Gold price forecast:

- gold prices It was limited on Friday, but the losses were limited

- Traders seem to be avoiding big directional bets ahead of important economic events in the coming days

- May meeting of the Federal Reserve Monetary policy The decision and the US labor market report will steal the limelight next week

Recommended by Diego Coleman

Get your free gold forecast

Most read: Core and major personal consumption expenditures diverge in the United States, employment costs rise, and the US dollar rises

Gold prices (XAU/USD) fell on Friday, dragged down by the strength of the US dollar, but the pullback was modest as falling US Treasury yields capped the downward trend. Late in the morning, bullion was down 0.05% at $1,999, with many traders on the sidelines avoiding taking big directional bets ahead of major US economic events in the coming days that could steer the markets in the near term.

There are a number of highlights in the calendar for the week ahead, but perhaps the most significant will be the FOMC monetary policy decision on Wednesday afternoon and the US Nonfarm Payrolls report on Friday.

American Economic Calendar

source: DailyFX

With an eye on the Fed, policymakers are expected to raise borrowing costs by 25 basis points to 5.00%-5.25%, but this could be the last rally of the cycle in the face of intensifying economic headwinds, including recession risks later this year. general. To gain insight into the policy outlook and better prepare for the future, traders should look closely at forward guidance and, most importantly, Powell’s press conference.

In any event, if the central bank officially confirms that the tightening campaign is over, yields are likely to start falling rapidly across the curve as markets attempt to pivot into an easing stance. In theory, this should favor rate-sensitive precious metals, boosting gold prices as summer approaches.

|

change in |

Longs |

Shorts |

Hey |

| Daily | -9% | 3% | -5% |

| weekly | -6% | 1% | -3% |

On Friday, the non-farm payroll (NFP) results will undoubtedly steal the spotlight. The March data, which showed employers added 236,000 workers, may have overestimated their strength by not reflecting the full impact of the US banking sector crisis, but the April report would better reflect these developments.

For the reason mentioned earlier, it wouldn’t be surprising if hiring slowed significantly and the economy created fewer jobs than the expected 178,000 jobs. A negative surprise may reinforce the view that the country is heading for deflation, creating a favorable backdrop for safe-haven assets. This scenario should be supportive for gold prices.

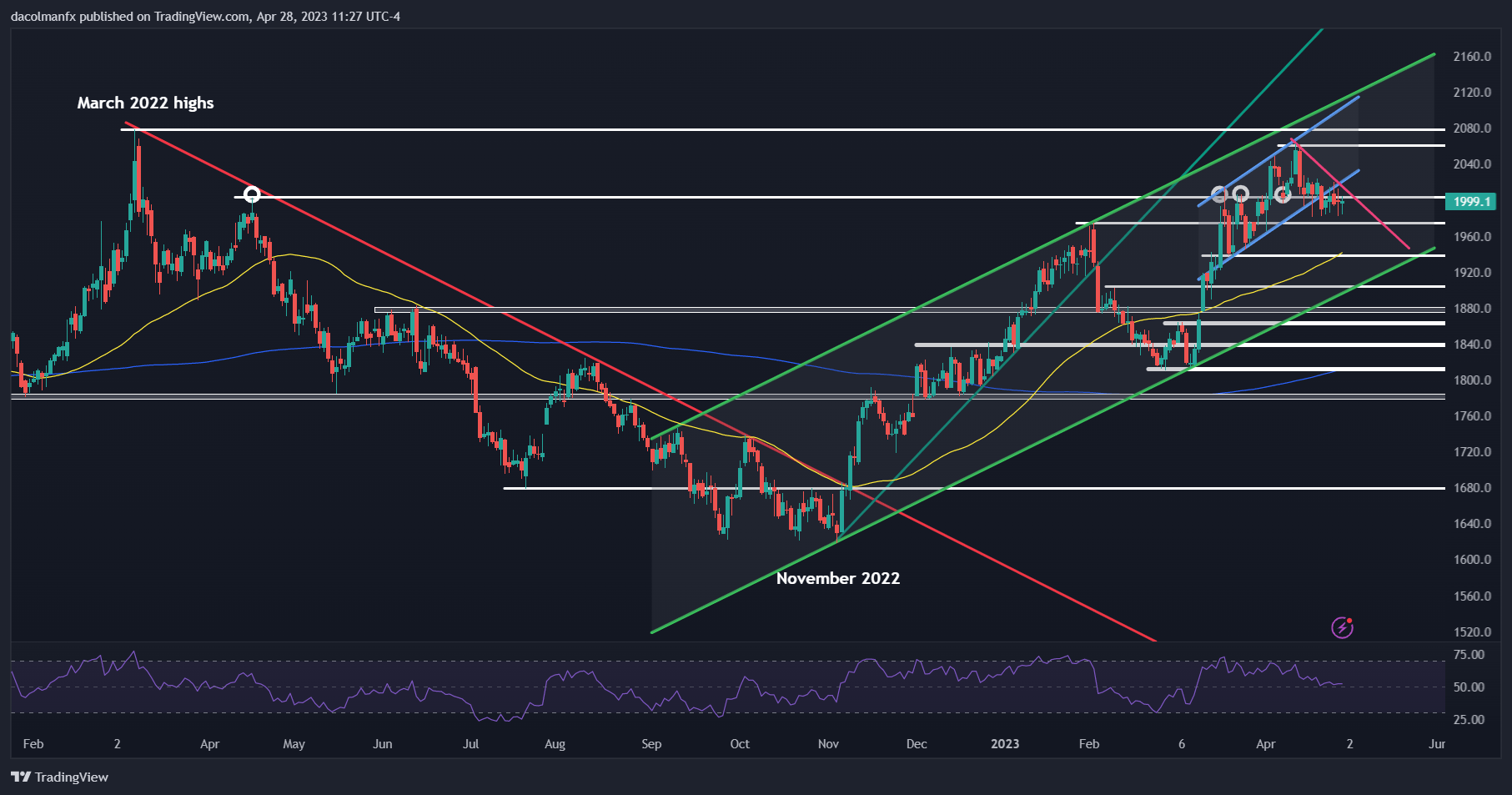

Turning to the technical analysis, it seems that gold has entered a consolidation phase after breaking below a short-term ascending channel, as prices are currently hovering above the $1,975 support. If this level holds, the XAU/USD pair could rebound and challenge the $2000 resistance soon. If this barrier is removed, the metal will face fewer hurdles to retesting its 2023 highs.

On the flip side, if the selling pressure accelerates and the price breaks the support at $1,975, we could see a decline towards the 50-day SMA in no time. On further weakness, attention turns to $1,905, which is the lower bound of a medium-term bullish channel.

Recommended by Diego Coleman

How to trade gold

Comments are closed.