S&P 500 Prediction:

- Standard & Poor’s 500 The week starts in full swing, buoyed by positive sentiment after the encouraging results from the banks last Friday

- The focus this week will be on earnings from tech giants Netflix and Tesla

- This article discusses the S&P 500 technical levels to watch in the coming days and weeks

Recommended by Diego Coleman

Get your free stock forecast

Most read: Gold’s recovery runs out of fuel ahead of US retail sales. What now for XAU/USD?

The S&P 500 traded slightly higher on Monday, bolstered by positive sentiment after benign corporate results from major lenders ahead of the weekend and signs that the US economy may be on its way to avoiding a hard landing.

At the market close, the index rose about 0.4% to 4522, marking its best close this year, as technology and financial stocks led the advance on Wall Street and the names of utilities and real estate bucked the upward trend.

Big banks like JP Morgan and Wells Fargo posted huge profits last quarter despite the tough backdrop. The administration’s guidance has also been constructive, suggesting that the worst may be over and the economy is stabilizing as inflation continues to ease.

For sentiment to remain upbeat, US companies will need to continue to deliver strong results, especially those in the technology sector. However, a major fundamental test will come on Wednesday, when Netflix and Tesla reveal their quarterly numbers.

This year, stocks of technology companies have risen and re-rated sharply on the back of the artificial intelligence craze. To justify premium valuations and maintain their performance, these companies will need to demonstrate earnings flexibility and the ability to expand profit margins while growing their top and bottom line.

For Netflix (NFLX), markets are expecting EPS of $2.84 on revenue of $8.27 billion. For Tesla (TSLA), analysts expect EPS of $0.79 on sales of $24.29 billion. Check out the DailyFX earnings calendar for a comprehensive list of companies announcing results in the coming days and weeks.

source: DailyFX earnings calendar

If earnings and future outlook fail to impress investors, the stock rally could lose steam and pave the way for a moderate correction. This is a risk for the S&P 500 and Nasdaq 100 that should not be overlooked as the second quarter earnings season progresses.

|

change in |

Longs |

Shorts |

Hey |

| Daily | 14% | 4% | 7% |

| weekly | -7% | 8% | 3% |

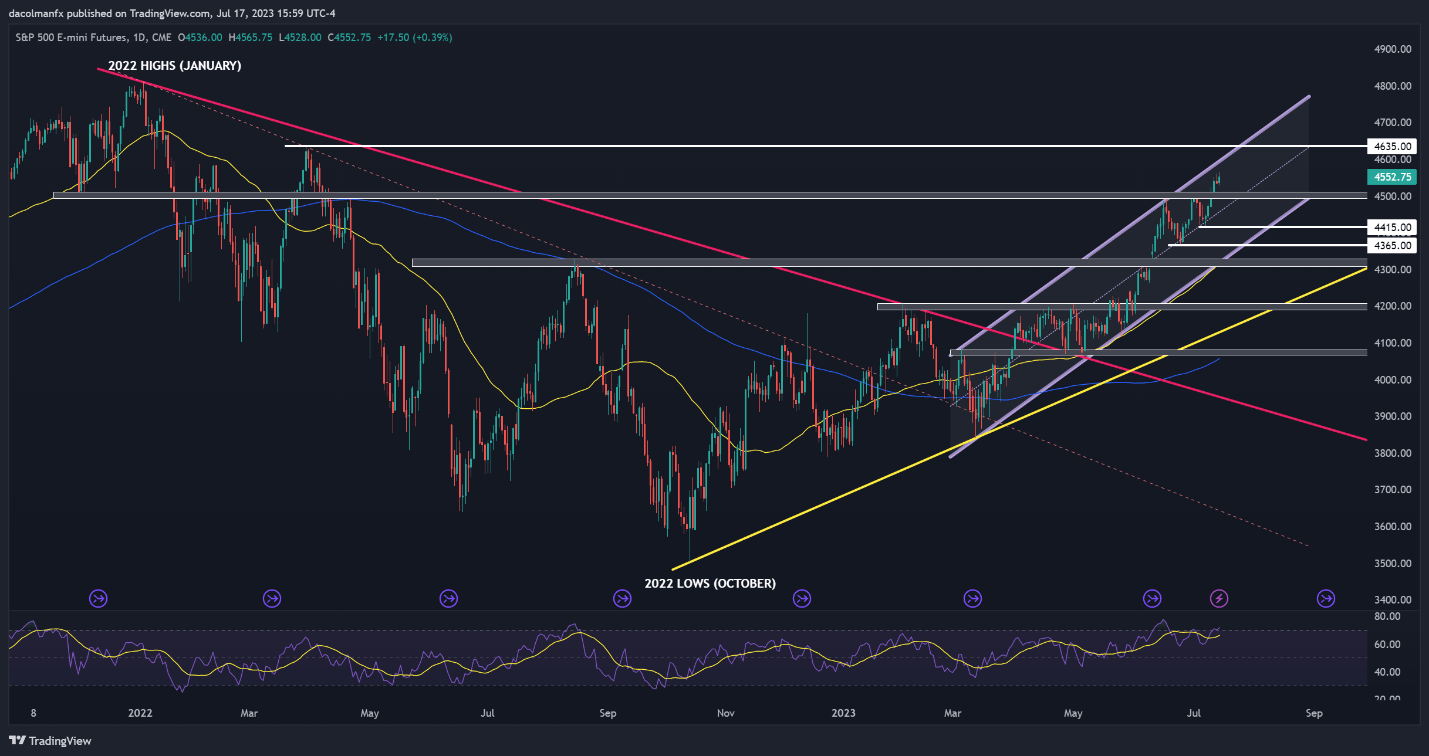

Technical analysis of the S&P 500 index

If the S&P 500 can extend its advance, the initial resistance appears at 4,600, near the upper border of the short-term ascending channel. If the bulls can push prices above this barrier, we could see a move towards 4635, the March 2022 high.

On the other hand, if the index reverses lower and starts to fall, the first support to consider is near the psychological level of 4,500, followed by 4,415 and 4,365 after that.