The leading cryptocurrency, Bitcoin (BTC), finds itself under the watch of a senior macro strategist at Bloomberg. With insight that carries weight, this strategist makes troubling price predictions, which suggest that the ongoing decline in Bitcoin’s value may continue for the foreseeable future.

In the latest edition of his report entitled “Crypto Outlook, June 2023Mike McGlone presents a view that Bitcoin may not yet have overcome its most difficult phase.

McGlone asserts that given the prevailing patterns, the multiple factors influencing the cryptocurrency market, and the sentiments of the US Federal Reserve, the future outlook for Bitcoin appears to be leaning towards a downward trajectory.

Concerns about the risk of a rebound in the Bitcoin price

In his latest analysis, McGlone draws attention to Bitcoin’s historical trading patterns. McGlone confirms that at the end of 2019, the cryptocurrency was worth around $7,000, but since then it has seen a significant increase in liquidity. This notable rally raises valid concerns about potential rebound risks.

Image: OptoCrypto

McGlone highlights the importance of June as a potential turning point, as the prevailing bias toward riskier assets, including Bitcoin, will continue or give way to a looming US recession.

Moreover, by any move central banks, according to McClon, could have unforeseen consequences that could negatively affect bitcoin and other risky assets in the near future.

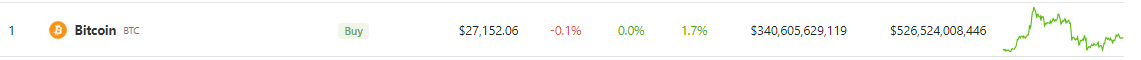

Source: Coingecko

As of this writing, Bitcoin’s current value is at Queen Gekko It stands at $27,152, confirming the downward trajectory of its 52-week moving average, which stands in stark contrast to the initial uptrend seen at the start of the pandemic. Alpha cryptocurrency is up a meager 1.7% in the past week.

The effect of higher interest rates at the central bank

McGlone stresses the importance of continued interest rate increases by central banks in shaping Bitcoin’s future. As central banks take a more aggressive approach to tightening monetary policy, the resulting increase in borrowing costs has the potential to dampen economic growth and market sentiment. This, in turn, may influence appetite for riskier assets such as Bitcoin.

BTCUSD slightly above the $27K level on the weekend chart: TradingView.com

Moreover, the strategist points out that market optimism surrounds the central bank Rising prices It may be misplaced. While these measures aim to curb inflationary pressures, there is a risk of overcorrection and inadvertently causing an economic slowdown or even a recession. In such a scenario, Bitcoin may be particularly vulnerable to a decline in value as investors seek safer havens for their capital.

As McGlone paints a bearish picture for Bitcoin, it is crucial to acknowledge the uncertainty inherent in predicting the future of any financial asset.

Featured image from Think Magazine