The Toncoin token remained in a bear market and was at risk of forming a fearsome death cross pattern, despite strong on-chain metrics.

Toncoin (TON) was trading at $5.81 on Monday, September 30, down more than 30% from its year-to-date high.

Robust on-chain metrics

Additional data showed that the number of active on-chain wallets rose to more than 20.8 million, a significant increase from the January low of 1.1 million.

Furthermore, the number of toncoins being burned daily continued to rise, reaching a year-to-date high of nearly 39,000. These burns coincided with a sharp decline in the number of toncoins minted, which fell to 39,000 from a high This month’s level reached more than 50,000.

The role in DeFi is fading

Toncoin’s price has likely declined due to its diminishing role in the DeFi industry, as the total value locked in the network fell from more than $765 million in July to $427 million.

TON has gone from being a top ten player in the DeFi industry to being the 20th largest in terms of volume. Smaller chains such as Core, Mode, Mantle and Linea have overtaken it in recent weeks.

Toncoin also declined due to the recent arrest of Pavel Durov in France and the performance of tap-to-earn codes. Hamster Kombat, which launched an airdrop last week, is down nearly 60% from its high.

Likewise, Notcoin (NOT) is down 71%, while Catizen (CATI) is down 50% from its all-time highs. Most of all, the recently launched click-to-earn codes in Telegram have dropped to record levels.

Meanwhile, open interest for Toncoin futures fell to $260 million on September 30, down from a year-to-date high of more than $360 million. This number has reached its lowest level since September 12, indicating declining demand.

Toncoin price analysis

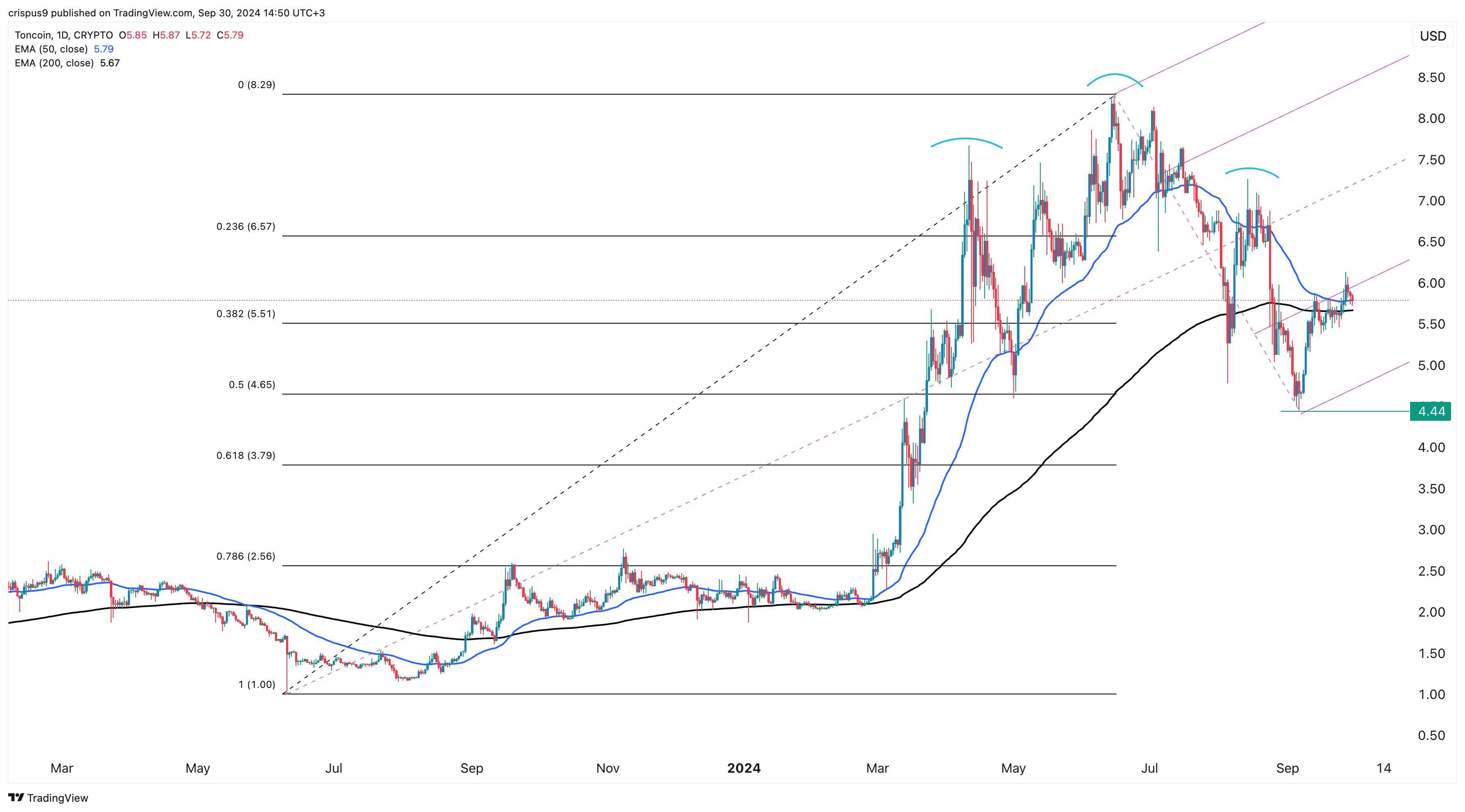

The Toncoin token is down more than 30% from its year-to-date high, and the 50-day and 200-day EMAs are close to forming a death cross pattern. The last time this pattern formed in May of last year, it resulted in a decline of more than 50%.

TON also formed a head and shoulders and rounded top pattern. It remains below Andrew’s Pitchfork’s first support level and the 23.6% Fibonacci retracement level.

Therefore, Toncoin may have a downside breakout to the next major support level at $4.45, its lowest point in September, unless it moves above the 50-day and 200-day moving averages.

Comments are closed, but trackbacks and pingbacks are open.