valtron84

Industrial real estate appears to have reached an inflection point and is poised to bounce up next year as the sector normalizes in the wake of the pandemic, according to a research note from Bank of America Securities.

The sector boomed when consumers, stuck at home during the pandemic, embarked on online shopping sprees, partly fueled by stimulus checks. That led to increased demand for warehouses and fulfillment centers to keep up with the surge in business. Then, as travel restrictions lifted, the demand for goods slowed.

That softening in demand may be bottoming out after BofA’s proprietary one-year industrial real estate leading indicator declined on a month-over-month basis for almost two years, BofA analyst Camille Bonnel said in a note to clients. While the analyst described the turning point, the note didn’t disclose numerical values of the gauge.

“We view the recent improvements as a positive for Industrial demand starting in late Spring ’24,” she said.

The indicator has a strong historical correlation with GAAP same-store net operating income growth for EastGroup Properties (NYSE:EGP), Prologis (NYSE:PLD), and Stag Industrial (NYSE:STAG), BofA’s Buy-related industrial REITs.

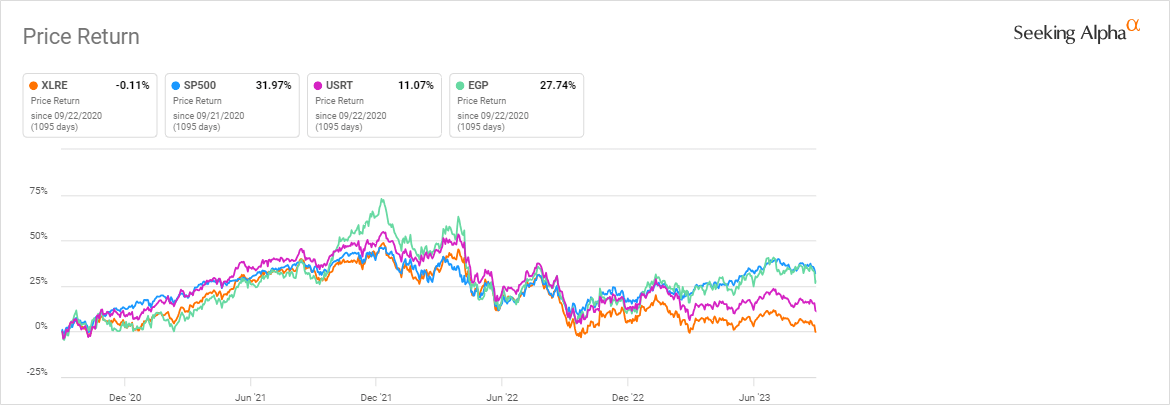

Note that in the past three years, the Real Estate Select Sector SPDR ETF (XLRE) and iShares Clore U.S. REIT ETF (USRT) have failed to keep up with the S&P 500. EastGroup (EGP) came close, rising 28% compared with the S&P’s 32% increase.

The BofA IndRel indicator identifies 10 variables that show a 12-month leading relationship with the demand cycles of industrial real estate. Inputs are across four main categories: consumption, trade/supply chains, construction, and jobs, with each key category weighted at 25% of the gauge.

The BofA analysts expected 2023 to “moderate from record levels of unsustainable growth in 2021/2022.” YTD, market data is tracking ahead of the indicator but is directionally in line with their expectations of “moderating healthy trends.”

While BofA expects industrial real estate demand to pick up steam, market conditions remained healthy overall. Prologis (PLD) forecasted that vacancy rates will stay below 5% and construction deliveries (i.e., supply of new industrial buildings) will decline by 35% in ’24, “both positives for landlord pricing,” Bonnel said.

She also expects an acceleration in 2024 leasing spreads, as BofA’s Buy-rated REITs have lower in-place rents on expirations vs. H2 2023. Meanwhile, Moody’s REIS real estate data analytics service forecasts +6% market rent growth in 2024, for additional upside.

See the SA Quant system’s stock picks for the real estate sector.