Silver Technical Analysis (XAG/USD)

- The rise in the dollar limits the possibility of silver rising after Powell’s hawkish comments

- Silver broke below the ascending channel – what now?

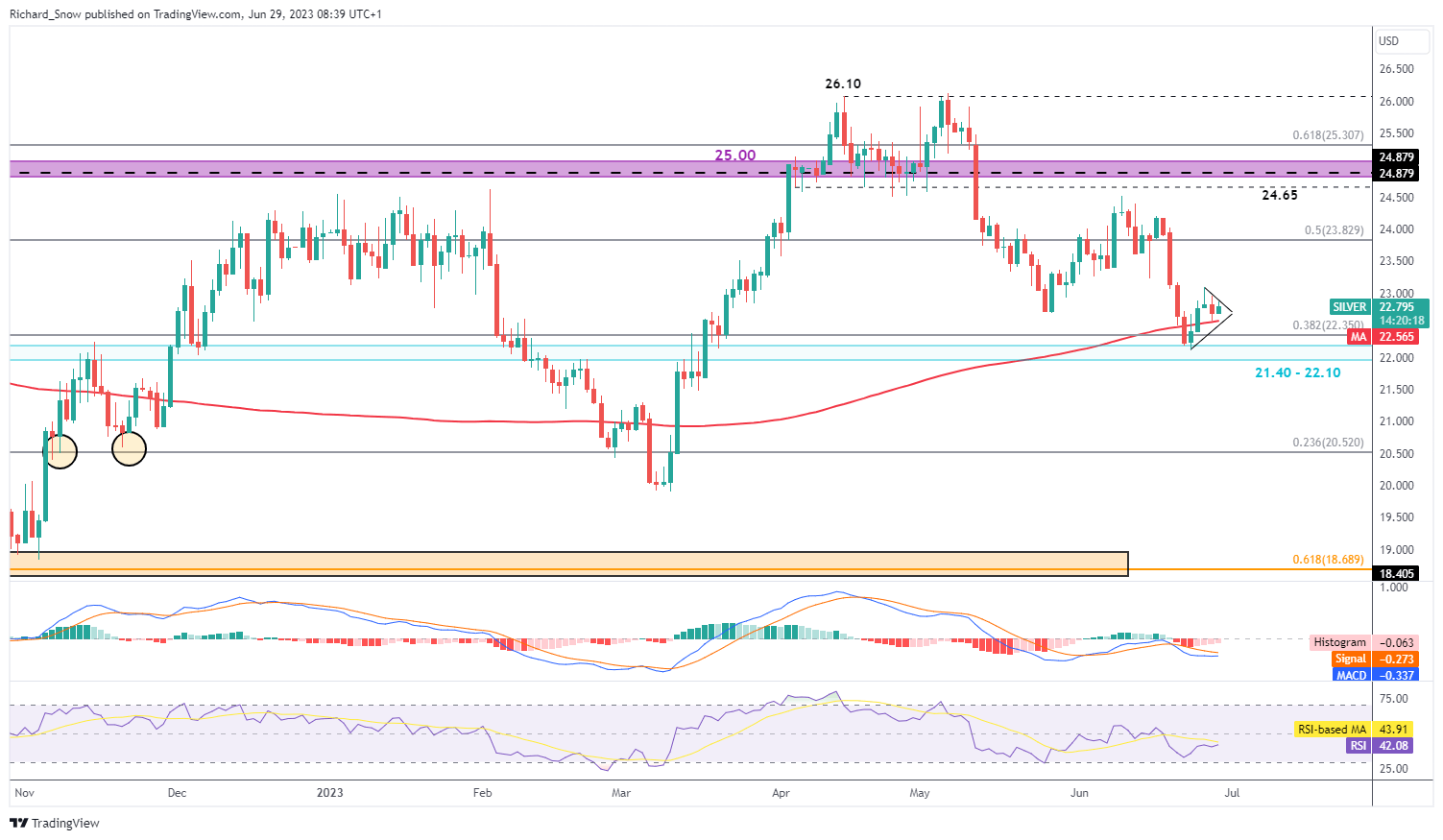

- The daily chart is showing a pennant-like consolidation just above the 200 SMA

- The analysis in this article is used chart patterns and key Support and resistance levels. For more information visit our comprehensive website Educational library

Recommended by Richard Snow

How to trade the “One Glance” indicator, Ichimoku

Silver’s breakdown of the ascending channel (weekly chart)

Silver, like gold, showed a tendency for bearish moves after recording the collapse of the multi-month ascending channel. Admittedly, the channel is not the cleanest, having posted a false breakout before the regional banking turmoil in March sent precious metals prices soaring.

If Jerome Powell’s comments yesterday that the US regional banking system is sound and seen going forward, this should provide less bullish driver for silver prices which means the current channel breakout may have a better chance of success.

Silver weekly chart

Source: TradingView, prepared by Richard Snow

Shorting silver meets a decent amount of support but it just can’t be beat

The daily chart below shows an attempted pullback that turned into more consolidation as Jerome Powell’s comments sent the greenback higher, capping silver’s bullish potential for the time being.

After three consecutive days of selling (which started on June 20), silver still favors a bearish continuation scenario. The RSI is far from oversold conditions and the MACD is showing that the momentum to the downside is still in place although the MACD line is approaching its signal line – a possible sign of slowing momentum.

Support for the metal takes many forms with the most pressing challenge being the 200 day moving average (SMA) which is below current prices. A decisive move below a metric often used to determine trend could open the door to an extension of the bearish move. After that, the 38.2% Fibonacci retracement of the regression from 2021 to 2022 provides the next level of support at 22.35. Not far from another potential support area between 21.40 and 22.10.

If the silver market can overcome the above support levels, that would leave plenty of room to run ahead of the 23.6% Fibonacci level at 20.52. Should prices rise from here, 23.83 is the next level of consideration with an eye on 24.65 after that.

Silver daily chart

Source: TradingView, prepared by Richard Snow

– Posted by Richard Snow for DailyFX.com

Connect with Richard and follow him on Twitter: @tweet