Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: US Dollar Forecast: Reversal Possible; Setups on EUR/USD, USD/JPY, GBP/USD

The U.S. dollar strengthened against its top peers on Tuesday, supported by higher U.S. Treasury yields, as markets tempered bets for a March interest rate cut, with odds of the event falling below 59% from 77% just one day ago.

The move was reinforced after Fed Governor Christopher Waller said the FOMC does not need to ease its stance as quickly as in the past, a sign that policymakers intend to proceed with caution. Against this backdrop, the euro, British pound and Australian dollar fell sharply against the greenback, breaking important thresholds during the pullback.

FED MARCH MEETING PROBABILITIES

Source: CME Group

In this article, we focus on the technical outlook for EUR/USD, GBP/USD and AUD/USD, analyzing market sentiment and price action dynamics.

For a complete overview of the euro’s technical and fundamental outlook, make sure to download our complimentary Q1 trading forecast now!

Recommended by Diego Colman

Get Your Free EUR Forecast

EUR/USD TECHNICAL ANALYSIS

EUR/USD sank on Tuesday, breaching the lower boundary of a short-term rising channel at 1.0930 and moving towards the 200-day simple moving average positioned just above 1.0840, which represents the next crucial support to monitor. It is imperative for this area to be maintained; failure to do so may result in a retracement towards 1.0770.

On the contrary, if the downward pressure begins to ease and prices rebound in the upcoming trading sessions, technical resistance looms at 1.0930, followed by 1.1020. Should market strength persist, attention could shift towards 1.1075/1.1095, and subsequently, 1.1140.

EUR/USD TECHNICAL CHART

EUR/USD Chart Prepared Using TradingView

Interested in learning how retail positioning can offer clues about GBP/USD’s directional bias? Our sentiment guide contains valuable insights into market psychology as a trend indicator. Download it now.

| Change in | Longs | Shorts | OI |

| Daily | 16% | -20% | -3% |

| Weekly | 10% | -15% | -2% |

GBP/USD TECHNICAL ANALYSIS

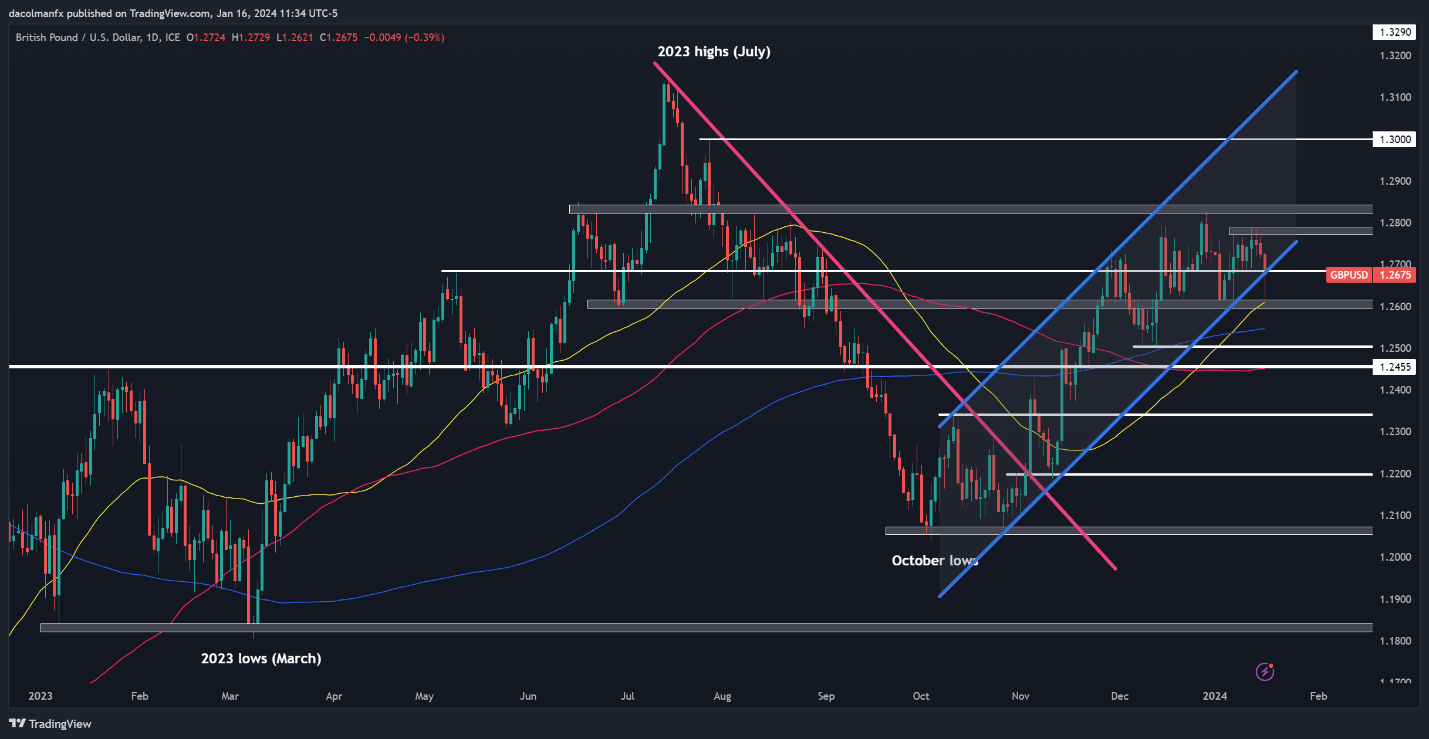

GBP/USD also took a sharp turn to the downside on Tuesday, breaking through channel support and descending towards the 50-day simple moving average located around the 1.2600 level. Cable is likely to establish a base in this region before rebounding, but a breakdown could expose the 200-day simple moving average.

On the flip side, if buyers resurface and spark a bullish reversal, initial resistance lies at 1.2675, followed by 1.2780. Sellers must resolutely protect this technical ceiling; any failure to do so might trigger an upward movement towards the December peak situated above the 1.2800 handle.

GBP/USD TECHNICAL CHART

GBP/USD Chart Prepared Using TradingView

Want to know how to trade the Australian Dollar? Get the “How to Trade AUD/USD” guide for expert insights and strategies!

Recommended by Diego Colman

How to Trade AUD/USD

AUD/USD TECHNICAL ANALYSIS

AUD/USD has slumped in recent weeks, with prices currently sitting above cluster support near 0.6570, where the 200-day SMA aligns with a long-term trendline and the 50% Fib retracement of the Oct-Dec rally. Maintaining this area is crucial; any inability to do so could trigger a descent towards 0.6525, followed by 0.6500. On further weakness, all eyes will be on 0.6460.

On the other hand, if buyers stage a comeback and propel the exchange rate higher, resistance appears at 0.6635 and 0.6685 thereafter. The bulls will have a hard time pushing prices above this barrier, but a successful breakout could pave the way for a rally toward 0.6825.