The Turkish lira fell on Wednesday by the most since late 2021 as President Recep Tayyip Erdogan’s new economic team began easing restrictions that have slowed its slide in recent months.

The currency fell 6 percent in London trading on Wednesday to a new record low of 23 against the dollar, leaving it down nearly 9 percent since Mehmet Simsek was appointed finance minister at the end of the week. Refinitiv data shows that the lira has never ended on such a large decline since December 2021.

Simsek, a former deputy prime minister who is appreciated by foreign investors, has promised to restore “rational” economic policies in Turkey after years of interest rate cuts and unorthodox measures to support the currency.

“This is the exchange rate. . . “I was severely suppressed by alternative financial (measures) before the elections,” said Enver Erkan, chief economist at Istanbul-based brokerage Dynamic Yatirim Menkel Degerler. “The new period will bring a more liberal approach in this regard and will create a situation that will enable the lira to approach its real value.”

This fall highlights how investors are increasingly anticipating a shift towards more traditional measures in the wake of Erdogan’s election victory last month. Some analysts expect Erdogan to also appoint a new head of the central bank, taking a more traditional economic approach.

The pace of the lira’s decline has been rapid: Goldman Sachs said over the weekend that it expected the lira to drop to 23 against the dollar in the next three months, predictions that actually came to fruition within days.

A major currency trading bank told clients on Wednesday that Turkish state banks appeared not to meddle in the market, according to a person familiar with the matter. Lira purchases from state banks have been seen as a major tool in propping up the currency in recent years.

Currency analysts widely say the lira is overvalued compared to Turkey’s economic situation, even after it has fallen more than 60 percent against the dollar over the past two years. Erdoğan had insisted on deep interest rate cuts, with the main interest rate dropping from 19 percent in March 2021 to 8.5 percent today despite skyrocketing inflation. This has pushed “real,” or inflation-adjusted, interest rates deeper into negative territory.

“With such pressure on the lira, we believe it is a matter of when, rather than whether, the currency weakens significantly, with a larger one-time adjustment more likely,” Goldman said in a note to clients, predicting a drop to 28 against the dollar next year.

The central bank has depleted some $24 billion in foreign exchange reserves this year alone, in part in an effort to strengthen the lira. Economists say the reserves were also used to finance Turkey’s huge current account deficit, which in turn was exacerbated by a lira that many exporters said was too strong to be competitive.

“Things are starting to make sense” with the currency, said Murat Gülkan, CEO of OMG Capital Advisors in Istanbul, since inflation has been “rising.”

Simsek, a former chief bond analyst at Merrill Lynch in London, pledged on Sunday that Turkey would turn to a policy of “transparency, consistency, predictability and compliance with international standards” with the aim of lowering inflation from around 40 percent at present. to a single number.

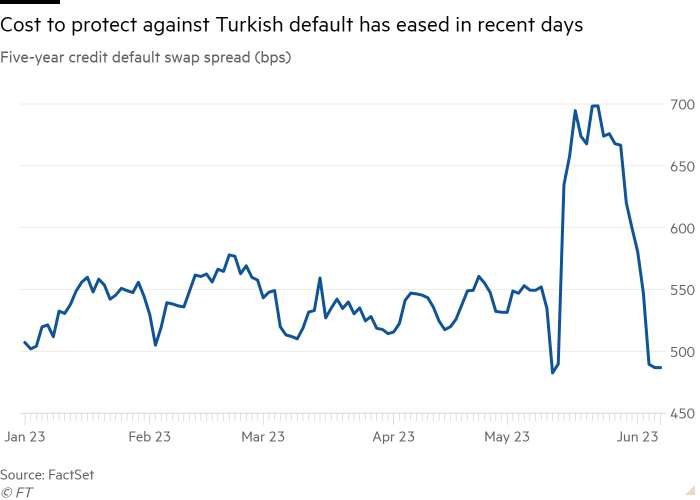

While the lira fell sharply, other indicators indicated relief among investors over the proposed policy change. Turkey’s dollar bond prices rose, while the cost of protection against default eased significantly.