US Dollar (DXY) price, chart and analysis

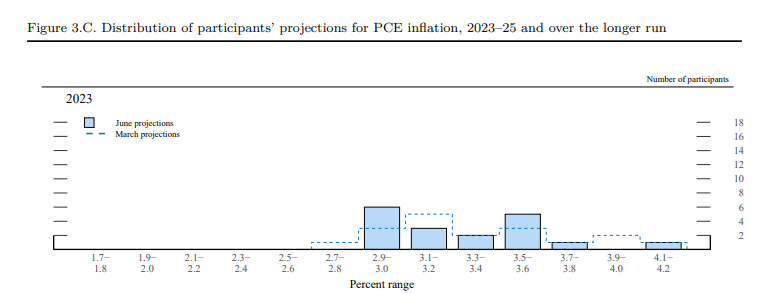

- Summary of Economic Proposals (SEP) See 50 basis point final interest rate hike.

- Markets are resisting the Fed.

Recommended by Nick Cooley

The most important trading lessons

Higher for longer price prospects due to takeaways from the FOMC meeting: Gold, Copper and the US Dollar

The Fed may raise rates by another half point to 550-575 basis points. According to the latest SEP plot, Chairman Powell continues to battle with higher and sticky price pressures. The midpoint of the target range has been raised from 5.1% to 5.6% for 2023…

… while expectations for personal consumption expenditures inflation for this year have been raised compared to last September.

See all market-influencing data releases and economic events in real time DailyFX calendar

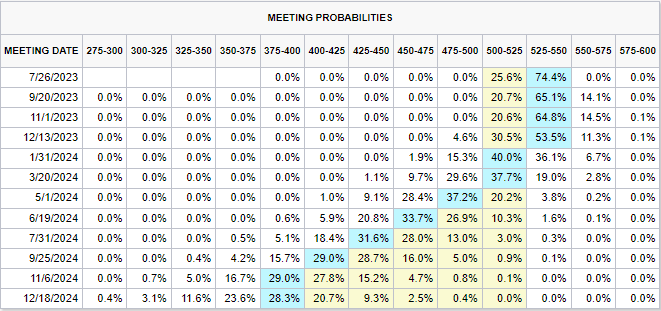

While the Fed is signaling its willingness to raise its rating by 50 basis points – depending on the data – the market is suggesting that the US central bank will raise interest rates by only 25 basis points this year before embarking on a rate-cutting cycle in 2024.

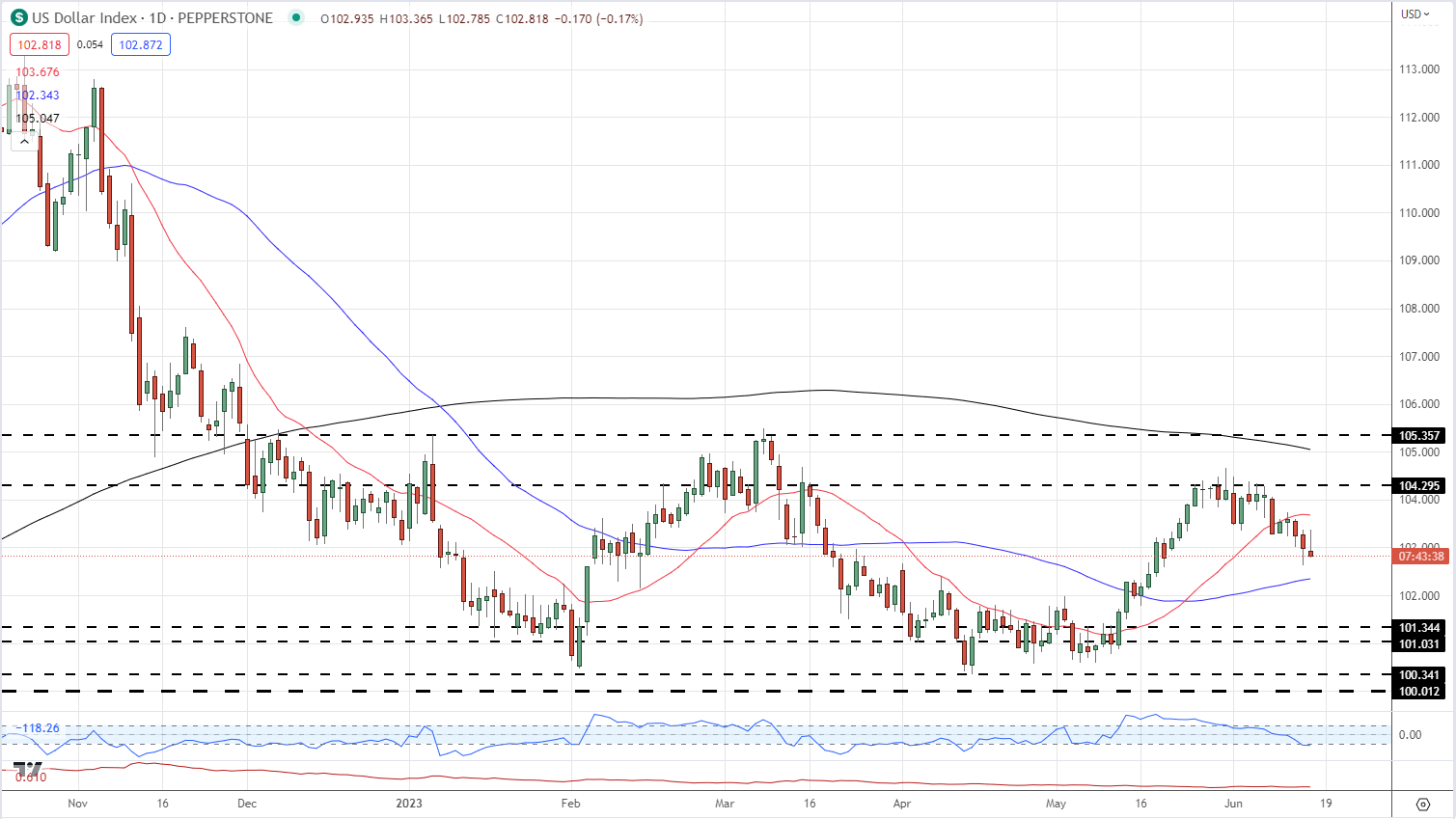

The US dollar picked up a little bid after the FOMC meeting, but that has now been pushed back as the euro rallied after the European Central Bank raised interest rates by another quarter point today. The euro makes up nearly 2/3 of the US dollar basket. The US dollar is stuck in a sideways wave pattern and is currently floating between the 20 and the 50 day simple moving averages, adding to the market hesitation. Volatility measured by ATR (below the chart) remains at or very close to multi-month lows.

Daily price chart for USD (DXY) – June 15, 2023

Chart via TradingView

what is your opinion of U.S. dollar Upward or downward? You can let us know via the form at the end of this piece or you can contact the author via Twitter Hahahahaha.