Vacationers filling up with gasoline in Brisbane or Durban this holiday season have a good chance of pulling into a station that’s part of the growing fuel-retailing empire of the world’s biggest independent oil trader.

Article content

(Bloomberg) — Vacationers filling up with gasoline in Brisbane or Durban this holiday season have a good chance of pulling into a station that’s part of the growing fuel-retailing empire of the world’s biggest independent oil trader.

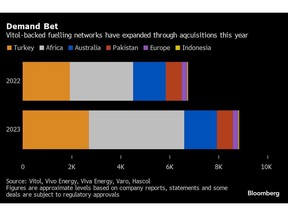

Vitol Group, a closely held company known for cutting oil deals from Kurdistan to Benghazi, made purchases this year that mean it either owns or has a share of over 8,800 gas stations worldwide. Those acquisitions give it a portfolio to rival some oil majors and will make the firm Africa’s No. 2 fuel retailer.

Advertisement 2

Article content

Article content

While Big Oil is pulling back from some downstream operations, the trading house is doubling down — betting fossil-fuel demand in emerging markets will remain robust, even as electric vehicles make headway in developed nations.

That’s giving Vitol, which made $15.1 billion in profit last year, both an outlet for the products it trades and physical assets to bolster its margins long after energy-market volatility subsides. A growing chunk of the world’s energy infrastructure is moving into private hands, including the trading company that’s owned by about 350 of its top employees.

“We want to have footprints on the ground and footfall on the ground,” Chris Bake, a member of Vitol’s executive committee said in an interview. “And in order to be able to survive on very skinny margins as we do in the commodity space, you need to have a very integrated platform.”

Vitol has held investments in downstream oil for more than a decade, but this year’s acquisitions will add roughly 30% more fueling stations to its network.

In February, Vitol’s Vivo Energy agreed to buy a 74% stake in South Africa’s Engen Ltd., valuing the company at about $2 billion. Subject to government approvals across several countries, the tie-up would take Vivo’s African network to more than 3,900 Shell and Engen-branded fuel stations.

Article content

Advertisement 3

Article content

In Turkey, Vitol’s Petrol Ofisi A.S. will operate over 2,700 fuel stations after agreeing to buy BP Plc’s gas station network in the country as well as a stake in an oil terminal. That’s alongside around a 30% stake in Australia’s Viva Energy Group Ltd., which also operates a refinery in Geelong near Melbourne. Vitol also has stakes in Pakistan’s Hascol Petroleum Ltd. and European refiner-retailer Varo Energy.

The deals come as more established players are seeking bigger returns from upstream projects. For Exxon Mobil Corp., that means buying shale and infrastructure companies, while selling refineries and retail units.

Energy majors are still the biggest distributors of oil products to consumers globally, with BP operating over 20,000 retail sites, according to its website. But others are gradually whittling down their portfolios; Italy’s Eni SpA now owns about 5,000 stations, while Spain’s Repsol SA has just over 4,600.

Vitol’s dealmaking reflects a continuing trend for trading houses to become more like energy producers, according to Adam Perkins, a partner Oliver Wyman Inc.’s energy and natural resources practice. In addition, a big sales network “is something the traders value incredibly highly,” he said.

Advertisement 4

Article content

Oil Bet

Vitol’s latest investments are also a bet on the longevity of oil demand in countries where vehicle fleets are unlikely to go electric anytime soon. That’s not to say the trader is ignoring charging stations — Varo, Viva and Vivo all have projects underway.

Read More: COP28 Ends With Deal on Transition Away From Fossil Fuels

But while fuel stations are forecast to close in places like Europe as sales slump, automotive oil consumption in emerging markets is expected to grow significantly. Fuel sales in African countries are expected to grow by more than a fifth by 2030, according to analysts at Citac Africa Ltd.

“Africa being a growth continent and expected to have solid GDP growth and solid transportation growth makes it more of a target as compared to a country that’s likely to be full of Teslas in 10 years time,” Vitol Chief Executive Officer Russell Hardy said, when announcing the Engen deal.

Vitol isn’t the only trader making the play. Trafigura Group has a large fuel network through it’s Puma Energy business, controlling stations across several African countries and in Latin America.

And this year’s deals may not be the last investments by Vitol in the sector.

“There are a few areas in Africa where we don’t have a footprint today and there are some other geographies where we would look at,” Bake said. “But we want to have critical mass and we want to be able to drive value.”

—With assistance from Paul Burkhardt.

Article content