Gold (XAU/USD) Analysis

- Gold expected to underwhelm this Thanksgiving weekend amid thin trading

- XAU/USD reveals an aversion to trading above $2000 as ceasefire tests safe haven appeal

- USD and Treasury yields remain a factor as markets lower expectations of rate cuts next year

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Gold Expected to Underwhelm this Thanksgiving Weekend

Gold prices rose in early trading but failed to capitalize on the move as activity is expected to remain rather light on this thanksgiving long weekend. In fairness, gold has struggled to surpass the $2000 level with any decent follow through. Price action has twice approached $2010, immediately heading lower both times.

Yesterday, a slight pick up in the dollar weighed on gold prices after initial jobless claims for November missed expectations. The figures suggests the labour market remains robust despite weaker US fundamental data that has appeared over the last three weeks. The next big question mark for gold is centered around the recently agreed ceasefire between Israel and Hamas to allow for safe passage of hostages and prisoners. The agreement is the most significant diplomatic achievement since the 7th of October attack and only time will tell if it represents a significant move towards further agreements and the facilitation of aid into the most affected areas.

Resistance remains at $2010 with nearby support at $1985, followed by the 200 SMA and the $1937 level.

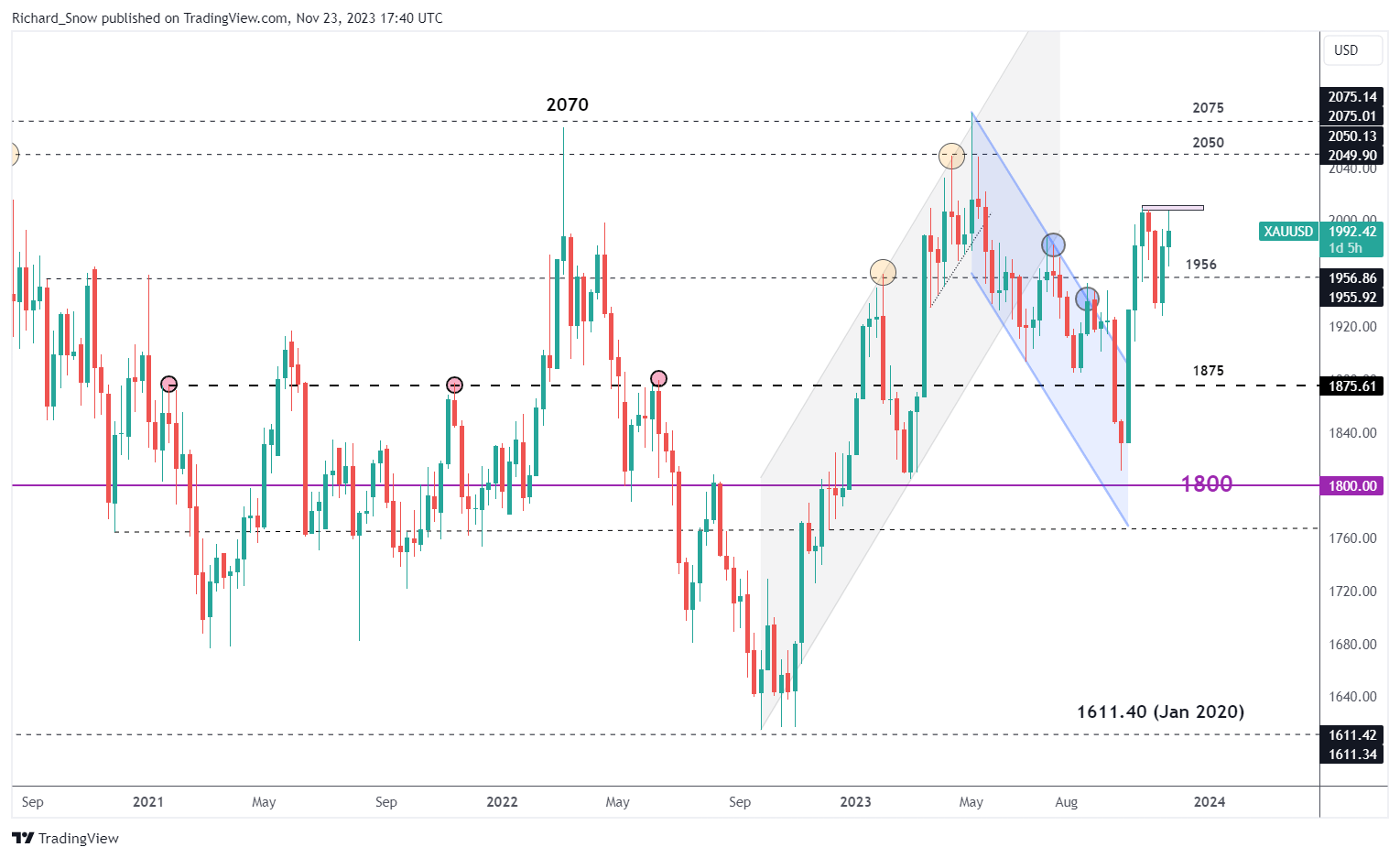

Gold (XAU/USD) Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade Gold

The weekly chart highlights the recent difficulty to surpass the $2010 level but still reveals the bullish trend remains intact. However, the recent swing low and the inability to mark a higher high, hints at a period of potential consolidation as the RSI heads lower.

Gold (XAU/USD) Weekly Chart

Source: TradingView, prepared by Richard Snow

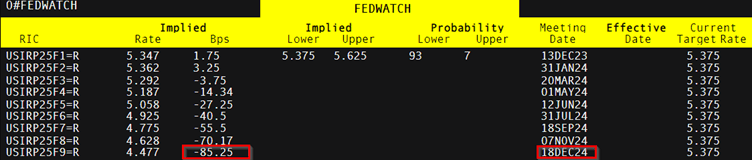

USD and Yields to play Further Role after Markets Lower Rate Cut Expectations for 2024

In the wake of cooler-than-expected US CPI data the US dollar and Treasury yields dropped, sparking mass speculation around the timing and magnitude of rate cuts next year. At its height, market expectations reached as much as 100 basis points worth of hikes for next year despite the Fed’s recent forecasts suggesting 50 bps. The more resilient labour market data this week has helped to temper those expectations by a full 25 bps cut, now seeing 85 bps by the end of next year. Gold tends to exhibit an inverse relationship with the dollar and US yields as they represent the opportunity cost of holding the non-interest-bearing metal.

Source: Refinitiv, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX