GBP/USD and EUR/GBP Analysis and Charts

- Gilt yields support Sterling against a robust US dollar.

- EUR/GBP set to test range support.

Recommended by Nick Cawley

How to Trade GBP/USD

The British Pound is ending the week in reasonable shape against the US dollar and is showing gains against a range of other G7 currencies. The expectation of higher UK rates in the coming months is underpinning the British Pound and is driving UK government bond yields ever higher. While the rate-sensitive UK 2-year mirrors the UK Bank Rate, longer-dated gilt yields are pushing ever higher with the 10-year benchmark hitting highs not seen since 2008. The Bank of England remains in a no-win situation; on one hand, they would like to bring rates down to help the economy grow further, especially in the housing sector, while on the other hand, inflation remains sticky and well above mandate.

The economic calendar is fairly light of heavyweight data next week with the annual Jackson Hole Symposium (August 24-26) the standout. This annual central bank get-together, along with other academics and high-profile policymakers, has been used before as a platform for Fed chair Jerome Powell to re-iterate his economic stance and this year will likely be no different. The theme of this year’s meeting is ‘Structural Shifts in the Global Economy’ leaves chair Powell with plenty of opportunity to make his case.

The latest look at the health of the UK high street earlier today showed shoppers keeping their hands in their pockets. Retail sales in July remained weak and missed market forecast by a margin.

For all market-moving economic data and events, see the DailyFX Calendar

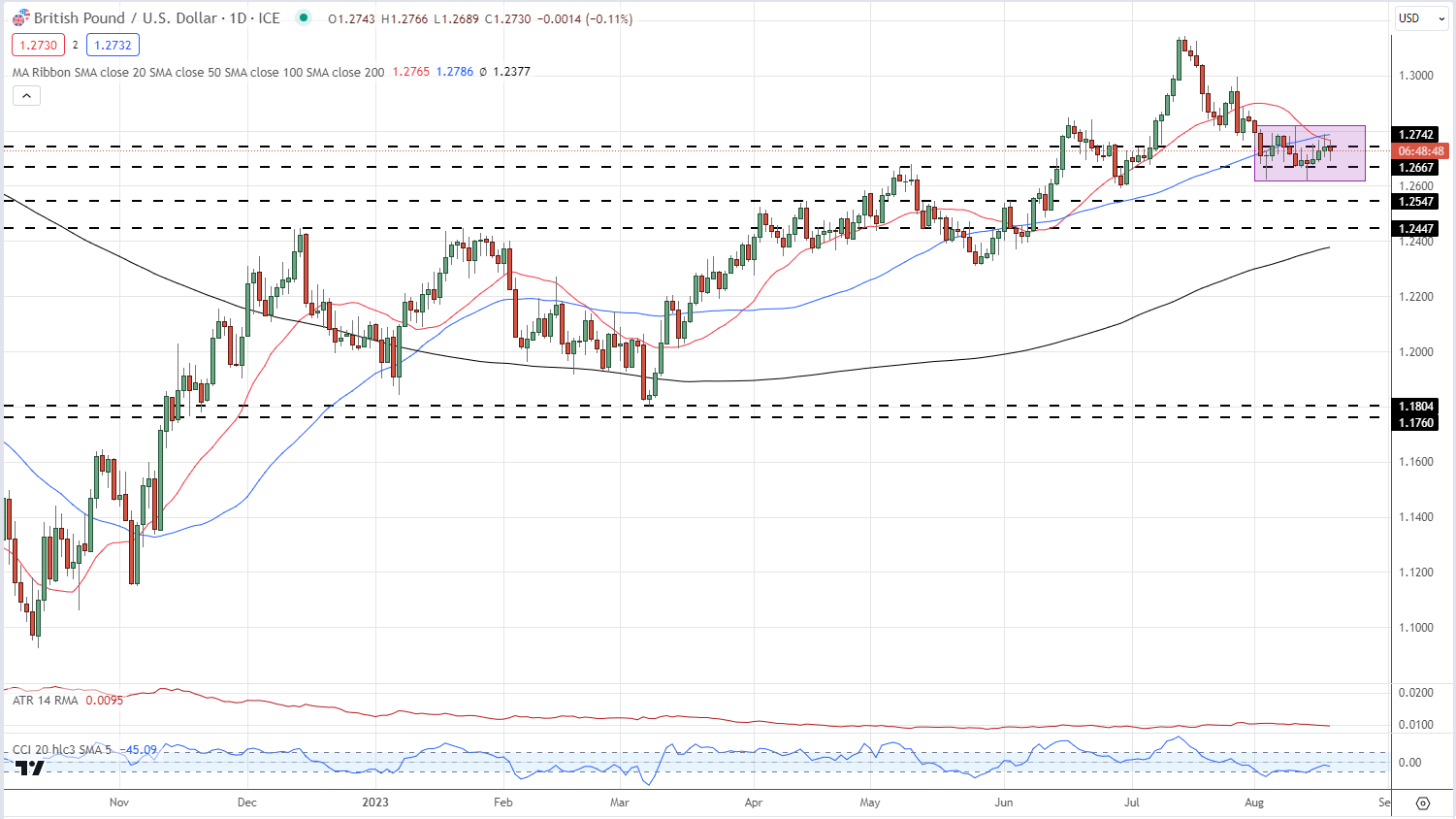

Cable is ending the week around one point higher despite ongoing US dollar strength. The pair are forming a short-term trading range that is unlikely to break ahead of the start of Jackson Hole. A two-point range with support at 1.2620 and resistance at 1.2820 should hold going into the end of next week and give range traders something to consider.

Recommended by Nick Cawley

The Fundamentals of Range Trading

GBP/USD Daily Price Chart August 18, 2023

| Change in | Longs | Shorts | OI |

| Daily | 3% | -8% | -3% |

| Weekly | -9% | 7% | -2% |

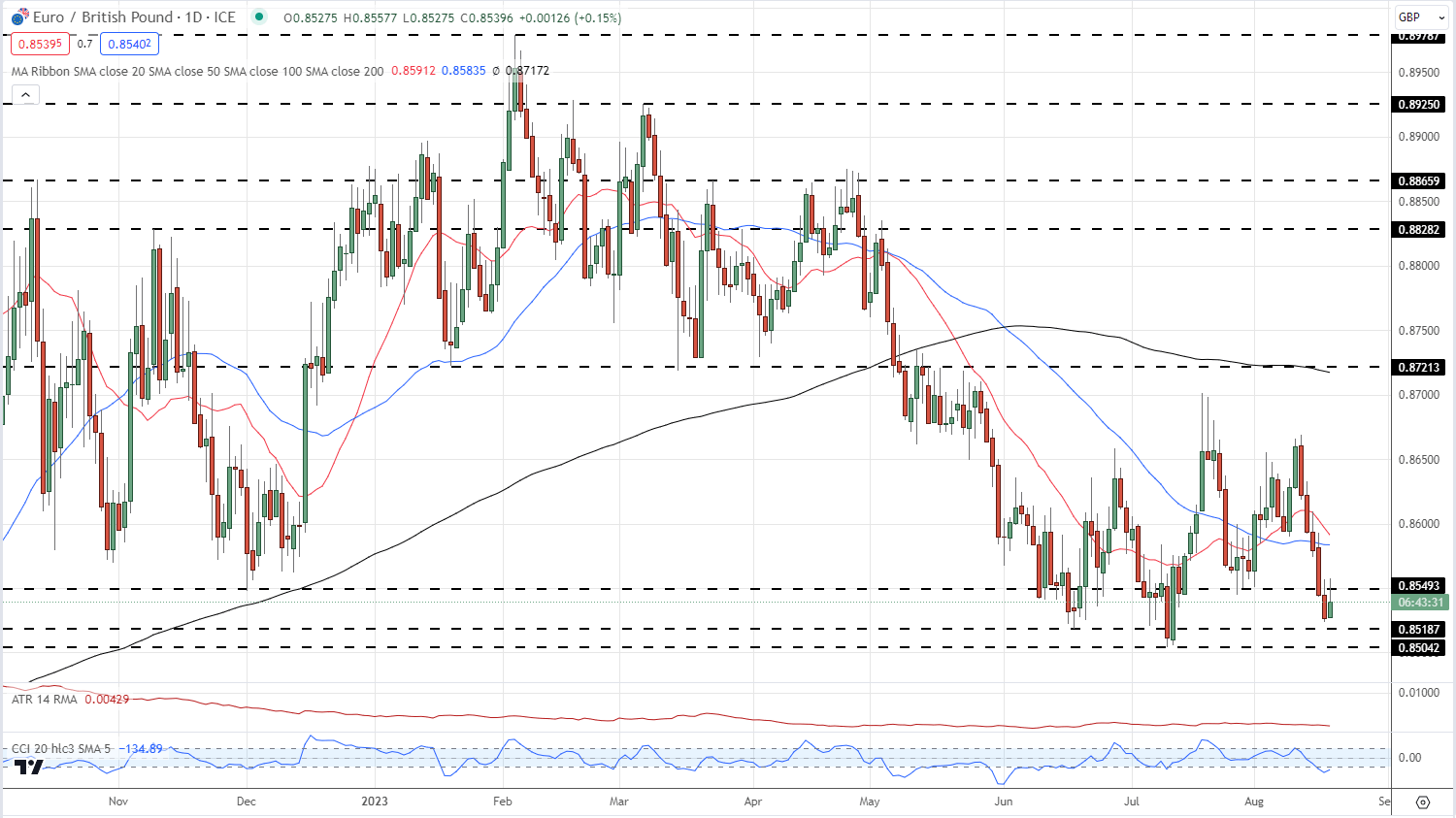

One longer-term range trade that is being tested at the moment is EUR/GBP. A rough 0.8500 to 0.8720 range has held for the last few months, but this may break soon with the pair looking at support. The CCI indicator suggests that the pair are oversold, and while this may be the case in the short term, while the pair remains below all three moving averages the outlook remains negative.

EUR/GBP Daily Price Chart – August 18, 2023

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.