Markets Week Ahead: S&P 500, Dow Hits Fresh Highs, Gold Fades, US Dollar Rallies

Fed Holds Steady, Ditches Tightening Bias, Gold and US Dollar on the Move

Fed chair Jerome Powell pushed back against aggressive rate cut expectations again mid-week after the FOMC left US rates unchanged. A March rate cut is currently being priced out, leaving the May meeting a live event, with six rate cuts seen in 2024, down from seven last week. The blockbuster US NFP report on Friday gave Chair Powell’s stance some validation as the US jobs market continues to forge ahead.

US Dollar Jumps After NFPs Smash Estimates, Gold Slumps

US Dollar Index Daily Chart

Learn how to trade the US dollar using our Q1 US Dollar Technical and Fundamental Reports

Recommended by Nick Cawley

Get Your Free USD Forecast

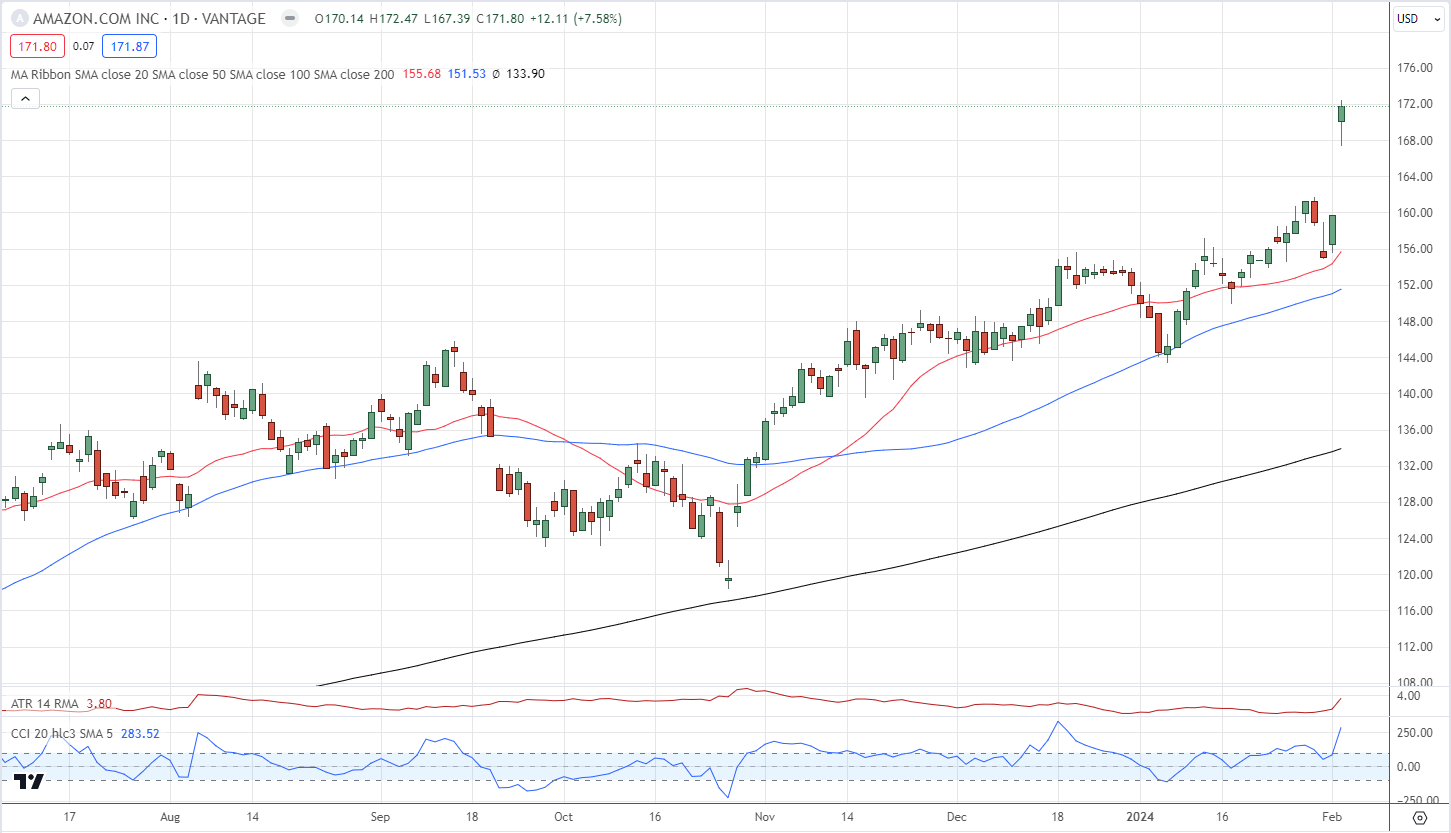

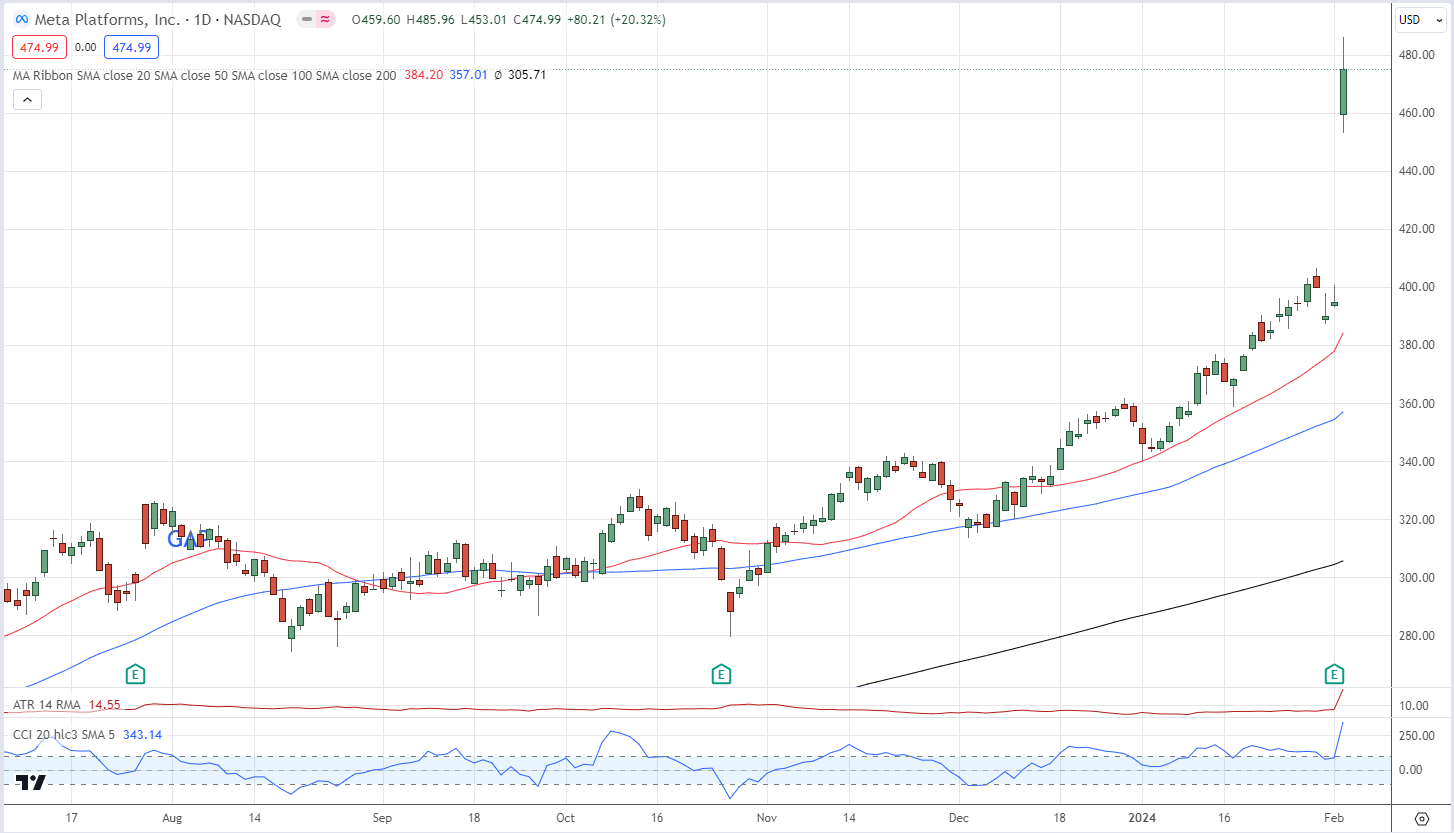

Despite US dollar strength, the US equity markets continue to power ahead, driven in part by some big moves in the big tech stocks, including Amazon and Meta.

Amazon (AMZN) Daily Chart

Meta Daily Chart

Recommended by Nick Cawley

Get Your Free Equities Forecast

The world’s largest company, Microsoft fell post-earnings but regained nearly all losses by the close on Friday, while Apple fell mid-week but also regained some losses. The US earnings calendar is not as busy next week although Ford, MicroStrategy, Uber Technologies, Alibaba, and PayPal will all be opening their books in the coming days and are worth noting.

For all earnings releases, see the DailyFX Earnings Calendar

After last week’s data and events-heavy week, the next few days are light of potential market-moving releases and events. Traders should note that after the pre-FOMC blackout, Federal Reserve members will now be allowed to give their latest opinions next week and these comments should be carefully noted, especially any talk of a rate cut timetable.

For all market-moving economic data and events, see the DailyFX Calendar

US regional banks were back in the headlines last week after the New York Community Bancorp release that sent their shares sprawling over 40% lower.

Chart of the Week – New York Community Bancorp

Technical and Fundamental Forecasts – w/c February 5th

British Pound Weekly Forecast: Rare BoE Vote Split will Continue to Provide Support

The British Pound was boosted last week by the widest split for sixteen years. on the Bank of England’s interest-rate-setting committee. The key bank rate was held at 5.25%, as more or less everyone had expected on February 1.

Euro Weekly Forecast: Stagnant EU Growth Exposes Euro Vulnerabilities

Euro pessimism drags on as the EU narrowly avoided a recession. ‘US excellence’ is very much alive after NFP, while the pound and yen could aid euro performance.

Gold Weekly Forecast: XAU/USD Testing Support After US NFPs Hammer Rate Expectations

Gold is likely to struggle to push higher over the coming week after the latest US Jobs Report smashed expectations, paring Fed rate cut expectations.

US Dollar Forecast: Bulls Return as Bears Bail, Setups on EUR/USD, USD/JPY, AUD/USD

This article provides a comprehensive analysis of the U.S. dollar’s fundamental and technical outlook, with a specific focus on EUR/USD, USD/JPY, and AUD/USD. The piece also offers insights into critical price levels for the week ahead.

New to trading or looking to get an extra edge? Download our new three-part trading conditions report.

Recommended by Nick Cawley

Recommended by Nick Cawley

Master The Three Market Conditions

All Articles Written by DailyFX Analysts and Strategists