, a breakdown through Wednesday’s low of 15,918 would invalidate the short-term bullish stance, and instead suggest a revisit of late May and current June lows of 15,710 to 15,625 over the coming weeks.

DAX 40 daily price chart

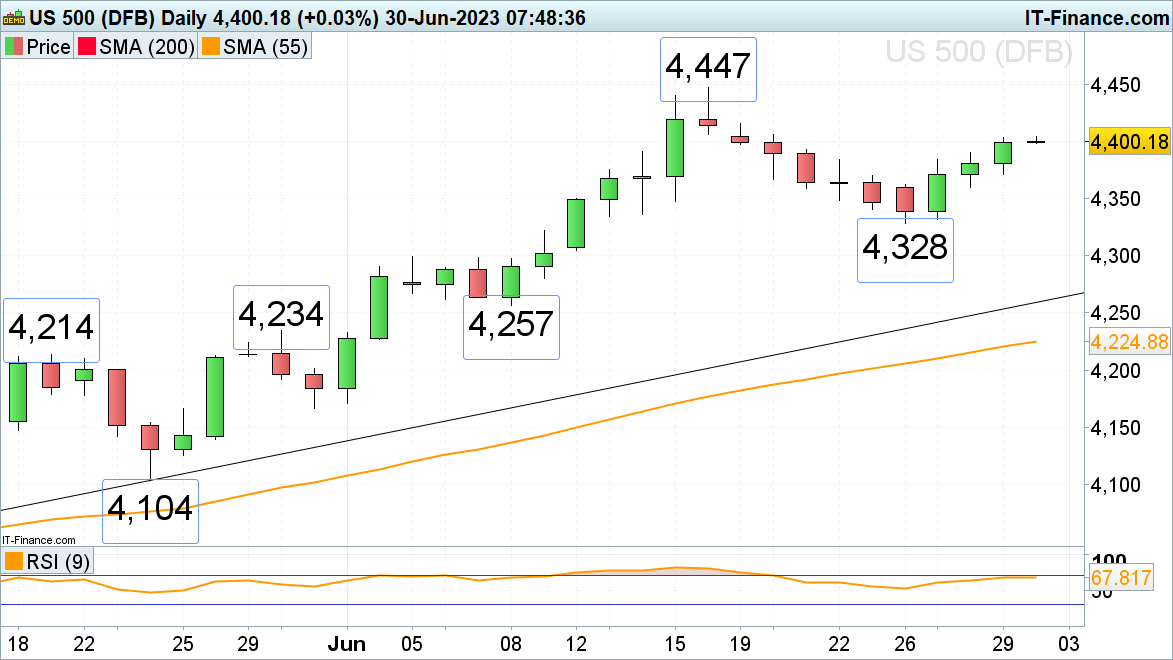

Standard & Poor’s 500 It is rising for the third day in a row

The S&P 500 rose for three consecutive days on the back of strong economic data and despite expectations of two rate hikes by the Federal Reserve. The highest level can be reached in June at 4447.

Only a bearish reversal below Thursday’s low of 4371 would negate the bullish short-term outlook and could send Monday’s low of 4328 back into the frame. If the decline occurs during this week’s low of 4328, then the early June high of 4300 will be targeted.

S&P 500 daily price chart