Gold, XAU/USD, FOMC, Fed, USD, Crude Oil, WTI, Yields – Talking Points

- the gold price It seems that it is consolidating its position above $2000 at the moment

- Treasury returns Crude oil prices They showed an inverse relationship with the mineral

- we CPI On Wednesday he may provide hints on Fed policy. Will you be driving XAU/American dollar?

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

Gold consolidated around the 2020 USD handle entering the trading session on Tuesday after falling last Friday as volatility in risk sentiment seems to be driving prices of the precious metal.

Treasury yields have moved up across the curve since the FOMC raised its rate target by 25 basis points to 5-5.25% last week.

The benchmark two-year note traded as low as 3.66% last Thursday, but has risen to 4% today.

On the same day that Treasury yields rebounded from their lowest levels, gold reached a 33-month peak of $2,085.4 on the Comex Futures exchange before falling ever since.

Similarly, real yields also seem to have moved with an inverse correlation to the yellow metal lately. The 10-year interest rate touched 1.29% overnight, well above the 1.11% low seen last week.

The real yield is the nominal yield minus the market price inflation rate derived from Treasury Inflation Protected Securities (TIPS) for the same duration.

WTI also reflects this reversed price action as the market awaits US CPI data on Wednesday for clues on the Fed’s rate path going forward. A Bloomberg survey of economists expects headline inflation to be 5.0% year-over-year through the end of April.

As the price of gold has fallen, so has volatility. The GVZ measures volatility in gold in the same way that the VIX measures volatility in the S&P 500.

Recommended by Daniel McCarthy

How to trade gold

GC1 (Gold Futures) WTI Crude Oil, 10-Year US Real Yield, Gold Volatility, in USD

GC1 (Gold Futures Contract) Technical Analysis

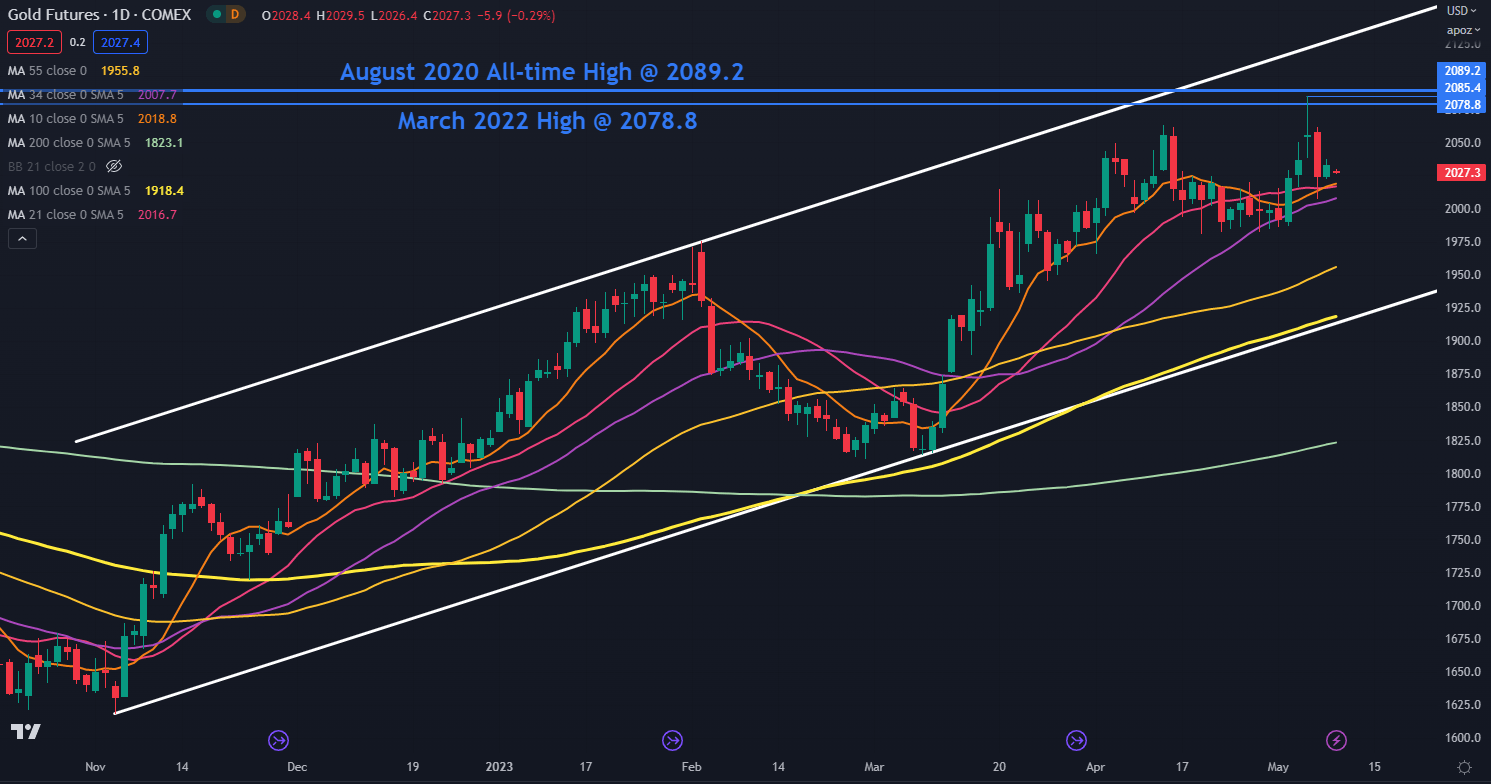

Gold is still in the uptrend channel that started in November last year.

Last week’s high of 2085.4 surpassed the March 2022 peak of 2078.8, but failed to beat the all-time high of 2089.2. This may indicate that the 2080-2090 area may offer an area of resistance.

A break above that level could open the way for a test of the uptrend line, which is currently unraveling at 2130.

Formation of a bullish triple moving average (TMA) requires the price to be above the short-term simple moving average (SMA), the latter to be above the medium-term SMA and the long-term SMA to be The average is above the long term simple moving average. . All SMAs also need a positive gradient.

Price action this week saw the 10-day SMA cross above the 21-day SMA and the 200-day SMA cross above the 260-day SMA. These are known as Golden Crosses.

This development means that given any combination of daily SMA, the TMA criteria have been met. Price closing without any SMA will invalidate the TMA.

On the downside, support may be offered at the lows of 1980.9, 1945.0 and 1936.5 before the uptrend which is currently at 1915. The 100 day SMA is near this trend line and could add support near it.

– By Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @employee on Twitter

Comments are closed.