Most Read: Fed Sticks to Dovish Policy Roadmap; Setups on Gold, EUR/USD, Nasdaq 100

Too often, traders get caught up in the herd mentality, buying when prices are rising rapidly and selling in a panic when the market takes a turn to the downside. Contrarian indicators, like IG client sentiment, offer a different perspective. By gauging whether positioning and the overall mood are excessively bullish or bearish, these tools can hint at potential reversals and turning points. The key is to look for opportunities to zig when everyone else is zagging.

Of course, contrarian indicators are most powerful when used as part of a well-rounded trading approach. Relying solely on sentiment data is unwise. Instead, combine these signals with fundamental and technical analysis to gain a comprehensive market understanding. This way, you might just spot attractive setups/opportunities others overlook. Now, let’s use IG client sentiment data to analyze three key U.S. dollar pairs: USD/JPY, USD/CAD and USD/CHF.

Wondering about the U.S. dollar’s prospects? Gain clarity with our latest forecast. Download a free copy now!

Recommended by Diego Colman

Get Your Free USD Forecast

USD/JPY FORECAST – MARKET SENTIMENT

IG client data paints a picture of extreme pessimism towards the USD/JPY. A staggering 86.79% of traders are betting against the U.S. dollar, with a short-to-long ratio of 6.57 to 1. The one-sided positioning has widened recently, with net shorts rising 7.55% since yesterday and a substantial 47.12% higher than last week.

Our typical strategy involves taking a contrarian view of crowd sentiment. In this case, the extreme bearish bets on USD/JPY implies a potential for additional gains, even after the latest upswing. Contrarian approaches hinge on the idea that the majority can be wrong, especially during periods of strong market emotion.

Interested in understanding how FX retail positioning may influence USD/CAD price movements? Discover key insights in our sentiment guide. Download it now!

| Change in | Longs | Shorts | OI |

| Daily | 8% | -21% | -8% |

| Weekly | 9% | -22% | -8% |

USD/CAD FORECAST – MARKET SENTIMENT

IG client data reveals strong optimism surrounding the USD/CAD. Almost 61% of traders hold bullish positions on the pair, creating a long-to-short ratio of 1.56 to 1. Positive sentiment towards the U.S. dollar has intensified recently, with net-longs up 35.17% from yesterday, though moderately lower than last week’s prevailing levels.

Our contrarian approach raises a red flag about the pair’s bias. When a significant majority leans one way, it can create imbalances and unsustainable conditions, making a reversal more likely. This could mean trouble ahead for USD/CAD. Of course, sentiment is just one tool among many. Savvy traders always integrate sentiment data with tech and fundamental analysis to craft well-informed decisions.

Disheartened by trading losses? Empower yourself and refine your strategy with our guide, “Traits of Successful Traders.” Gain access to crucial tips to help you avoid common pitfalls and costly errors.

Recommended by Diego Colman

Traits of Successful Traders

USD/CHF FORECAST – MARKET SENTIMENT

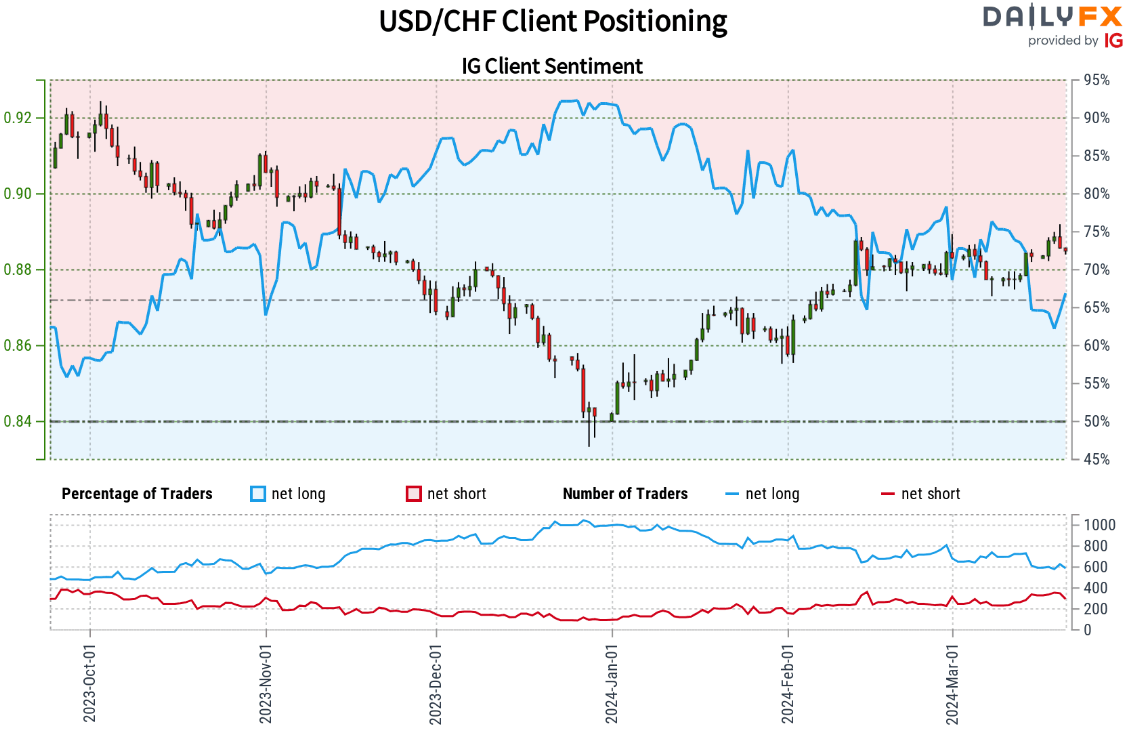

IG sentiment data reveals a strong bullish bias towards the USD/CHF. As of Thursday morning, a sizable 70.44% of retail clients hold long positions, resulting in a long-to-short ratio of 2.38 to 1. However, this bullish tilt has decreased slightly, with net-long positions down 3.75% from yesterday and 18.14% from last week.

Our contrarian strategy suggests caution regarding this heavy bullish sentiment. A significant majority leaning one way can signal a potential pullback in the USD/CHF. Of course, market sentiment is just one factor to consider. Astute traders understand that a comprehensive approach, including technical and fundamental analysis, is crucial for informed decision-making.