POUND STERLING ANALYSIS & TALKING POINTS

- UK GDP changes grim UK economic outlook.

- US PCE price index in focus later today.

- GBP/USD pulls out of oversold territory (RSI).

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

The British pound found some respite this Friday morning from both the US dollar and the local UK GDP release (see economic calendar below). UK GDP beat estimates on the headline YoY print as well as the business investment metric. An overall positive report that was driven by the production sector from an output point of view as well as an uptick in household savings ratio and disposable income. After the recent gloomy UK economic outlook, these figures bring some positivity with the UK’s Chancellor Hunt stating that “Today’s GDP data once again proves doubters wrong”.

The resultant impact on Bank of England (BoE) expectations (refer to table below) has been slightly repriced in favor of a higher peak and lesser interest rate cuts by year end 2024. The culmination of which has bolstered GBP in early trade.

BANK OF ENGLAND INTEREST RATE PROBABILITIES

Source: Refinitiv

The US added to cable’s upside due to recent Fed officials (Barking & Goolsbee) highlighting concerns around the central bank being too aggressive in their monetary policy stance and possibly overshooting on rate hikes. This is in stark contrast to the hawkish Neel Kashkari who favored an additional hike while opting for no rate cuts in 2024.

The day ahead is filled with potential market moving data with the focus on the PCE price index (fed’s preferred measure of inflation). The release will definitely provide short-term volatility pre and post-announcement and will give traders clues as to the next steps in the Fed’s decision making. Michigan consumer sentiment is expected to drop inline with the CB consumer confidence report earlier this week but an upside surprise could assist in dollar upside. Finally, the Fed’s Williams is scheduled to speak and it will be interesting to see whether or not he prefers the dovish or hawkish narrative.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

TECHNICAL ANALYSIS

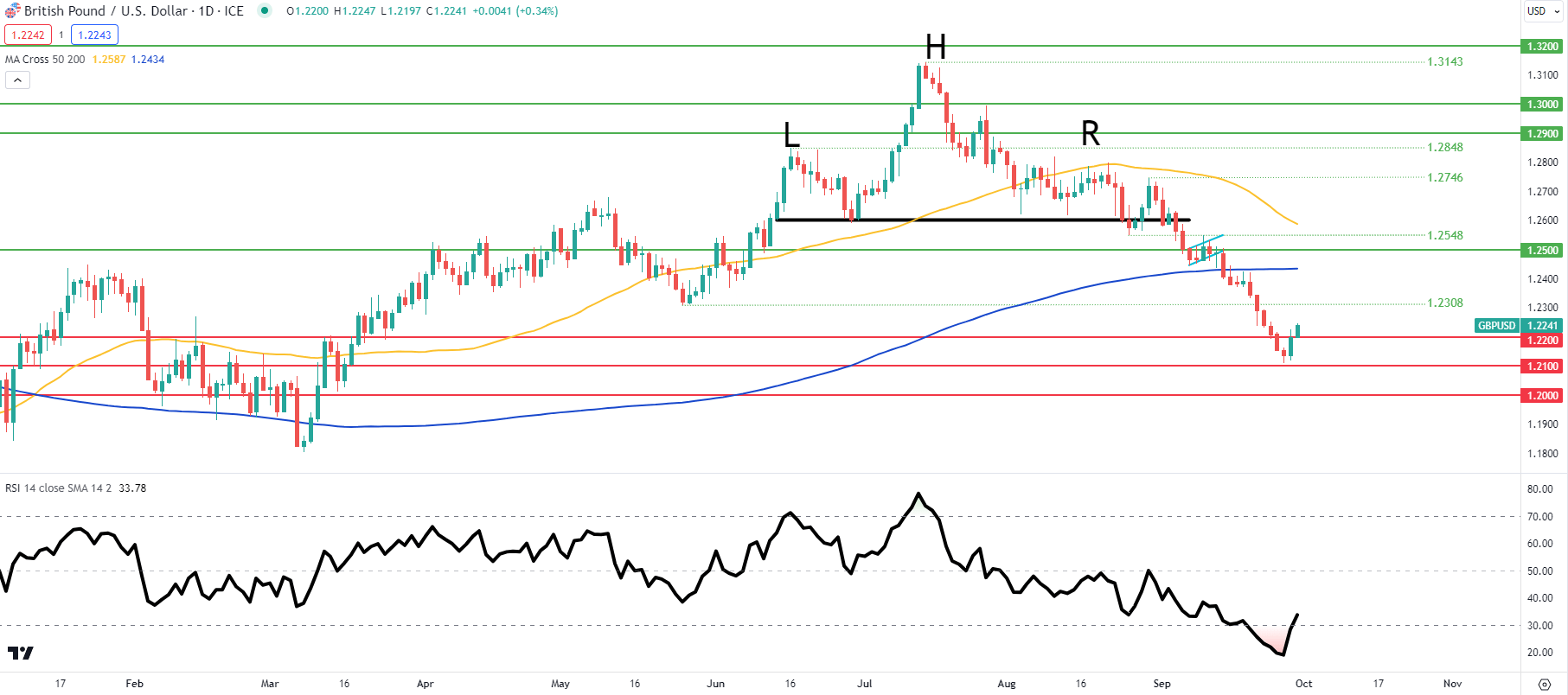

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Price action on the daily cable chart above shows bulls peering above the 1.2200 psychological handle while moving out of the oversold zone reflected by the Relative Strength Index (RSI). Upcoming data will provide a short-term directional bias as to whether or not the pound can continue this run or will it be short-lived.

Key resistance levels:

Key support levels:

MIXED IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 71% of traders holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect GBP/USD sentiment and outlook!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas