GBP/USD and EUR/GBP rates, charts and analysis

Recommended by Nick Cooley

Get your free GBP forecast

The latest look at UK inflation will determine sterling’s strength over the coming days and weeks with key price pressures expected to ease sharply in April as energy prices start to rise. The headline number is expected to decline to 8.2% from 10.1%, in line with recent comments from Bank of England Governor Andrew Bailey. The head of the British central bank said this week that rising energy prices account for nearly a third of headline inflation, and he expects at least two full points to appear in this week’s report. Inflation reports have been closely watched over the past year or more and this report will be no exception.

May 24, 2023

May 26, 2023

Bring inflation back to the 2% target – Bank of England Governor Andrew Bailey

While next week’s economic calendar is dominated by US and UK inflation reports, along with the latest batch of PMIs and FOMC meeting minutes, the constant driver of risk sentiment for now is the US debt ceiling. Markets turned risk-averse earlier in the week after positive comments between House Speaker McCarthy and President Biden, and in the coming days it looks more likely that a deal will be reached before the US runs out of money.

Debt Ceiling Blues, Part 79. What Happens If the US Defaults?

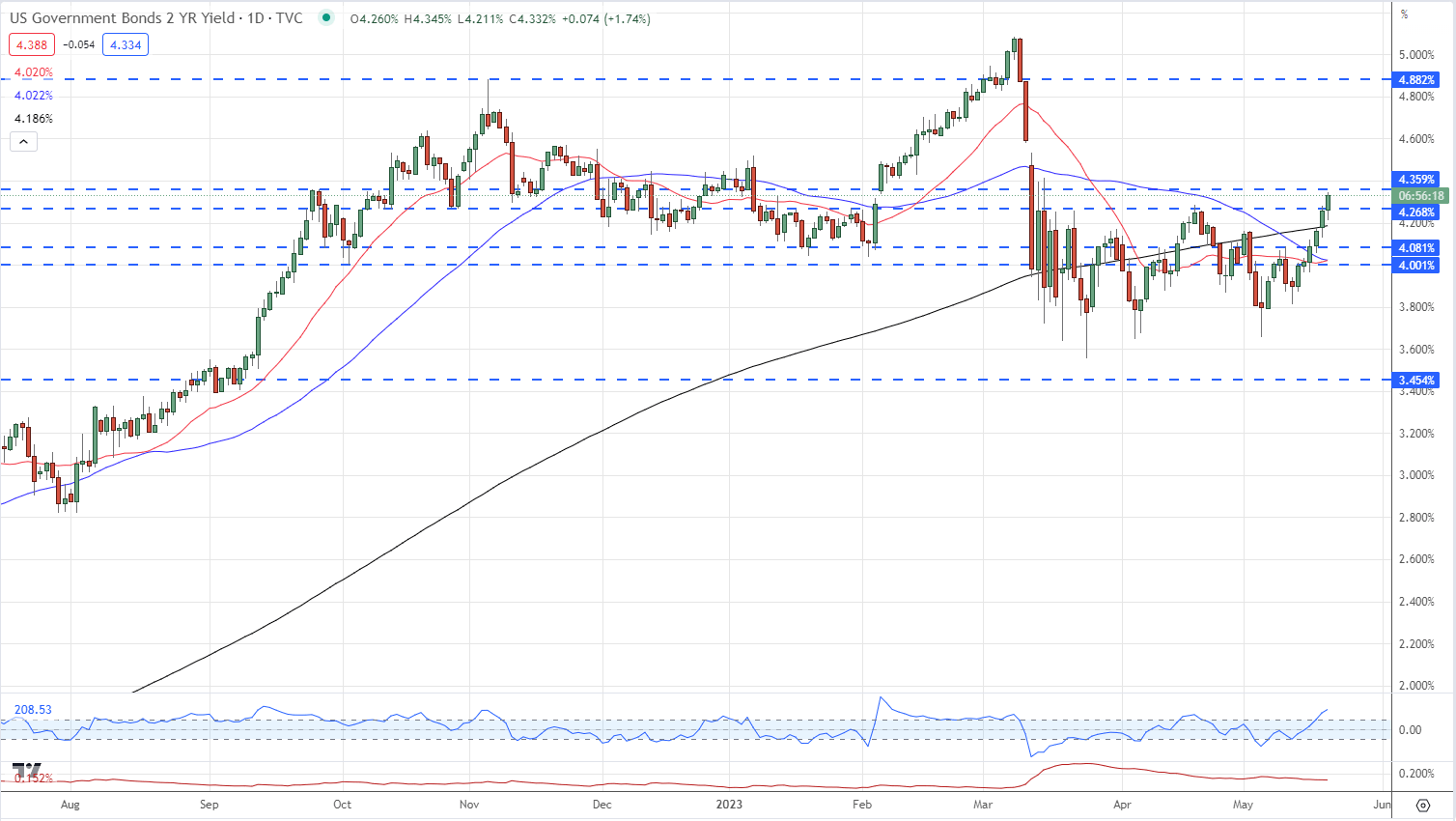

As mentioned earlier, the potential advance in the US debt ceiling has boosted risk appetite this week. In addition, the US Federal Reserve’s upbeat talk saw interest rate expectations move as the market started to hike interest rates at the FOMC meeting in June. This repricing sent US Treasury yields higher, boosting the value of the US dollar.

2-Year US Treasury Return – May 19, 2023

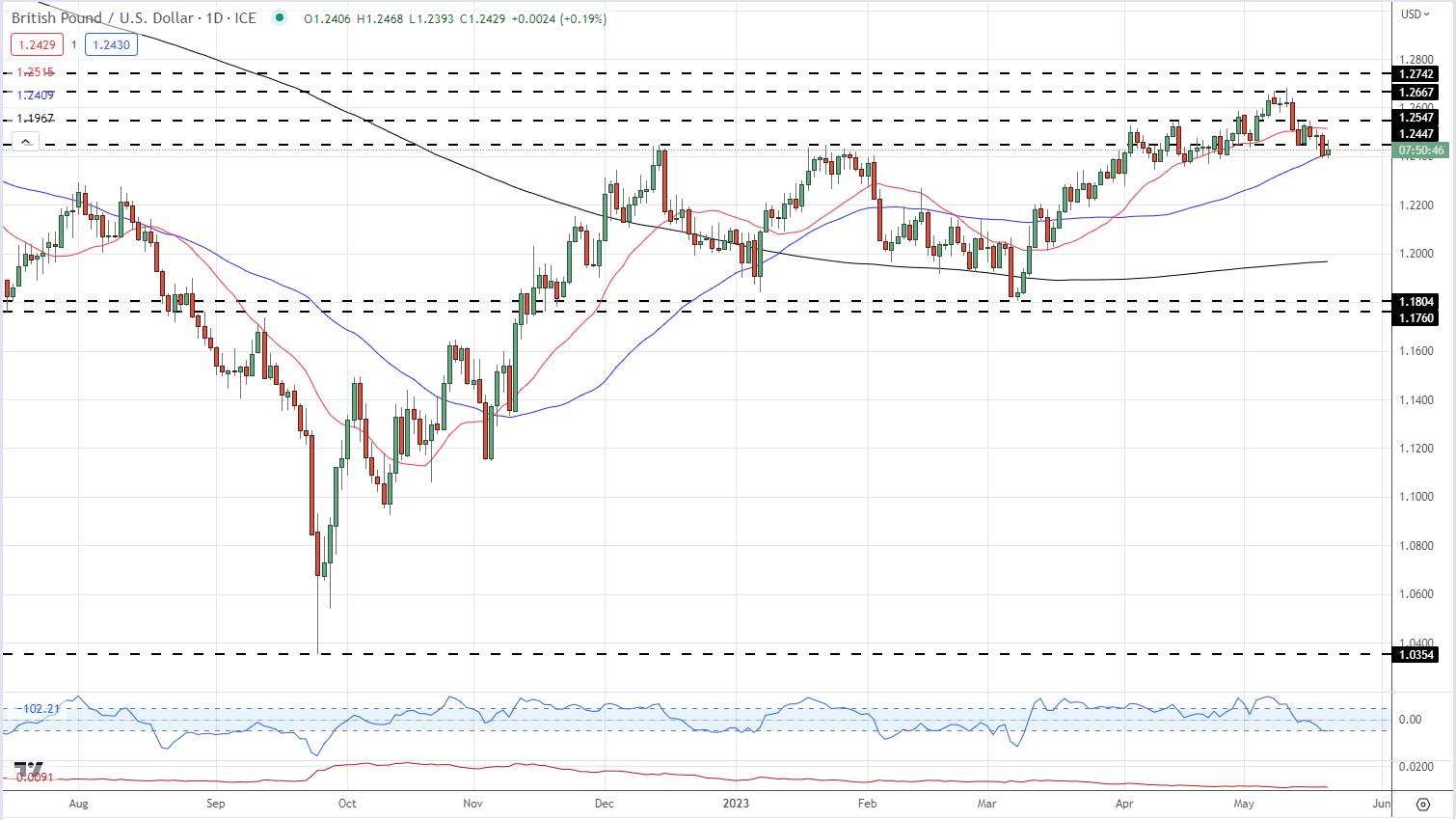

The British Pound has been relatively stable this week but has not been able to withstand the strong dollar. The previous support around 1.2447 was breached in the middle of the week as the pair made a fresh multi-week low, just below 1.2400. There are a few previous lows all the way to 1.2350 that might slow any further selling, but next week’s data, and ongoing talks on the US debt ceiling, could make this level vulnerable.

Daily price chart for GBP/USD – May 19, 2023

Chart via TradingView

|

change in |

Longs |

Shorts |

Hey |

| Daily | -12% | 3% | -5% |

| weekly | -5% | 0% | -3% |

Retail traders increase their net long positions

Retail trader data shows that 56.31% of traders are net yellow with the ratio of long to short traders at 1.29 to 1, the number of net long traders is 7.49% higher than yesterday and 7.35% higher than last week, while the number of traders is down Traders’ net short positions increased by 7.97% compared to yesterday and decreased by 9.83% from last week.

We usually take a view contrarian to crowd sentiment, and the fact that traders are holding on suggests that GBP/USD prices may continue to drop. Traders are long positions longer than yesterday and last week, giving us a mix of current sentiment and recent changes The strongest bearish contrarian trading bias for GBP/USD.

what is your opinion of British Pounds / US Dollars Upward or downward? You can let us know via the form at the end of this piece or you can contact the author via Twitter Hahahahaha.