Forex volatility rose this week thanks to high-profile economic releases, prompting traders to re-price their monetary policy expectations.

The US dollar was all over the charts as traders priced in higher Fed rates simultaneously and perhaps a soft landing and a US recession.

The British Pound held the top spot after hot CPI data from the UK fueled speculation of a rate hike.

Meanwhile, a combination of marked slowdown in inflation rates in Canada and New Zealand and risk aversion battered the Canadian and New Zealand dollars to end the week at the bottom of the pack.

US dollar pairs

overlap US dollar pairs1 hour forex chart

The US dollar spent the first half of the week trading as a safe haven, rising when traders were worried about global growth, and falling when major economies printed better-than-expected economic reports.

The tone changed sometime in the middle of the week when the hawkish comments of the FOMC members were printed alongside the missing mid-level economic data in the US.

The idea of raising interest rates amid the decline in economic activity raised traders’ concerns about the US economy, and this is what appeared. The dollar’s safe-haven status has kept it in the green against “risky” bets such as the Canadian and New Zealand dollars but on shaky ground against non-risky currencies such as the Japanese yen, Swiss franc and euro.

Ascending main arguments

Ascending main arguments

New York State Manufacturing Index for April: +35 points to 10.8; The prices paid index decreased by 9 points; The orders index increased by 46.8 points, to 25.1

St. Louis Fed President Bullard (non-voting member) doesn’t see a recession in the next six months; It makes the argument a 50 basis point hike to the 5.5% to 5.75% range.

On Tuesday, Atlanta Fed President Bostick said he would like to see another rate hike before pausing and holding it above 5% “for a while.”

Williams, Fed official: Inflation is still very high, so the Fed needs to work to bring rates down and it will likely take two years to reach the 2% target

The FOMC official Mester also assessed that inflation remains very high and the Fed has more work to do and probably needs to raise interest rates above 5% and keep rates there for a while.

The S&P Global US Services Business Activity Index came in at 53.7 vs. 52.6 previously

descending main arguments

descending main arguments

US Housing Starts for March: -0.8% m/m to 1.42M (1.3M expected) vs. 1.43M in February; Building Permits Decreased -8.8% MoM (-6.0% Expected) vs. 1.55M in February

US mortgage applications fell 10% year-on-year as the 30-year average fixed interest rate increased from 6.30% to 6.43%

The Fed Beige Book noted that overall economic activity hasn’t changed much in the past weeks, with only three out of nine counties reporting modest growth and consumer spending mostly flat.

Conference Board US Leading Economic Index for March: -1.2 vs. -0.5 in February

Continuing US jobless claims rose to the highest level since November 2021 at 1.87 million, indicating the difficulty in finding a new job.

Philadelphia Fed Manufacturing Index for April: -31.3 (-18.0 expectation) vs. -23.2 in March

March US Existing Home Sales: -2.4% mom to 4.44M vs +13.8% mom in February

US S&P World Manufacturing Index for April: 50.4 vs. 49.2 previously

euro pairs

overlap euro pairs1 hour forex chart

With not a lot of high-profile data releases and market-moving ECB rhetoric, the Euro has been trading in wide ranges against its major peers.

Its low-level safe-haven status in the Euro-Zone helped the common currency survive when risk aversion gripped the markets in the second half of the week.

The Euro capped the week higher against the Australian Dollar, Canadian Dollar, New Zealand Dollar, and British Pound, while it was slightly weaker against safe-haven currencies such as the US Dollar, Swiss Franc, and Japanese Yen.

Ascending main arguments

Ascending main arguments

The current account of the eurozone for the month of February: a surplus of 24 billion euros compared to a surplus of 19 billion euros in January

Final Eurozone inflation reading for March: -6.9% y/y as expected; -8.3% yoy as expected in the EU

Philip Lane, chief economist at the European Central Bank, indicated another potential hike next month if current expectations hold

European Central Bank meeting minutes showed that the majority favored a 50 basis point rate hike in March despite the concerns of the global banking sector.

ECB Lagarde still sees the need to remain vigilant about combating high inflation conditions; He rejects the idea of revising the 2% inflation target.

Eurozone Consumer Confidence for April: -17.4 vs. -19.1 in March

HCOB Flash Eurozone Services PMI at 56.6 vs. 55.0 previously

descending main arguments

descending main arguments

Germany’s ZEW Economic Sentiment fell from 13.0 to 4.1 in March against an expected improvement to 15.5, as problems in the banking sector undermined the credit outlook.

The Eurozone ZEW Economic Sentiment fell from 10.0 to 6.4 in March, reflecting weakening optimism

Eurozone HCOB Flash Manufacturing PMI for April: 45.5 vs. 47.3 prior

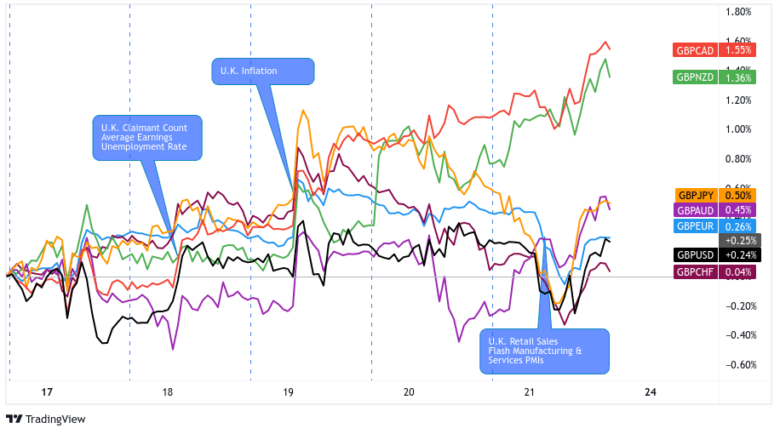

Sterling pairs

overlap Sterling pairs1 hour forex chart

Bullish surprises in the British labor market and inflation reports supported expectations of a BoE rate hike and boosted the pound to its highest levels during the week by the middle of the week.

The pound sterling quickly traded as a risk asset, quickly losing some of its gains during the week as traders began to worry about sticky global inflation, high interest rates, and a recession ahead.

But even when combined with disappointing retail sales numbers in the UK, the British pound managed to hold on to its broad weekend gains.

Ascending main arguments

Ascending main arguments

UK claimants increased by 28.2k in March vs. an expected 2.5k decrease in unemployment, lifting the unemployment rate from 3.7% to 3.8%.

The UK’s average earnings index rose from 5.7% to 5.9% in the three-month period to February, adding pressure to headline inflation.

UK inflation has edged to the upside, rising 10.1% yoy in March versus 9.8% expected and 10.4% in February, as households continue to deal with rising food and energy bills.

Gfk UK Consumer Confidence in April: -30 vs -36 previously

The UK Flash Services PMI improved to 54.9 vs. 52.9

descending main arguments

descending main arguments

UK Retail Sales for March: -0.9% m/m (-0.5% m/m) vs. 1.1% m/m

UK Manufacturing PMI for April: 46.6 vs. 47.9 previously

Swiss Franc pairs

overlap Swiss Franc pairs1 hour forex chart

A round of risk appetite early in the week weighed on the Swiss Franc to its lowest levels in the week.

Risk sentiment turned to the safe haven on Thursday when a slew of US reports highlighted the weakness of the US economy and jittered the dollar representative.

Declining concerns about the Swiss banking sector and the safe-haven status of the Swiss Franc helped propel the currency to the top of the forex series by the end of the week.

Ascending main arguments

Ascending main arguments

SNB Governing Council member Maischler suggested on Wednesday that further tightening may be needed as the latest measures could push inflation down to just 2%, the top of the target range.

AUD pairs

overlap AUD pairs1 hour forex chart

The Australian dollar traded in wide ranges for most of the week as traders priced in risk appetite, better-than-expected China data, and the RBA surprisingly almost contemplating a rate hike at its April meeting.

The US dollar peaked on Thursday when risk aversion gripped the markets. Although the Australian dollar capped the week still higher than its opening prices, it also gave up most of its gains during the week to end the week mixed against the majors.

Ascending main arguments

Ascending main arguments

RBA meeting minutes revealed that policymakers considered raising interest rates in April’s decision before agreeing to pause, citing the need to reassess tightening given inflation, jobs and spending expectations.

Australian Chancellor of the Exchequer Jim Chalmers has proposed reform of the RBA’s rate-setting board and culture

The Judo Australia Flash Services PMI is at 52.6 vs. 48.6

descending main arguments

descending main arguments

Jodo Australia Flash Manufacturing PMI for April: 48.1 vs 49.1 previously

CAD pairs

overlap bastard Pairs: 1 hour forex chart

Risk aversion, lower crude oil prices, and Canada’s slower inflation update (opening up the idea of a BOC rate cut in 2023) sent the Canadian dollar into a slow (unsteady) downtrend, and last place against the majors for the week.

Ascending main arguments

Ascending main arguments

March Canadian CPI reading: +0.5% m/m (+0.3% m/m expected) vs. +0.4% m/m prior.

In testimony before the House of Commons Finance Committee, Bank of Canada Governor McClim said he was “encouraged” by slowing inflation but stressed “The importance of maintaining course and restoring price stability.“

Canadian Manufacturing PPI for March: +0.1% m/m vs -0.6% m/m in February; The raw material PPI was -1.7% m/m vs. -0.3% m/m

descending main arguments

descending main arguments

Canada Housing Starts for March: -11% m/m to 213k units (236k start forecast)

Canadian CPI Annual Read for March: +4.3% yoy vs. 5.2% yoy in February

Canadian Retail Sales in February: -0.2%m/m (expect -0.6%m/m) to C$66.3b vs +1.6%m/m in January; Core retail sales were -0.7%m/m (forecast -0.1%m/m) vs +0.9%m/m

NZD Pairs

overlap New Zealand dollar Pairs: 1 hour forex chart

With both the RBA and BoC already pausing rate hikes, it would have been easy for NZD traders to pause the RBNZ rate hike once they saw the slowdown in New Zealand CPI.

The New Zealand dollar, which revisited its highs for the week on Wednesday, saw a reversal in the middle of the week and ended the week as the second weakest major currency.

Ascending main arguments

Ascending main arguments

Global dairy prices rose 3.2% (-4.7% in April 4) to $3,362 at auction on Tuesday.

descending main arguments

descending main arguments

New Zealand’s business services index fell from 55.8 to 54.4 to reflect a slower pace of growth in March, as the economy slowed and general uncertainty emerged.

New Zealand’s Food Price Index rose 0.8% month-over-month in March, after a previous increase of 1.5% to indicate a slowing in consumer price pressures.

New Zealand’s CPI for the second quarter fell from 1.4% to 1.2% qoq versus the expected increase to 1.5%, dampening the RBNZ’s heightened hopes as energy prices tumbled.

Japanese yen pairs

inverted overlay Japanese yen pairs1 hour forex chart

Much like the Swiss Franc, risk and price action for individual currencies kept the Japanese Yen in wide ranges relative to the majors for most of the week.

safe haven truly It started to make gains when the US continued to publish disappointing reports and the US dollar lost its luster.

Then, the continued rise in core inflation in Japan on Friday raised the possibility of (hawkish) changes in monetary policy from the Bank of Japan. This made it easier for the yen bulls to push the safe haven higher when everyone else and their mum priced in their recession fears.

Ascending main arguments

Ascending main arguments

Bank of Japan Governor Kazuo Ueda has ruled out any sudden policy changes at the upcoming April meeting.

Japan’s core inflation rate held steady at 3.1% year-on-year in March, above the BoJ’s target of 2%.

The Japanese services PMI for April showed continued optimism, but eased to a reading of 54.9 from 55.0 in March.

descending main arguments

descending main arguments

The Reuters Tankan survey showed that major Japanese manufacturers remained pessimistic for the fourth consecutive month in April.

Japan’s flash manufacturing PMI rose from 49.2 to 49.5 in April reflecting a slightly slower pace of industry contraction versus the estimated increase to 49.9.

Japan Trade Balance for March: Trade Deficit increased to 754.7 billion yen (1.1 trillion yen expected) vs. 898.1 billion yen previously

Comments are closed.