Hungary’s central bank signaled it’s moving toward temporarily embracing bigger cuts to the European Union’s highest borrowing costs after a rapid slowdown in inflation, according to Deputy Governor Barnabas Virag. The forint fell against the euro.

Article content

(Bloomberg) — Hungary’s central bank signaled it’s moving toward temporarily embracing bigger cuts to the European Union’s highest borrowing costs after a rapid slowdown in inflation, according to Deputy Governor Barnabas Virag. The forint fell against the euro.

Policymakers will consider a full percentage point reduction to their 10.75% benchmark interest rate when they next meet on Jan. 30, in addition to the option of a fourth consecutive monthly 75 basis-point cut, Virag told reporters in Vienna on Wednesday.

Advertisement 2

Article content

Article content

“Now there’s more room to move in the direction of 100 basis point cuts” than in December, Virag said on the sidelines of the Euromoney conference in the Austrian capital. He said any bigger reductions would be “a temporary phenomenon for one month or two months or for three months.”

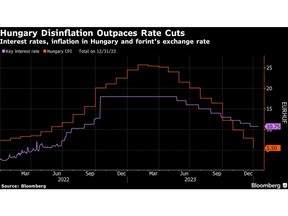

Hungary has been cutting interest rates from a peak of 18% in May as lower energy prices and a collapse in domestic consumption helped tame inflation. The central bank had considered a full percentage point rate cut already in December but decided to opt to maintain the pace of monetary easing.

The forint fell as much as 0.5% against the euro to the weakest level in two weeks after Virag’s comments.

Money market traders have stepped up rate-cut bets after data last week showed the annual inflation rate fell to 5.5% in December, a bigger decline than economists had forecast and down from more than 24% in the same period a year earlier.

Read more: Hungary Inflation Rate at Two-Year Low Widens Rate-Cut Room (1)

Forecasts for Hungary’s key interest rate level to drop to “around 6%-7% in the middle of the year is a very realistic path,” Virag said. The pace of easing will also depend on risk appetite going foward, he added.

Advertisement 3

Article content

Inflation may return to the central bank’s tolerance band, within one percentage point of 3%, in the first quarter, Deutsche Bank analysts said on Monday, predicting a full percentage point interest rate cut this month.

Bigger interest rate reductions would be in line with calls by Prime Minister Viktor Orban’s government, which has urged the central bank to accelerate monetary easing to kickstart growth following a recession last year.

The rate-cut room also widened after the EU unblocked more than €10 billion ($10.9 billion) in funding for Hungary last month, about a third of the amount suspended a year earlier due graft and rule of law concerns under Orban’s rule.

That’s helped bolster investor confidence in Hungary, which has seen forint volatility drop and bond yields plunge to the lowest level in almost two years.

(Updates with currency in first and fifth paragraphs, December rate meeting in fourth.)

Article content