European gas prices have fallen to their lowest levels since mid-2021, when Russia was just beginning to cut back on supplies before its invasion of Ukraine, helping to reverse rising inflation and put consumers at ease.

Article content

(Bloomberg) — European gas prices have fallen to their lowest levels since mid-2021, when Russia was just beginning to cut back on supplies before its invasion of Ukraine, helping to reverse rising inflation and bring relief to consumers.

Advertising 2

Article content

The recession – gas futures have fallen by two-thirds this year – has not eased pressure on household budgets. It also undermines one of President Vladimir Putin’s biggest bargaining chips – the ability to squeeze gas supplies in the region.

Article content

With some traders predicting that short-term prices could turn negative at times this summer, the picture couldn’t be more different than in May of last year. Back then, futures contracts were four times what they are now, and countries had to revive coal generation to keep the lights on after Russia cut gas supplies.

There have also been concerns about shortages and whether Europe will be able to build up gas storage levels before winter. Right now, inventories are above average and may fill over the summer and ahead of schedule.

Article content

Advertising 3

Article content

Dutch benchmark futures have fallen for eight consecutive weeks and are below €25 per megawatt hour, the lowest since May 2021.

Increased LNG imports to replace Russian supplies helped, as did the relatively mild winter, which meant the region didn’t need to indulge in storage sites on a large scale. Europe’s reserves are about 67% full, compared to a five-year average of about 50%. German stocks are at 73%, according to data from Gas Infrastructure Europe.

Economic weakness is also playing a role, with reduced energy consumption. China’s recovery has lost momentum, European manufacturing is in a deep recession and Germany unexpectedly contracted in the first quarter, sending it into recession.

Advertising 4

Article content

Plus, Europe has been pushing to build more renewables. Solar farms, new wind power and good weather conditions have helped reduce the need for gas for power generation this year, easing demand further.

The price drop is “excellent news for Europe and shows that increased LNG imports combined with reduced demand succeeded in quickly rebalancing the European market after Russia closed the taps,” said Georg Zachmann, a senior fellow at the Brussels-based think tank Bruegel.

Read the big show on Germany: Europe’s economic engine is collapsing

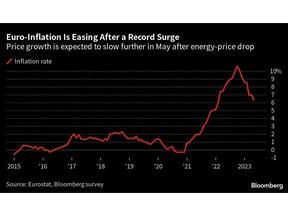

For households, the price benefits can clearly be seen. Inflation in the eurozone probably slowed to 6.3% in May, the lowest level since before Russia invaded Ukraine. In the report, due on Tuesday, Nomura economists say they expect to see “lower wholesale energy prices reaching consumers broadly across the eurozone.”

Advertising 5

Article content

But even after central banks raise interest rates, core measures of inflation have proven to be more stable. This is partly because energy costs are reflected in the prices of goods and services in the broader economy. As headline inflation subsides, so will wage pressure but this process will take time.

Read more: Eurozone creeping towards 2% inflation keeps ECB in rate hike mode

For most sectors, the crisis began when Russia invaded Ukraine in February 2022. For energy, it began two years ago when Moscow began curtailing supplies by refusing to increase deliveries to Europe via Ukraine. Now, Ukraine is the last remaining pipeline route for Russian gas to Western Europe after a closed Nord Stream to Germany was damaged in September.

Advertising 6

Article content

The market is closely watching China’s gas demand. European gas prices could fall further, to below €20 a megawatt-hour, if Chinese LNG imports prove too weak, according to analysts at Energy Aspects.

In Europe itself, the current low prices do not lead to an increase in industrial demand, which was reduced last year during the rise in energy costs. If and when it will return is one of the biggest questions for gas traders as they try to judge where the bottom of the market might be. Some say part of that loss will be permanent.

“Demand destruction is a euphemism for industry collapse,” said Brenda Shaffer, a senior fellow at the Atlantic Council’s Global Energy Center in Washington. “Because of the high energy prices in Europe, many industries, especially gas-intensive industries, have either collapsed or moved outside of Europe.”

“Those industries will not come back, even if energy prices go down,” she added.

— with assistance from Stephen Stapczynski and Anna Shiryaevskaya.

comments

Postmedia is committed to maintaining an active and civil forum for discussion and encouraging all readers to share their opinions on our articles. Comments may take up to an hour to be moderated before they appear on the site. We ask that you keep your comments relevant and respectful. We’ve enabled email notifications – you’ll now get an email if you get a response to your comment, if there’s an update to a comment thread you’re following or if it’s a user you’re following. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the conversation