Wall Street didn’t change much last Friday amid weak moves in Treasury yields, while the US dollar was more stable (+0.3%) after the recent sell-off. Some reservations about big tech stocks persist ahead of several major earnings this week in the likes of Alphabet, Microsoft and Meta Platforms, with recent releases from Netflix and Tesla suggesting earnings forecasts could be near perfect. Technical conditions may warrant overbought and “extreme greed” sentiments as evidenced by the CNN Fear & Greed indicator for some calm in the recent stock rally, although the broader trend remains biased towards the upside.

The start of a new trading week is likely to lead to some hesitation, before volatility picks up the onslaught of big tech earnings and the latest half-day FOMC meeting, along with meetings of the European Central Bank (ECB) and Bank of Japan (BoJ). Until today, a slew of global PMI data will be in check, with the consensus largely being that global economic conditions remain weak.

With the recent recovery in the US financial sector due to earnings releases (XLF +3.1% over the past week), perhaps one indicator to watch is the SPDR S&P Regional Banking Index, which recently broke through the neckline of an inverted head and shoulder formation. The neckline drop would suggest an eventual target of 56.10, with immediate resistance to overcome at 46.94 for now. The increasing Moving Average Convergence/Divergence (MACD) and the move above the 100-day Moving Average (MA) seem to support some bullish momentum in place.

Source: IG Charts

Asian Open Championship

Asian stocks seem set for a positive opening, with Nikkei +1.32%, ASX +0.04% and KOSPI +0.27% at the time of writing. Chinese stocks were trying to find a foothold last Friday, with the Nasdaq Golden Dragon China Index gaining 0.4%, following a 0.8% rise in the Hang Seng in the previous session. Recent stimulus measures to boost consumption of cars and electronics have failed to provide much conviction that they will be enough to lift pessimistic growth conditions, with hopes growing at this week’s Chinese Politburo meeting for further follow-up.

Closer to home, Singapore Consumer Price Index (CPI) will be on the radar today, with further moderation in pricing pressures likely to be the story. Core inflation is expected to ease to 4.6% from 5.1% prior, while core is expected to head to 4.2% from 4.7% prior, generally reversing some progress in inflation and providing room for an extended pause in tightening from the Monetary Authority of Singapore (MAS).

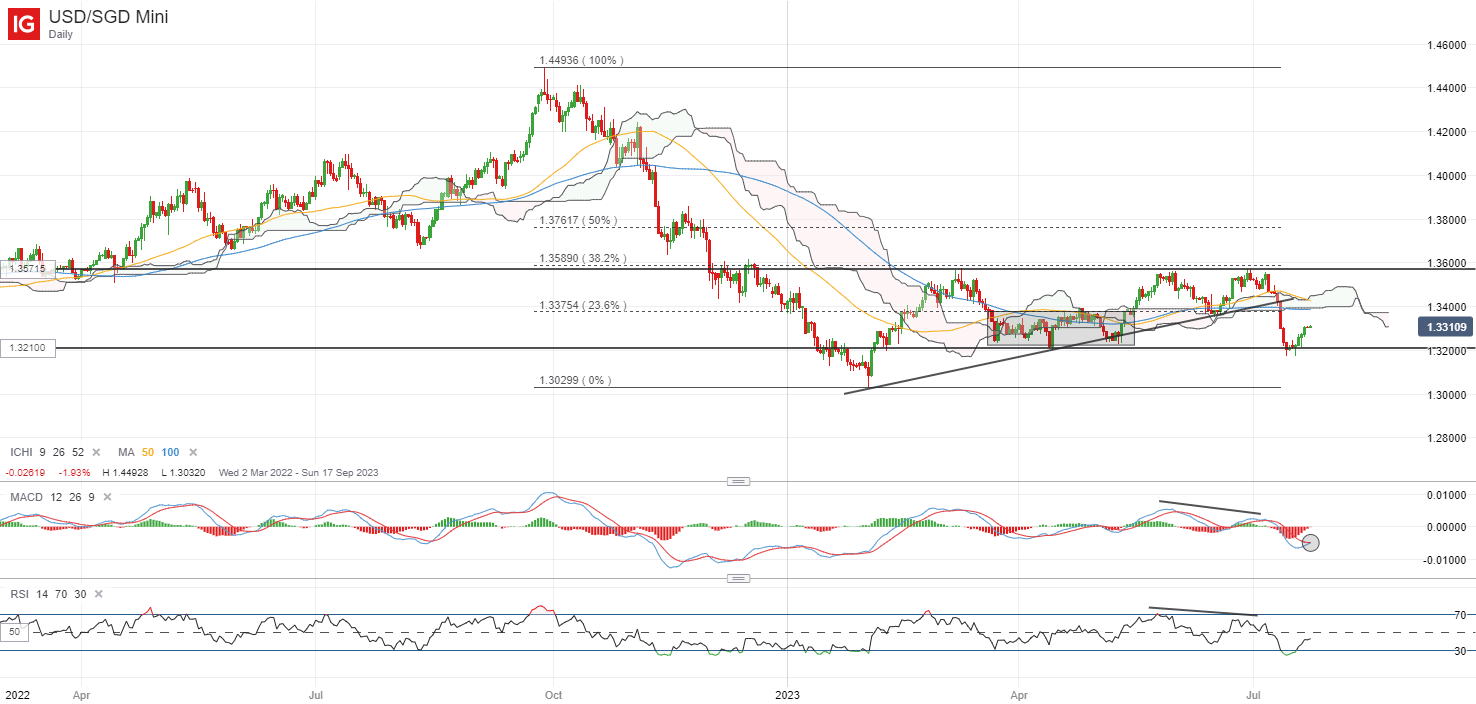

The USD/SGD has been trading largely within a rectangle pattern since the beginning of the year, and recently it has been trying to find support from the bottom base at the 1.320 level. A bullish cross on the MACD and an increasing RSI could indicate bullish momentum in the near term as a bounce from technical oversold conditions takes place, but a broader consolidation pattern still suggests broader indecision. In the near term, any weaker than expected reading in the inflation figures may leave 1.338 in check as immediate resistance to overcome.

Source: IG Charts

On the watchlist: gold prices Watched in the run-up to this week’s FOMC meeting

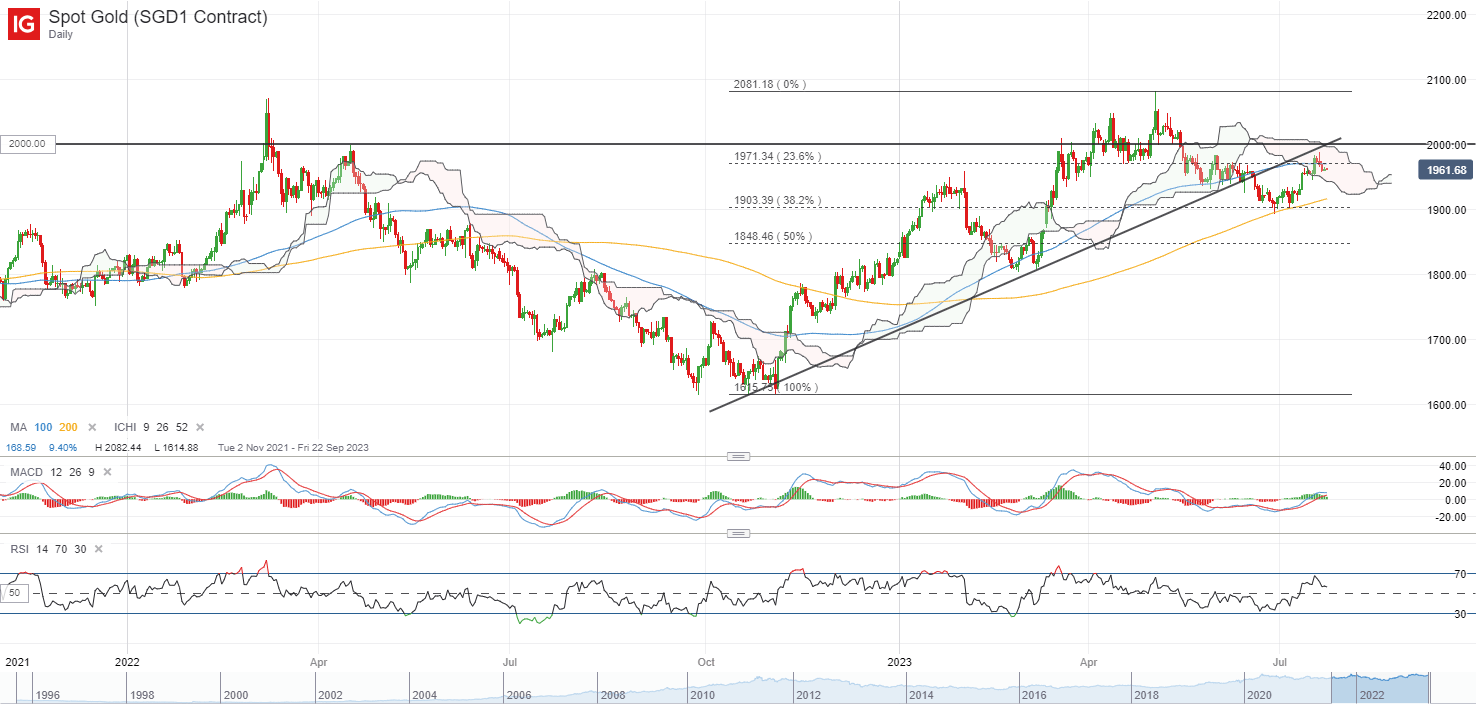

At this week’s FOMC meeting, expectations were priced in that the Fed would raise interest rates by 25 basis points before taking a long pause in the rate hike cycle through the rest of the year. Any focus on a more data-driven stance by the Fed at the upcoming meeting could be seen as less hawkish, which could help limit the downside in gold prices. So far, gold prices have recovered 4.5% in July due to a weaker US dollar and lower Treasury yields, but are facing some resistance at the $1980 level.

Recent CFTC data revealed a sharp buildup in long positions among money managers to a two-month high last week (135,907 contracts, up from 100,619 contracts in the previous week). At the moment, the Weekly Relative Strength Index (RSI) has also managed to defend the key 50 level. The biggest convincing for buyers may have to come from reclaiming the key psychological level of $2,000, with any successful attempt likely to put the 2023 higher high back on the radar for a retest.

Source: IG Charts

Friday: DJIA +0.01%; S&P 500 +0.03%; Nasdaq -0.22%, DAX -0.17%, FTSE +0.23%