Key points of ISM manufacturing:

- Manufacturing activity fell to 46.9 in May from 47.1 previously, slightly below expectations

- New orders decline, while employment and production indicators offset weakness in other components of the ISM PMI survey

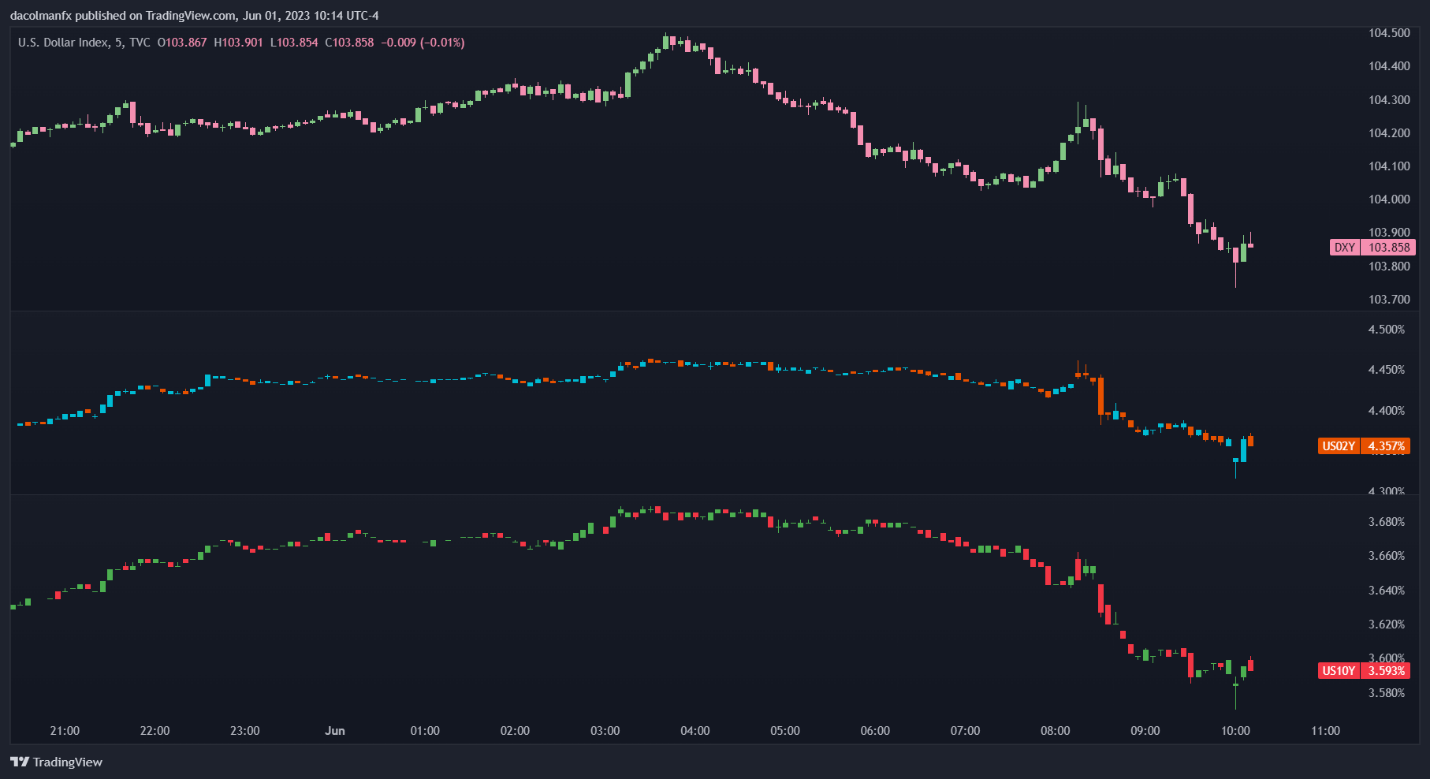

- U.S. dollar Extending losses as disappointing economic data reinforced the case for the Federal Reserve to keep interest rates steady at its meeting this month

Recommended by Diego Coleman

Get free forecasts in US dollars

Most read: The US dollar fluctuates after the conclusion of the debt deal from the House of Representatives, so will the Fed lead the dollar now?

A gauge of US factory activity worsened, extending its contraction for the sixth consecutive month in May, in a sign that the economy is still struggling to stabilize in response to weak demand conditions amid stubbornly high inflation and rapidly rising interest rates.

According to the Institute for Supply Management (ISM), the May manufacturing PMI fell to 46.9 from 47.1 previously vs. 47.00 expected, marking the lowest level since March. For context, any number above 50 indicates growth, while readings below that mark indicate a contraction in output.

Given the invisibility, the goods-producing sector of the economy was hampered by the apparent decline in the new orders index, which fell to 42.6 from 45.7. Meanwhile, employment and production indicators offset weakness elsewhere, with the former rising to 51.4 and the latter rising to 51.1.

Finally, the prices paid index eased sharply after a brief rebound in April, falling to 44.2 from 53.2, a welcome development for the Fed. Easing cost burdens for manufacturers, if sustained, could help mitigate inflationary pressures, paving the way for a less aggressive stance by the central bank.

ISM data overview

source: DailyFX Economic Calendar

Recommended by Diego Coleman

Forex for beginners

Disappointing manufacturing activity results are likely to bolster the Fed’s case for holding interest rates steady at its June meeting to assess the delayed effects of cumulative tightening and other economic risks before deciding on the next move.

The growing possibility of the Fed hitting the pause button should undermine the US dollar in the near term by impacting Treasury yields. Traders may view the “hold” as the first step towards a dovish pivot point, even if policy makers refer to it as a “skip” rather than a long pause or the end of a hiking campaign.

Immediately after the release of the ISM results, the US dollar extended losses for the session as yields fell further, but then pared the decline as the rapid response began to fade. Despite this reaction, the US dollar could head lower in the coming days as the markets try to manage the Fed’s upcoming action.