Oil demand rose in the third quarter of the year amid supply cuts from OPEC+

Crude oil prices have been on a downward trajectory this year with many fundamental factors influencing the overall trade dynamics. OPEC+ has been at the center of the discussions once again by imposing its influence through recent production cuts to boost crude oil prices. The actions of OPEC+ highlighted its insistence on supporting oil prices giving traders the underlying support that there is a floor to how low OPEC+ is willing to let prices drop. In June 2023, OPEC+ members agreed to production cuts until the end of 2024 that is likely to trigger an upward bias for the third quarter of 2023. According to OPEC forecasts (see table below), the third quarter is expected to rise slightly for both the ECO region and and development and non-members of the Organization for Economic Co-operation and Development.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

OPEC world demand forecast

Source: OPEC

China dominates the demand side factors

The reopening in China after the lifting of COVID restrictions has not been as robust as many expected and this is evident by the recent Chinese economic data releases. A positive for China is that inflationary pressures have been relatively low allowing the People’s Bank of China (PBoC) to cut interest rates to stimulate a lagging economy. This has already begun and is likely to continue throughout the year leaving room for commodity prices to rise; However, major institutions including Goldman Sachs have lowered their forecasts for the Chinese economy. Markets are looking for deeper interest rate cuts than the recent 10bp cut to become optimistic about China’s recovery. Key metrics that include manufacturing, exports, housing, unemployment and retail sales will be watched closely for signs of a turnaround.

Foundational knowledge of the trade

Commodity trading

Recommended by Warren Vinkitas

Where next for the US dollar?

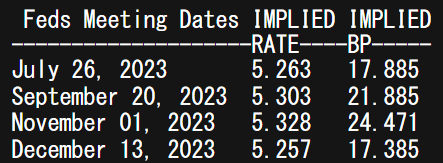

The traditional inverse relationship between Crude Oil and the US dollar could be important in the coming quarter as the Federal Reserve approaches its peak rate. Although there is a gap between the Fed’s guidance and money market pricing, the markets know that the final price of this cycle is near. Low inflation has been the recent trend despite firmer-than-expected core inflation, but some Fed officials now favor a more cautious approach to monetary policy that could boost oil prices.

As it stands, implied interest rate expectations point to another possible 25bp hike, but with data playing a crucial role in the Fed’s decision, weak US economic data could take that off the table.

Implied futures contracts for federal reserve funds

Source: Refinitive, by Warren Venketas

supporting factors

1. The weather

The US, Europe and Asia are entering the summer period which generally leads to higher demand for Crude Oil as consumption increases. Refrigeration use tends to rise as more energy is needed and with supply reduced by OPEC+, higher demand and lower supply could boost oil prices.

2. Hurricane season

Besides the summer months, the Gulf of Mexico region will experience its annual hurricane season in the third quarter which could disrupt supply production and systematically push up oil prices.

Potential risks that limit crude oil prices

1. Central banks

If global central banks largely maintain their hawkish rhetoric by insisting on aggressive monetary policy and restraining consumer spending and demand for goods and services, demand for oil may wane leaving little room for upward support.

2. Russia

Russia’s accession to the OPEC+ consortium has been controversial in recent times as the war in Ukraine has drained its coffers. Russia’s need to maintain a high level of oil exports to fund the country’s normal activities plus any war-related costs leaves Saudi Arabia and Russia at loggerheads regarding their primary objectives. Close attention should be paid to the relationship moving forward, but for now these two major players appear to be very publicly friendly.

3. Slack

Recession fears are being mentioned more and more by analysts around the world but for the purposes of the third quarter, it may be too early to predict this. After global markets avoided a banking crisis and the US showed signs of resilience, this factor may be more relevant in the fourth quarter and beyond.