Missed Out on Nvidia? Buy This Magnificent Artificial Intelligence (AI) Stock Before It Soars at Least 43% in 2025.

Artificial intelligence (AI) has helped. Nvidia‘s (Nasdaq: NVDA) Stocks are posting stellar gains around the clock in 2024, with shares of the semiconductor giant up more than 183% as of this writing, but investors now appear to have doubts about the company’s ability to maintain its impressive growth rate over the long term.

Maybe this is why Nvidia shares fell Despite providing better-than-expected numbers and guidance last month. The company’s revenue for the third quarter of fiscal year 2025 increased a staggering 94% year-over-year to $35.1 billion, while earnings jumped 103% year-over-year to $0.81 per share.

Start your morning smarter! Wake up with Breakfast news In your inbox every market day. Register for free »

However, Nvidia’s revenue guidance of $37.5 billion for the current quarter suggests its top line is on track to increase at a relatively slower pace of 70% than the same quarter last year. Additionally, the margin pressure the company will face in the near term due to the introduction of Blackwell processors appears to have dented investor confidence.

Of course, Nvidia can overcome these challenges and provide more gains to investors. However, for those who missed the Nvidia rally and are looking for a relatively cheaper price Artificial Intelligence Stocks Ones that aren’t trading at a price 31 times as expensive might consider taking a closer look Marvell technology (NASDAQ: MRVL). Let’s look at the reasons.

Marvell Technology released its fiscal third quarter 2025 results (for the three months ended November 2) on December 3. The chipmaker’s total revenue increased 7% year over year to $1.52 billion, above consensus expectations of $1.46 billion. Its non-GAAP (adjusted) earnings rose to $0.43 per share from $0.41 per share in the year-ago period, again beating the consensus estimate of $0.41.

You might wonder why Marvell would be a good alternative to Nvidia given its slow pace of growth, but a closer look at the company’s data center business will reveal the real picture. The data center segment produced 73% of Marvell’s total production last quarter, compared to 39% in the same period last year. This segment’s revenue nearly doubled year-over-year to $1.1 billion, offsetting sharp declines the company saw in other segments such as Enterprise Networks, Carrier Infrastructure, Automotive/Industrial, and Consumer.

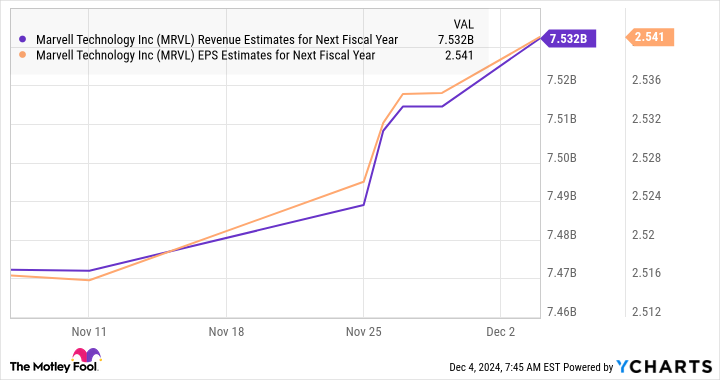

The good part is that the strength of Marvell’s data center business, which benefits from growing demand for custom AI processors and optical networking equipment, will be enough to lift the company’s growth higher in the current quarter. This is evident from Marvell’s fiscal fourth-quarter revenue guidance of $1.8 billion, which represents a 26% jump from the same period last year. Analysts had settled on revenue of $1.65 billion for Marvell for the current quarter.

Comments are closed, but trackbacks and pingbacks are open.