US Dollar Price and Charts

- NFP revision sends the US dollar lower.

- Unemployment rate rises, average monthly earnings fall.

Recommended by Nick Cawley

Get Your Free USD Forecast

The headline NFP number beat market expectations by a healthy margin but this was more than compensated for by a steep downward revision to January’s release. In February, 275k new roles were created compared to market forecasts of 200k, while the January figure of 353k was revised down to 229K, a difference of 124k. The unemployment rate rose to 3.9%, compared to a prior level and market forecast of 3.7%, while average hourly earnings fell to 0.1% compared to 0.3% market consensus. Aside from the headline NFP figure, this month’s report shows a weaker-than-expected US labor market, and underpins market expectations of a 25 basis point cut at the June 12th FOMC meeting.

Recommended by Nick Cawley

Trading Forex News: The Strategy

For all economic data releases and events see the DailyFX Economic Calendar

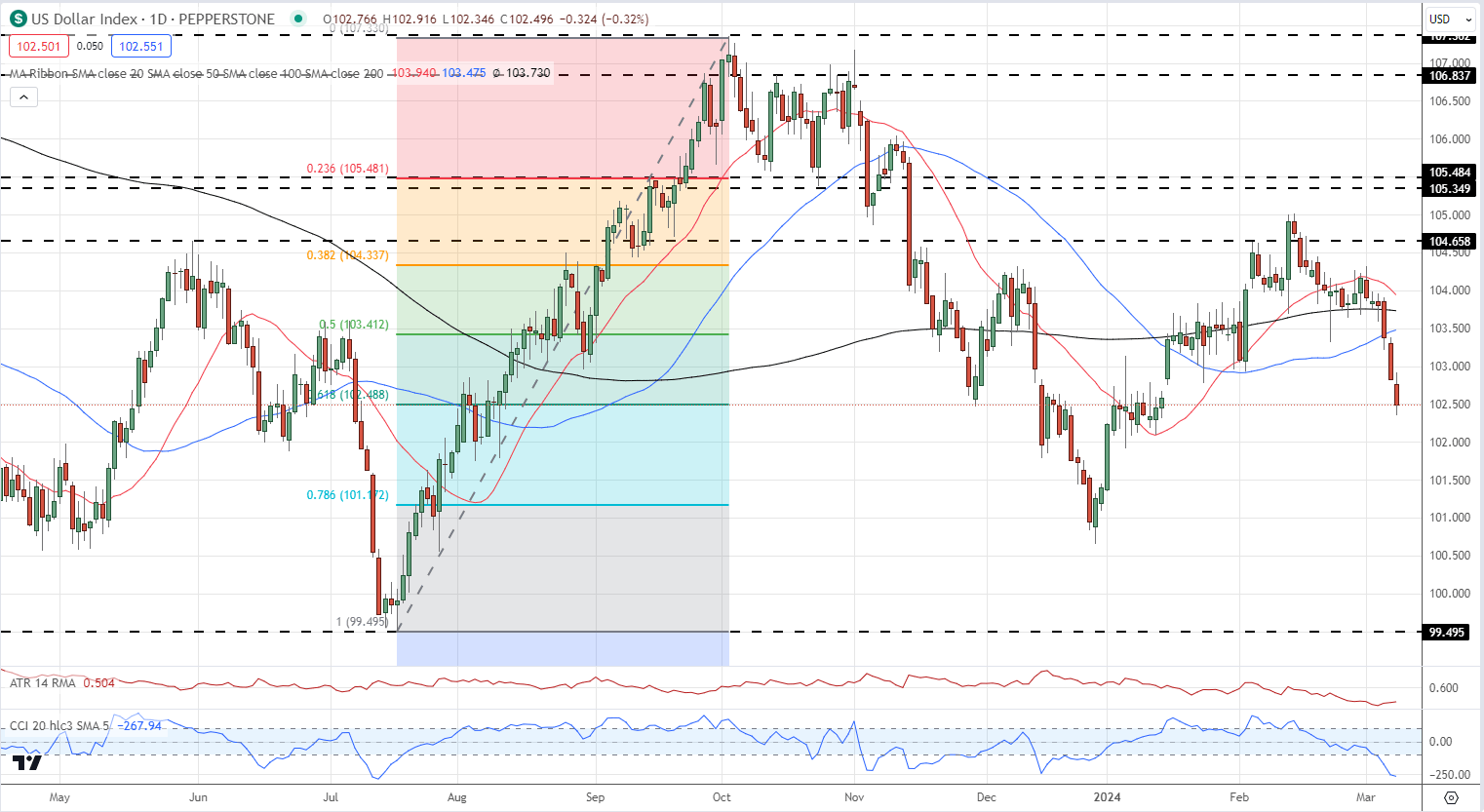

The US dollar slipped further release and is currently resting on the 61.8% Fibonacci retracement level around 102.50. A cluster of old highs and lows around 102.00 may slow any move lower before the 71.8% Fib retracement at 101.17 and the December 28th multi-month low at 100.74 come into focus.

US Dollar Index Daily Chart

Charts via TradingView

What is your view on the US Dollar and Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.