The Israel-Hamas war dominated developments across key commodity markets last week. Gold benefited from safe haven flows, and oil prices spiked. Risk appetite stabilized somewhat today, as investors watch efforts to contain the conflict.

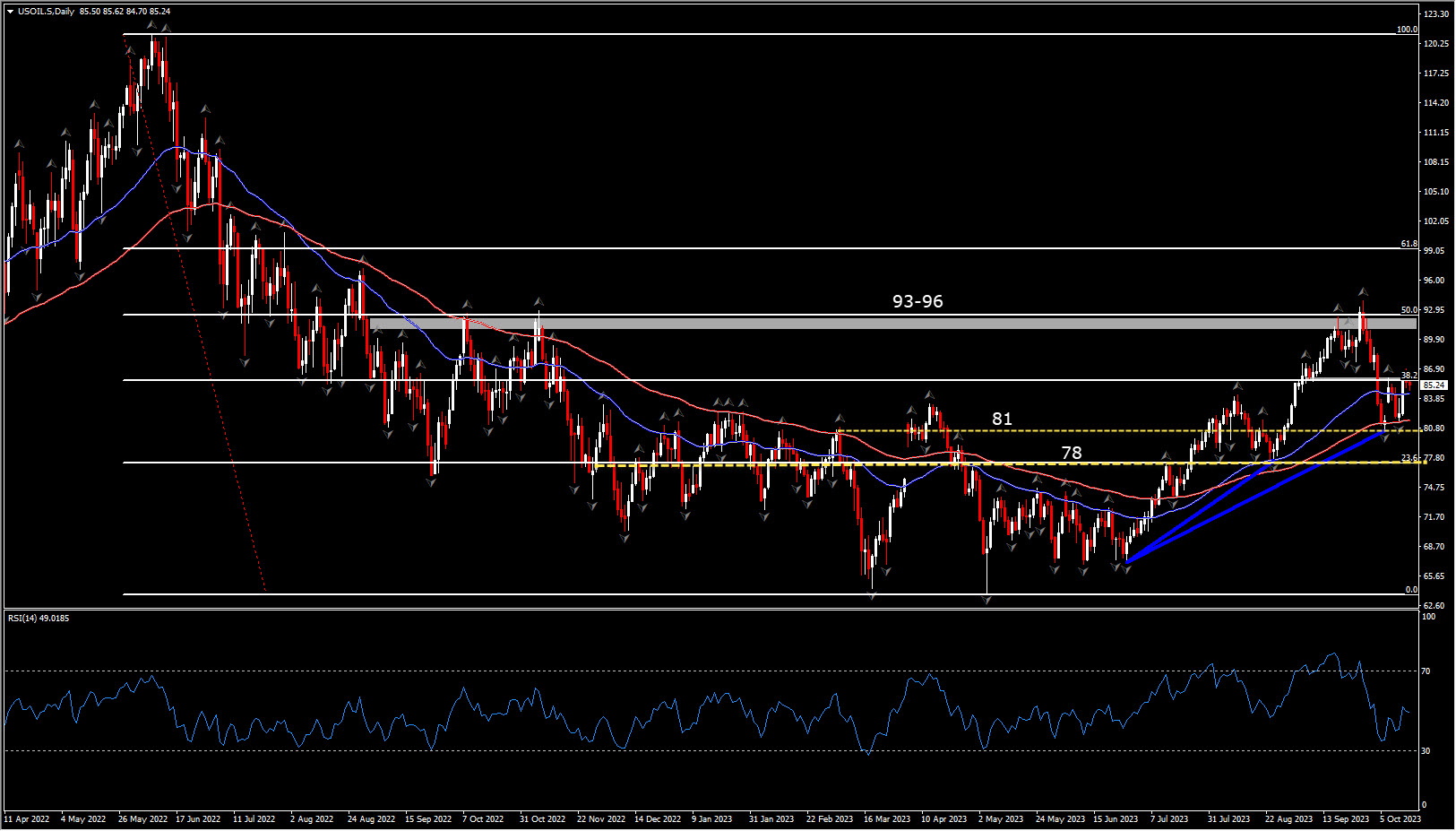

USOIL surged nearly 6% on Friday and posted a weekly gain of 5.9% amid concern that the conflict between Israel and Hamas would widen. UKOIL traded at $90.89 per barrel on Friday, but prices have settled down somewhat today. For now, investors are watching efforts to contain the conflict, and markets are not really pricing in the risk of a further escalation that could potentially threaten supplies.

Still, the International Energy Agency warned last week that “markets will remain on tenterhooks as the crisis unfolds”. JPMorgan flagged that supply could be hit if the US were to strictly enforce restrictions on Iranian oil exports, or if the conflict were to lead to disruption in the Strait of Hormuz. Iran officials meanwhile suggested that a ground attack on Gaza could prompt other militant groups to enter the conflict. Against that background, fears that oil could hit $100 a barrel have picked up again.

Gas futures declined today, and US prices fell to the lowest level in over a week amid increased production and reduced exports to Mexico, as well as forecasts of mild weather through the end of the month. In Europe prices have also settled, after rising sharply last week. TTF soared 41% to hit a high of EUR 56 per megawatt-hour on supply concerns and weather developments. Israel has morphed from a gas importer to an exporter over the past two decades and production at the “Tamar” platform has already been halted in the wake of the conflict.

At the same time, strike action at Chevron’s key gas production sites is set to resume this week, which is complicating the picture. A potential halt of the “Gorgon” and “Wheatstone” projects, which together account for over 5% of global liquefied natural gas production capacity, could further undermine supply. Meanwhile the investigation of the leak at the Balticconnector subsea gas pipeline between Finland and Estonia is ongoing, but Nordic and Baltic seismologists said that they had detected blast-like waves last Sunday when the pipeline ruptured. They suggested that the data was not strong enough to say whether explosives were involved. Official agencies have suggested that mechanical damage and not an explosion looked like the most likely cause, but supply remains disrupted.

Europe’s gas storage levels are almost full but are insufficient to shield the area through the winter, which means EU countries will rely on ongoing deliveries. This is especially true if the weather turns adverse. For now, European gas prices have settled down, and TTF is -8.9% lower than on Friday, while UK gas has corrected by -9.3%. Both are still up 40% compared to the same time last month, and while prices are considerably lower than in the corresponding period last year, developments highlight that central banks will have to factor in a possible back-up in energy prices.

The gold price has benefited from safe haven demand, and it surged more than 3% on Friday as markets watched developments in the Middle East and Israel’s preparation for a ground attack. Risk aversion eased somewhat at the start of this week and haven flows receded, but bullion is currently still trading at $1,920 — more than 3% higher than a week ago.

In the bigger picture, XAUUSD experienced a slight pullback after being overbought, with the 200-day EMA providing support and catching investors’ attention. The pivotal question is whether the market can maintain this level; a breakdown might lead to further corrections, possibly dropping to $1900.

Shorting the market is risky given recent surges, and a substantial correction is uncertain. Traders might consider shorting only if gold falls below $1900 or reverses and breaks above $1950, potentially reaching $2000. The market is currently at a conflict point, indicating erratic price movements. Caution is advised, with a need to monitor US interest rates, as rising rates typically lead to lower gold prices, a correlation supported by recent market behavior.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.