Bitcoin has had a turbulent week, with price swings ranging from a local high of $69,500 to a low of $65,000, only to calm down after weeks of bullish excitement. Now, BTC is consolidating below the crucial $70,000 level, a price point seen as a key threshold for the next major move.

Despite the decline in prices, leading investors and analysts are closely monitoring the market dynamics. CryptoQuant analyst and prominent investor Maartunn recently shared a chart highlighting a significant increase in BlackRock’s balance and balance changes in BTC, suggesting that the financial giant may be strategically supporting the market.

This insight into BlackRock’s growing involvement has sparked new optimism among investors, who view institutional support as a strong foundation for Bitcoin’s potential rally. The company’s growing presence in the Bitcoin market, as highlighted in Martin’s analysis, means a deep commitment that could bring greater stability and strength to Bitcoin prices in the coming weeks.

As Bitcoin stabilizes below $70,000, these signals from big players like BlackRock add an extra layer of anticipation to the market, with analysts predicting that their influence could push Bitcoin through critical resistance levels.

Bitcoin’s growth is supported by institutions

Bitcoin is approaching a pivotal moment, with market sentiment strongly favoring a rise to all-time highs in the near future. Analysts and investors are growing increasingly optimistic as ETF flows have shown consistent positivity over the past few weeks, boosting expectations about Bitcoin’s upward trajectory. Price action was also resilient, consolidating near critical resistance levels and indicating underlying strength in the market.

Recent analysis by Senior Analyst Martin It highlights an interesting dynamic related to BlackRock’s BTC holdings. Maartunn shared a chart revealing BlackRock’s Bitcoin balance and net balance changes, suggesting that the financial giant may be subtly supporting the market.

The chart highlights a notable trend: positive balance changes at BlackRock have significantly outpaced negative changes, indicating a sustained accumulation phase. This pattern suggests that BlackRock may be positioning itself as a major market maker for BTC, perhaps providing liquidity and contributing to price stability in a highly volatile market.

Such actions by BlackRock could be a major catalyst for Bitcoin’s price, as institutional participation historically encourages investor confidence and mitigates market downturns. With positive ETF flows and strategic accumulation from major players like BlackRock, the current setup points towards an environment ripe for upward movement. If Bitcoin continues to hold these levels and institutional support remains strong, the way could be set for a rally that takes Bitcoin into uncharted territory.

Bitcoin tests critical liquidity

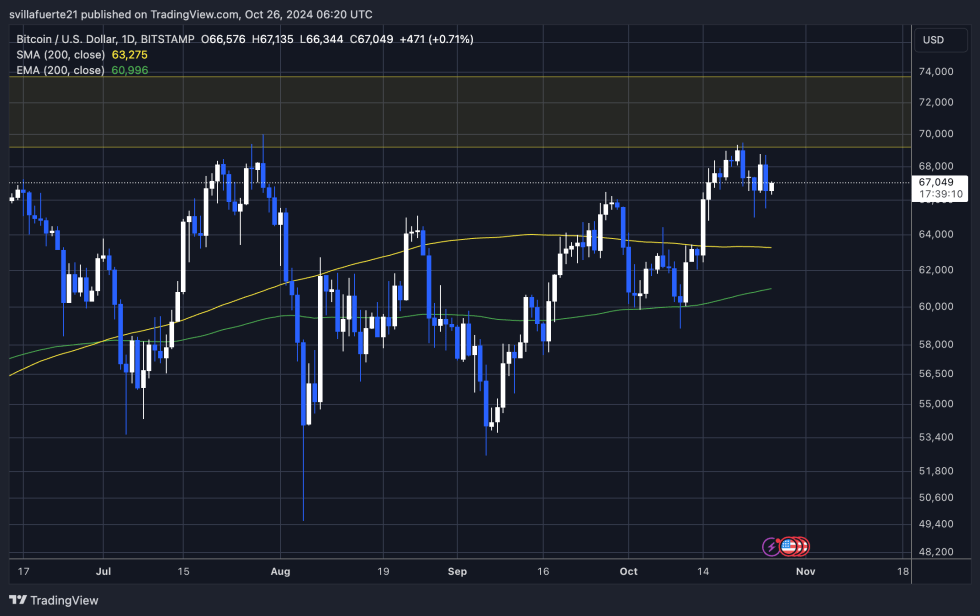

Bitcoin is currently trading at $67,000 and appears to be forming a bull flag pattern, which could push the price higher in the near term. The price has managed to hold above the critical level of $65,000, providing a solid basis for a bullish outlook as it indicates strong interest from buyers. This key threshold acted as support, preventing further declines and boosting optimism among traders.

However, next week will be crucial for Bitcoin. If the price fails to break the $70,000 level, a bounce back to lower demand levels is likely. Such a move could test the 200-day moving average, which currently stands at $63,275. If Bitcoin drops below the $65,000 level, this area will become a focal point for traders looking for strong demand, as it has historically served as an important support level.

Maintaining the bullish flag pattern and beating the resistance at $70,000 will be vital to maintain the bullish momentum. Traders will be watching the price action closely to determine if BTC can continue its rise or if a pullback to lower levels is on the horizon. The coming days will reveal whether bullish sentiment can push BTC to new heights.

Featured image by Dall-E, chart from TradingView

Comments are closed, but trackbacks and pingbacks are open.