HANG SENG, ASX 200, FTSE STRAITS TIMES INDEX – Outlook:

- Asian indices fell sharply after China’s weak data.

- The Hang Seng Index broke below a key support level.

- What is the outlook for ASX 200 index f FTSE Straits Times Index?

Recommended by Manish Grady

Traits of successful traders

Asian indices fell sharply after manufacturing activity in China contracted faster than expected in May – another sign that China’s post-Covid recovery is losing momentum.

The official manufacturing PMI fell into contraction territory to 48.8 in May from 49.2 in April, compared with forecasts of 49.4. This comes after a series of weaker-than-expected data, including retail sales, industrial production, and fixed-asset investment amid deepening producer price deflation.

Harmonious growth forecasts

Source data: Bloomberg; The graph is prepared in Excel

China’s economic outlook has steadily improved after Beijing lifted easing Covid restrictions, prompting a significant upgrade in China’s economic growth forecast for 2023 (see chart). Recently, though, some of the optimism has waned, as evidenced by the slight downgrade in those ratings. The main focus will be on stimulus measures to support the economy which could mitigate some of the downside risks.

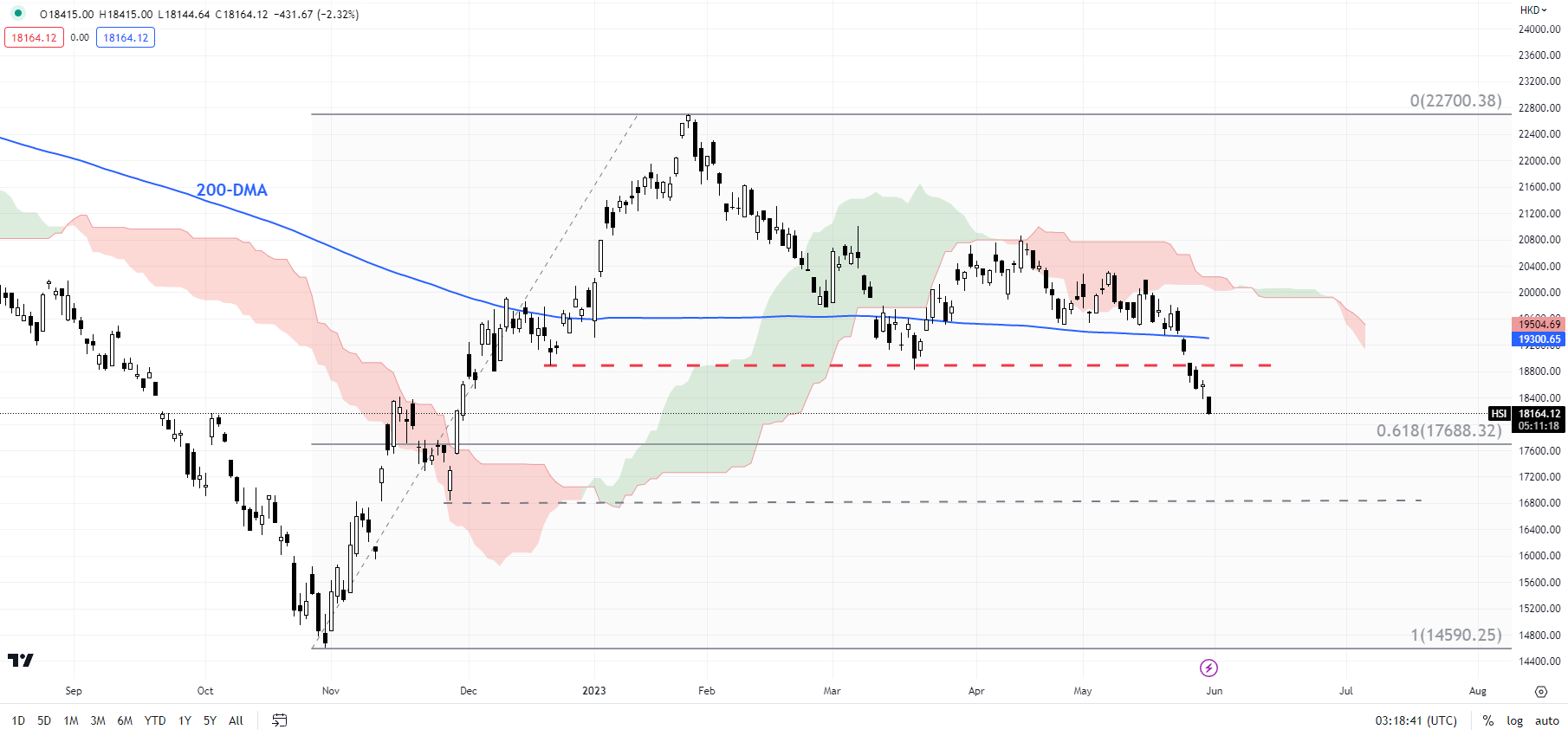

Daily chart of the Hang Seng Index

Chart by Manish Gradi using TradingView

Hang Seng Indicator: breaks below the main support level

The Hang Seng Index broke below major horizontal trendline support at around 18,800, reversing a higher-to-high-down sequence that began in late 2022. This comes after failing in April to rise above a vital ceiling at March’s high of 21,000. The index seems poised to decline towards 17,680 (61.8% retracement of the October 2022-January 2023 high). Subsequent support is seen at the end-2022 low of 16,830. On the upside, the HSI will, at the very least, need to rise above the 200-day moving average for the downward pressure to start fading.

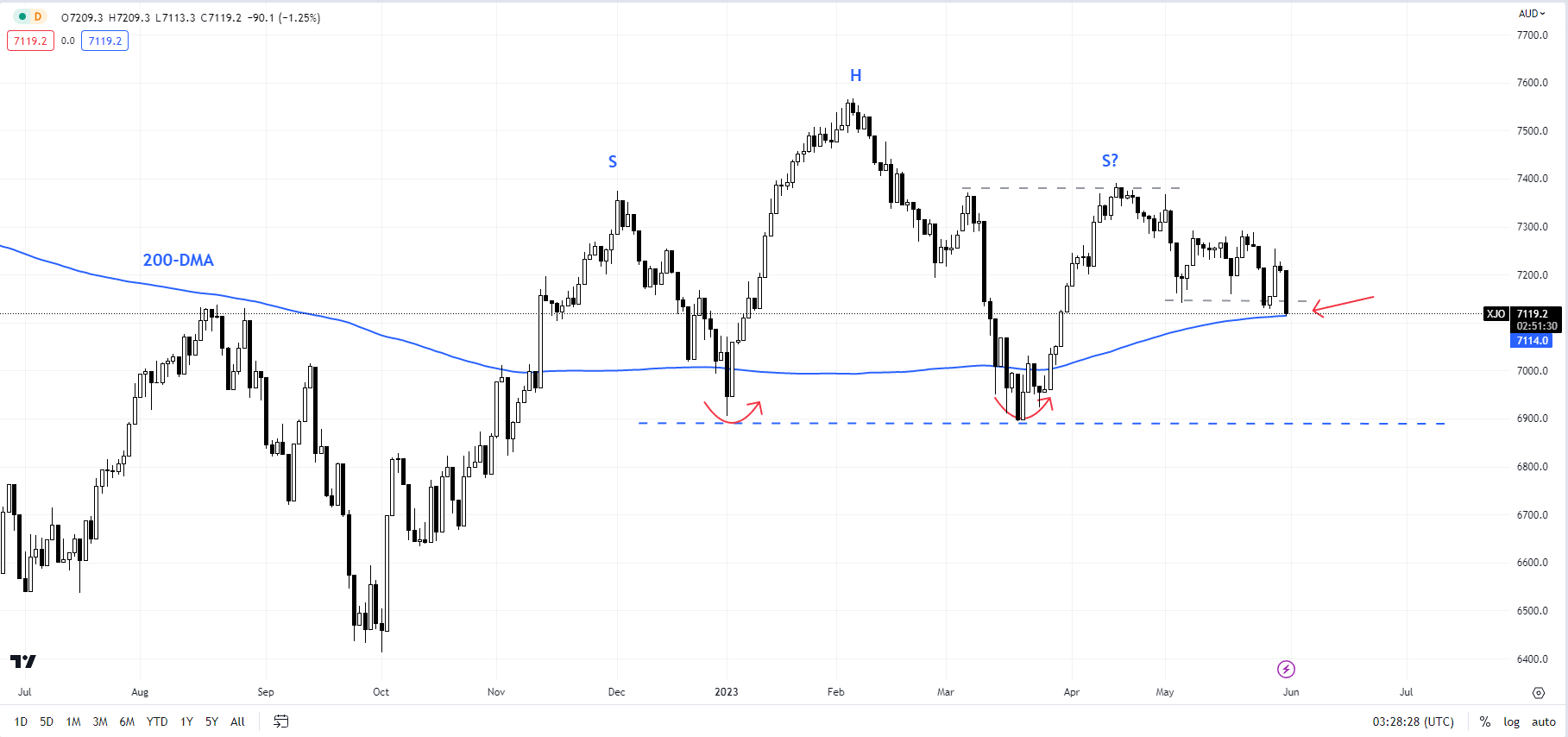

Daily chart of the ASX 200 index

Chart by Manish Gradi using TradingView

ASX 200: Tail Risk Downward Scenario

Possibly a tail risk scenario, but one that cannot be ignored. There is a potential head and shoulders pattern developing in the Australian ASX 200 Index (left shoulder at December high, head at February high, right shoulder at April high). There’s a long way to go before the neckline (which comes in at around 6,900), and in all fairness, the model may not run at all. However, one still needs to watch out as the index is now trying to break out of immediate support at the early May low of 7,141, near the 200-day moving average. A decisive break could increase the odds of a decline towards the neckline.

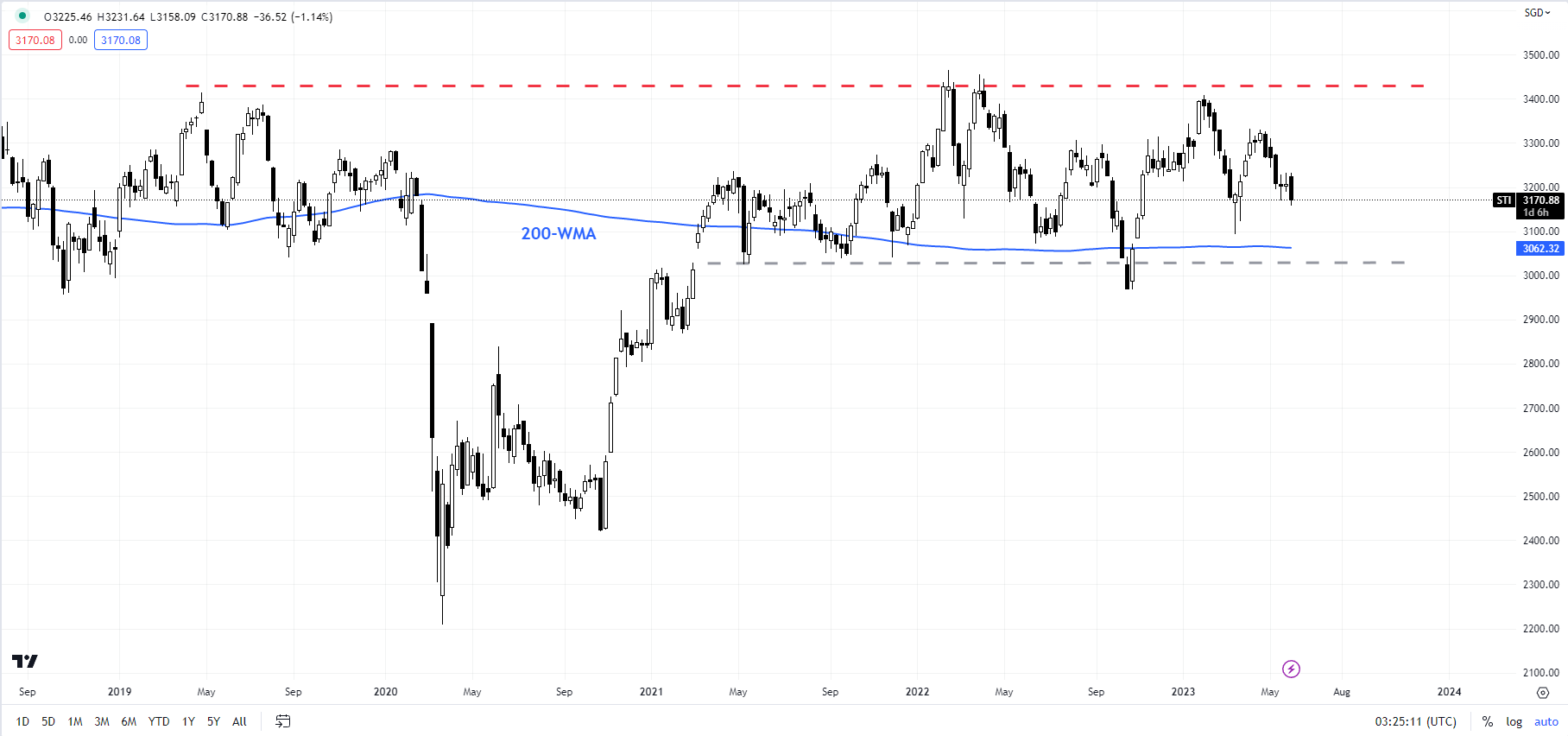

FTSE Straits Times Weekly Chart

Chart by Manish Gradi using TradingView

FTSE STI: Risks a decline towards the lower end of the range

The February pullback from heavy resistance on the horizontal trendline from 2019 and the subsequent lower high set in April raises odds of a decline towards the lower end of the range. The FTSE Straits Times Index in Singapore has been skewed for months, and it looks like it may be a while before it starts trending again. Important support is on the lower edge of the range at around 3025, near the 200-week moving average. A decisive break lower could threaten the post-Covid upside.

Recommended by Manish Grady

Range trading basics

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish