This article is also available in Spanish.

Solana is currently trading above the $140 level, showing signs of strength as it prepares for a potential move to higher levels. After a modest 5% injection on Friday, investors and analysts have become increasingly optimistic about the direction Solana could take in the coming months.

One prominent analyst, Karl Rohnfelt, shared a technical analysis predicting a 20% upside for SOL in the next few weeks, citing bullish patterns and favorable market conditions. His analysis suggests that Solana could reach $176 by the end of the year if current momentum continues.

Related reading

However, Solana still faces key resistance levels that may challenge its upward trajectory. Despite the recent rally, some market participants are cautious, given the general volatility in the cryptocurrency space. If Solana can maintain its current support and break through resistance, the next few months could be pivotal for the asset’s long-term price movement.

Can SOL build on its recent gains and reach new highs, or will it struggle to maintain momentum in the face of market headwinds? Investors are looking forward to seeing how this plays out as we approach the end of the year.

Solana tests supply levels

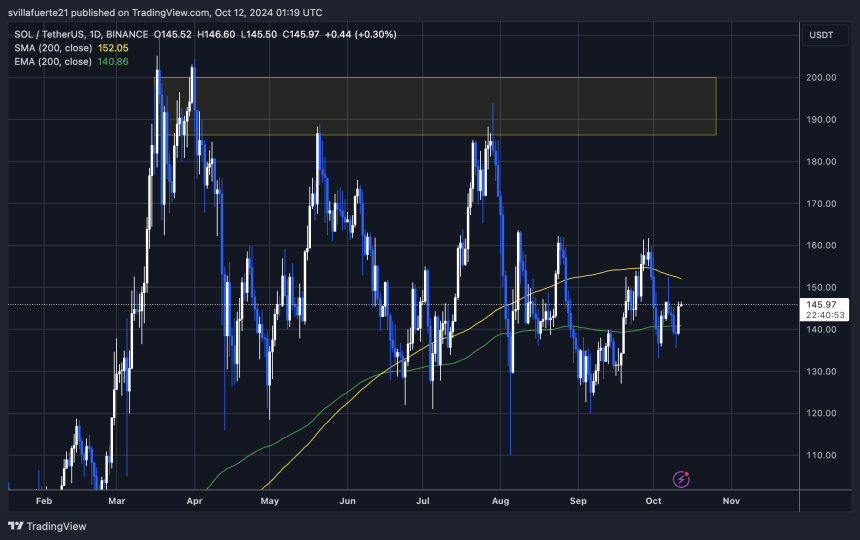

Solana has been trading in a range of $210 to $110 since mid-March, which has led to mixed opinions among investors. While some see this price action as a consolidation phase, others believe it could signal an upcoming breakout. Notably, chief analyst and businessman Carl Roenfeldt recently Share technical analysis on Xrevealing the formation of an ascending triangle pattern for SOL.

According to Runefelt analysis, if Solana breaks out of this triangle pattern, it could see a sharp upward movement, potentially reaching $176 in the coming weeks. This would represent a significant breakthrough from current trading levels and a major milestone for SOL. The price has struggled to break the $160 resistance level since early August, but Roonevelt notes that a breakout from the triangle could push the price beyond this resistance.

Related reading

A successful breakout above these critical levels would mean a 20% upside for Solana, with upside momentum potentially sending it higher. Investors are watching these movements closely, as a breakout could signal the end of extended sideways trading for Solana and mark the beginning of a new uptrend. If SOL can maintain support and continue this rally, it may soon test new highs and consolidate its position as one of the best performing altcoins.

SOL Technical Analysis: Areas to Watch

Solana (SOL) is currently trading at $145, after a 7% rally from local lows of $135. The price managed to rise above the daily 200 Exponential Moving Average (EMA) at $140, which is a leading indicator of short-term trend strength. However, SOL is still 4% away from the crucial 200 moving average (MA) at $152, which represents a stronger, longer-term trend signal.

A break above the EMA and MA levels is essential to regain full control of the bulls and restore the trend. Going beyond these indicators could pave the way for a move to the $160 supply zone, where sellers are expected to be more active. This would indicate continued upward momentum, with the potential for further gains.

Related reading

On the other hand, if the price fails to hold above the $140 level, this recent rally may be short-lived, and a deeper correction may follow. A break below this level could push SOL to $110, an important demand area that buyers may defend. Traders are watching these levels closely as the next few days will determine SOL’s short-term trend.

Featured image by Dall-E, chart from TradingView

Comments are closed, but trackbacks and pingbacks are open.