Analysis of the USD/JPY pair

- Will Fed Chairman Powell continue his hawkish rhetoric?

- US economic data awaits as fears of a global slowdown grow.

- 145.00 on the cards for the USD/JPY bulls?

Recommended by Warren Vinkitas

Get a free Japanese Yen forecast

The Japanese yen’s primary back

The Japanese Yen had a tough time last week and is heading into the week on a generally weaker backdrop due to Fed Chair Jerome Powell’s hawkish testimony as well as Friday’s drop in the Japanese CPI. Low inflation will make it difficult for the Bank of Japan (BOJ) to shift from its ultra-loose monetary policy but changes in Yield Curve Control (YCC) are still possible.

The week ahead is dominated mostly by US central data (see economic calendar below) including the core PCE print which is the Fed’s preferred measure of inflation. Mr. Powell is set to speak again and is likely to continue his path of tightening rather than suspending interest rates as the money market prospects are closer than ever. 25 bits per second high in July. Other major releases include Michigan Durable Goods Orders, GDP and Consumer Sentiment which will provide a clearer picture of the broader US economy. If the data indicates a slowdown in the economy, recession fears may creep back in and may play into the hands of the safe-haven yen.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

Economic calendar (GMT +02:00)

source: DailyFX Economic Calendar

Technical Analysis

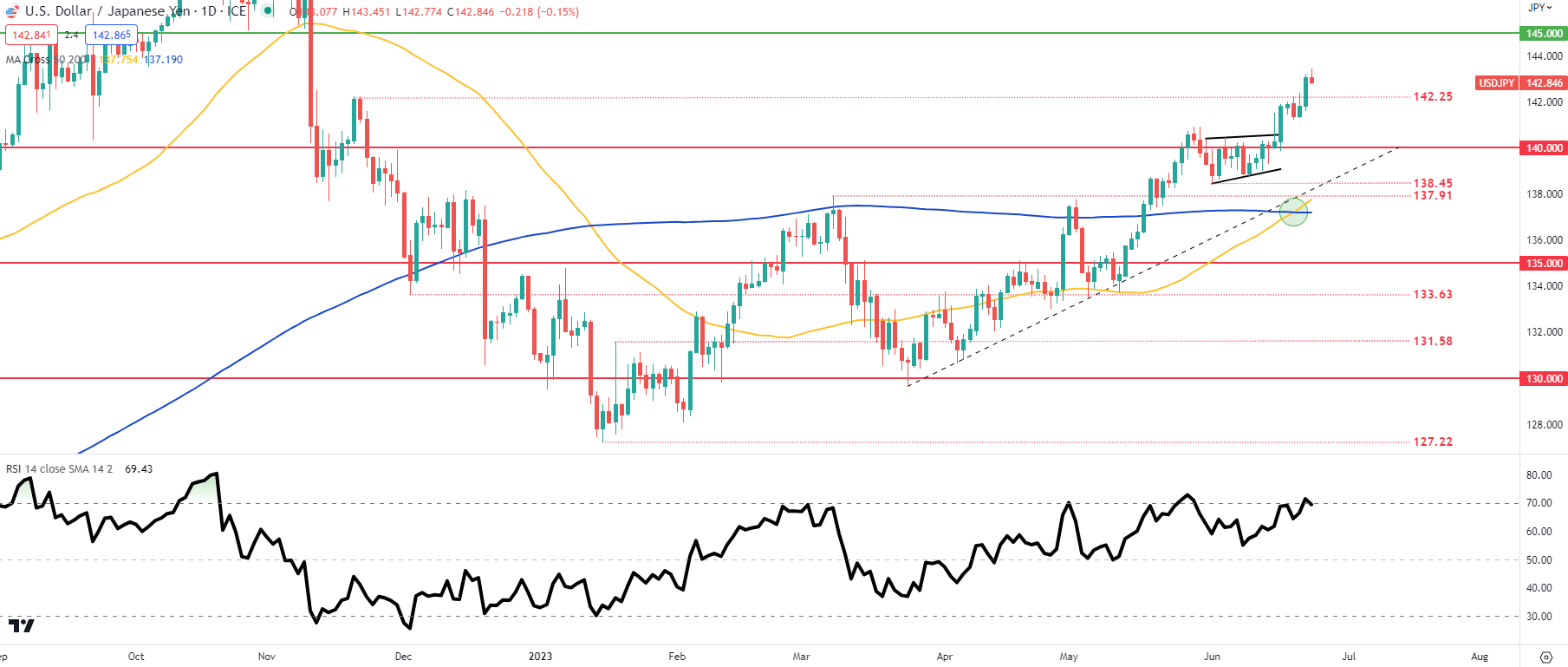

USD/JPY daily chart

Chart created by Warren VenkitasI.G

USD/JPY is showing that price action has been following the golden (green) crossover signal pushing to new 2023 highs. While the pair is in the overbought region as indicated by the Relative Strength Index (RSI), more heading towards is still to come 145.00 psychological level before regression to the bottom.

Key resistance levels:

Key support levels:

Client Sense: Up

IGCS shows that retail traders are currently net traders short On USD/JPY, with 72% of traders who hold short positions (as of this writing). At DailyFX, we take a contrarian view on sentiment which leads to a short-term bullish trend.

Contact and follow up@employee