S&P 500, SPX, NASDAQ 100, and NDX – Outlook:

- the Nasdaq The 100 seems overbought with some signs of fatigue, but no sign of a reversal.

- the Standard & Poor’s 500 The indicator broke above the main resistance.

- Which way for the two pointers?

Recommended by Manish Grady

Get your free stock forecast

A break above key resistance of the S&P 500 and Nasdaq 100 confirms that the 2022-2023 downtrend is over, increasing the odds of a resumption of the long-term bullish trend. However, it is showing some signs of fatigue, especially on the NASDAQ 100 charts.

The Nasdaq 100: leading the way

The Nasdaq 100 rose in May over a severe hurdle of 13,720, the high of August 2022, confirming that the downward pressure has faded. This follows a rebound in late 2022 – early 2023 from near-strong support on the 200-week moving average, and a break above the 89-week moving average in April – the shorter moving average was strong resistance in mid-2022 recovery. The shift to the upside was first highlighted in early 2023 — see “S&P 500 and Nasdaq 100 Technical Outlook: Turning Bullish,” posted Jan. 28.

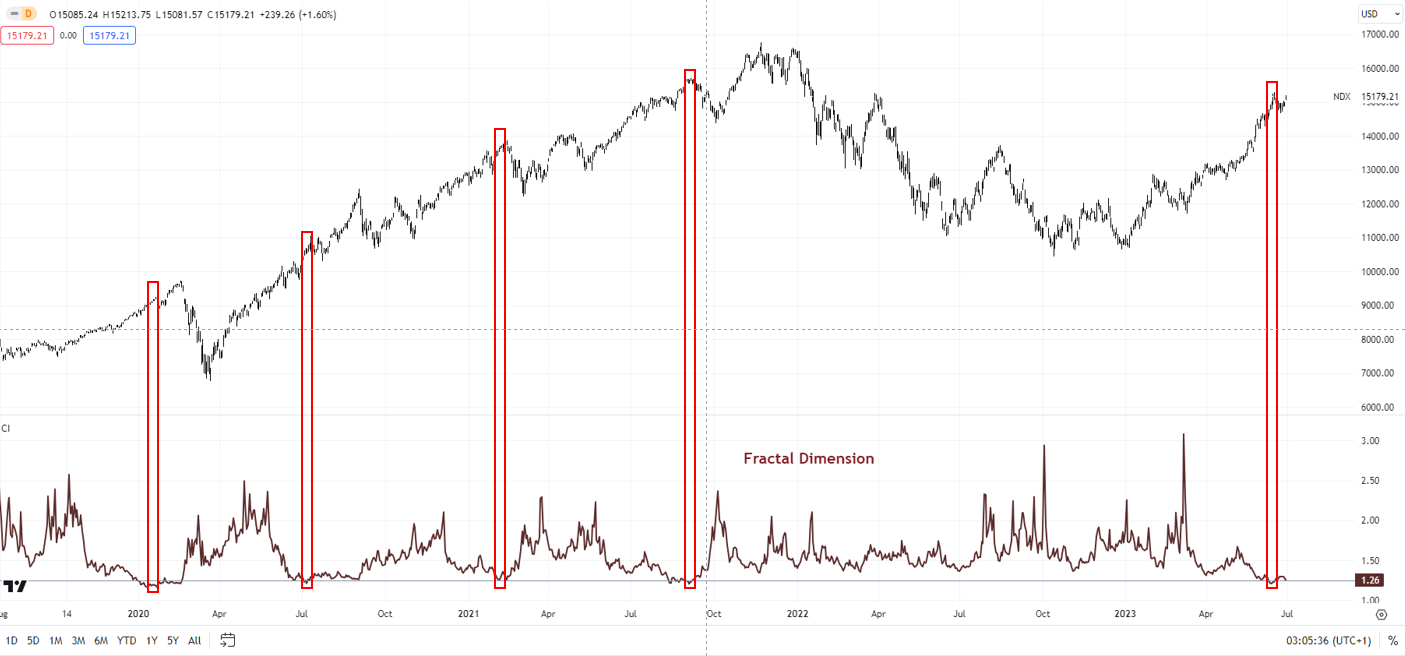

Nasdaq 100 daily chart

Chart by Manish Gradi using TradingView

Having said that, the indicator is looking overbought/stretched. Market diversification as measured in fractal dimensions appears to be low. Fractal dimensions measure the distribution of diversity. When the scale reaches a lower bound, usually 1.25-1.30 depending on the market, it indicates a very low variance as market participants bet in the same direction, increasing the odds of a price reversal. For the Nasdaq 100, the 65-day fractal dimension fell below the 1.25 threshold, triggering a red flag.

Nasdaq 100 daily chart

Chart by Manish Gradi using TradingView

To be fair, this does not mean an imminent price reversal. This means that the bar for sustained gains before the correction is now much higher. However, unless there is price confirmation, the path of least resistance remains to the upside. Immediate support is at the end of June low at 14,550-14,650 – a break below support confirms that the upward pressure has faded. On the upside, immediate resistance is at the April 2022 high of 15,265, and a stronger barrier is at the 2021 record high of 16,765.

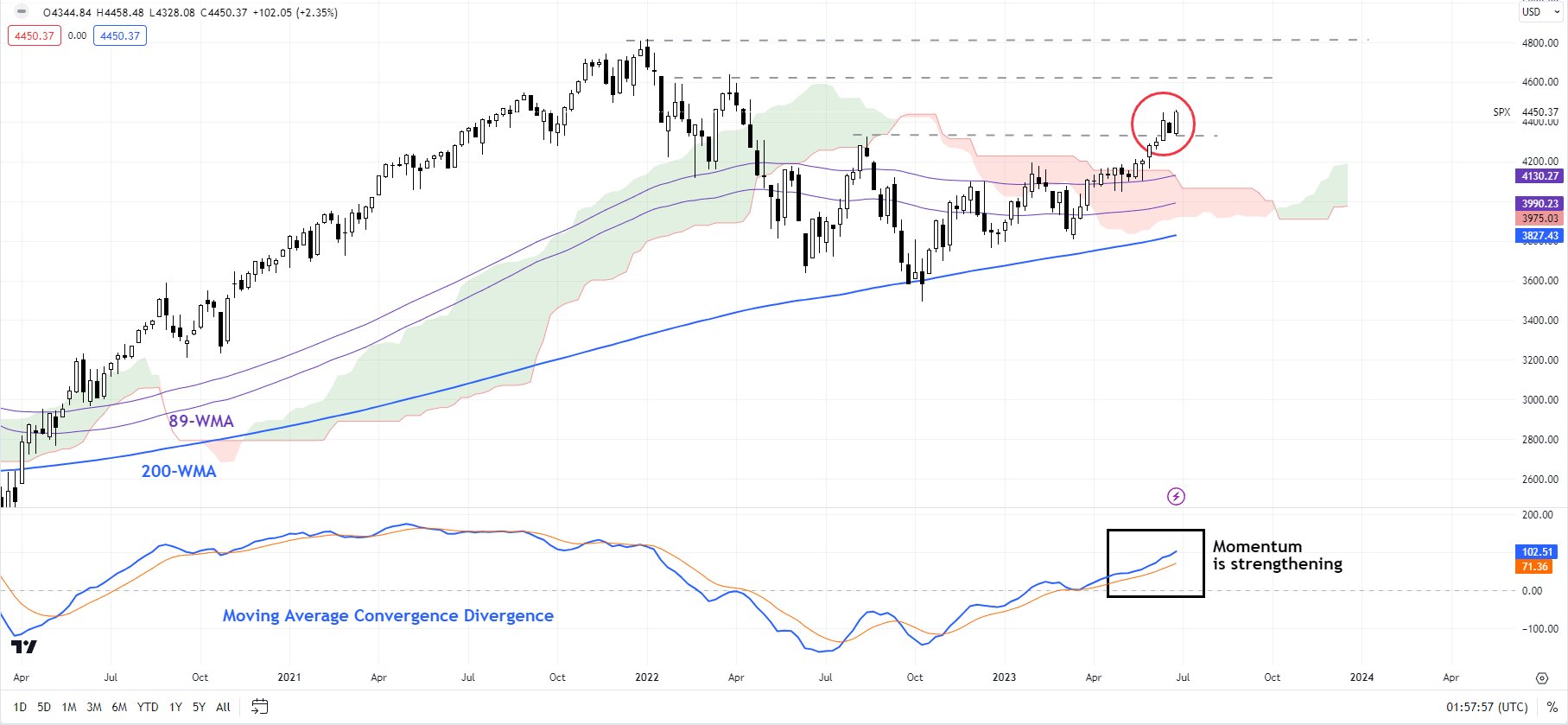

S&P 500 Weekly Chart

Chart by Manish Gradi using TradingView

Standard & Poor’s 500: Clears a difficult hurdle

After months of sideways/volatile price action, the S&P 500 rose earlier this month above the vital ceiling at the August high of 4325. Momentum on the weekly charts is picking up after the bullish breach, indicating further gains. The break opened the doors towards the April 2022 high of 4,637, a possible 2022 high of 4,819.

Recommended by Manish Grady

Traits of successful traders

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish