Canadian Dollar Rate, Charts and Analysis:

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

Read more: EUR/USD Rate Forecast: EUR/USD looks to the ECB forum for guidance

Canadian dollar backdrop

The Canadian dollar has had an interesting couple of weeks as the Canadian dollar had a great rally against the greenback in particular. This comes on the back of lower oil prices, which is a surprise given the correlation between the two.

Over the past two weeks, attention has been on other major central banks and their rate paths for the rest of 2023, allowing the Bank of Canada (BoC) to slip under the radar. Last week brought a summary of the Bank’s deliberations from the June meeting which confirmed that strong discussions had taken place regarding the rate hike seen in June while also pointing to a possible hike in July. The central bank stated that it was surprised by the strength of the economy as household consumption remained strong with underlying price pressure still evident across broad sectors of the economy.

Market participants are pricing in a further 25 basis points higher in July and this week’s data from Canada is likely to prove to be a key gauge. Tomorrow brings inflation data for May which will no doubt be viewed with particular interest in light of the persistent price pressures experienced by other advanced economies, most notably the UK. The weekly average earnings data may provide further evidence of the evident inflationary pressure in the labor market as we round out the week with Canadian preliminary GDP for the month of May. Increases in inflation and weekly earnings could provide further support for the Canadian dollar as rate hike expectations are likely to face a hawkish repricing as a result. There is a lot to digest and unpack for the Canadian dollar heading into the third quarter.

For all the economic data and events that move the market, see DailyFX calendar

Introduction to technical analysis

Learn technical analysis

Recommended by Zain Fouda

Price actions and possible setups

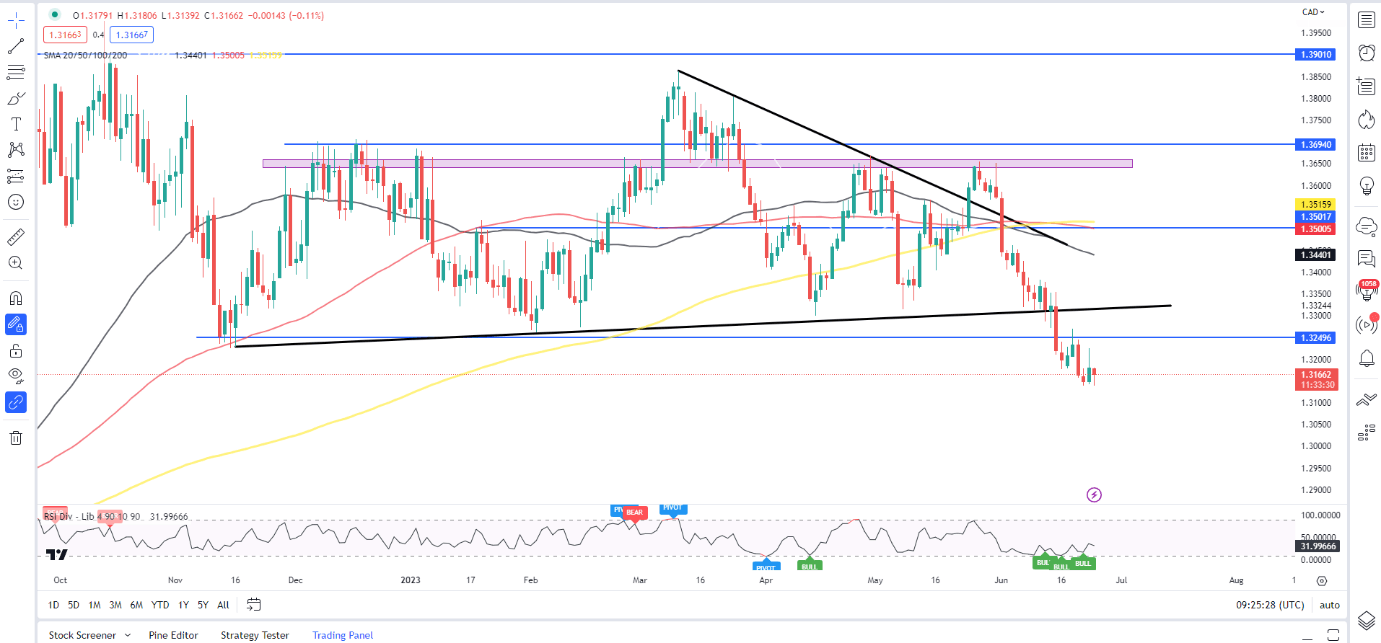

USDCAD

US dollars / Canadian dollars daily chart

Source: TradingView, prepared by Zain Fouda

USDCAD continued lower this morning after Friday’s attempt to recover. The daily candlestick closed as an inverted hammer hinting at the possibility of some bullish momentum today which has yet to materialize.

Possibility of an upward bounce here before resuming the continuation of the downside trend remains with immediate resistance around 1.3250 handle before breaching the uptrend line, and it might finally retest around 1.3320 handle.

Instead, the continuation of the bearish momentum from the current price levels brings support at the psychological level of 1.3000 with a bearish break opening for a possible retest of the August 2022 lows around the 1.2750 handle.

Key levels to watch out for:

Support levels:

- 1.3000

- 1.2900

- 1.2750 (Aug 2022 swing low)

resistance levels:

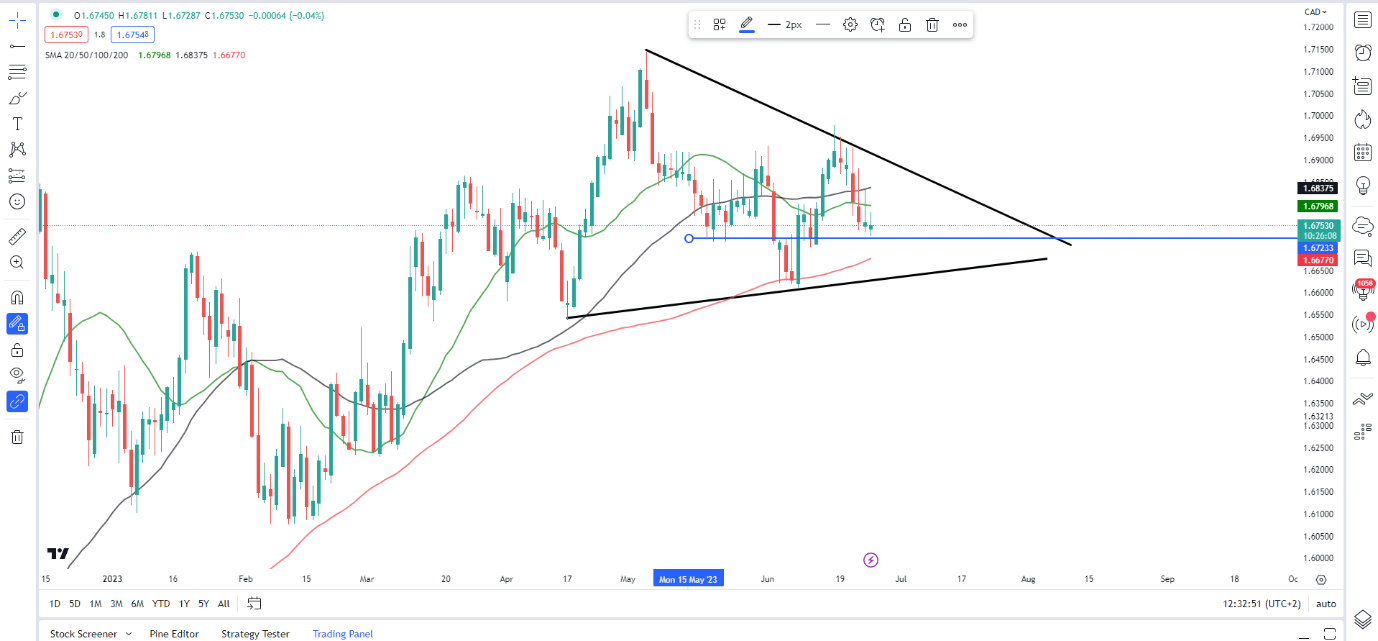

GBPCAD

British Pounds / Canadian Dollars daily chart

Source: TradingView, prepared by Zain Fouda

From a technical perspective, GBPCAD has been very interesting lately. The British pound has enjoyed a stellar rally recently, much of which was negated by the strength of the Canadian dollar before some of the losses ended last week.

Looking at the price action, it appears that we are printing higher highs and higher lows since bottoming out on June 8th. Friday’s daily candlestick closed as an inverted hammer with price action remaining mixed so far.

A daily candle’s close above 1.6720 could see a new high and a potential breach of the triangle pattern valid at the moment. Immediate resistance could be a sticking point though, with the 20 and 50 day moving averages resting at 1.6797 and 1.6840 respectively. Alternatively, a break to the downside would first require a daily candlestick to close below the 1.6720 handle before the 100-day moving average can come into focus and then a possible bearish break of the triangle pattern. A break in either direction is likely to lead to a 600 pips rally.

Key levels during the day to watch:

Support levels:

- 1.6720

- 1.6670 (100-day moving average)

- 1.6540

resistance levels:

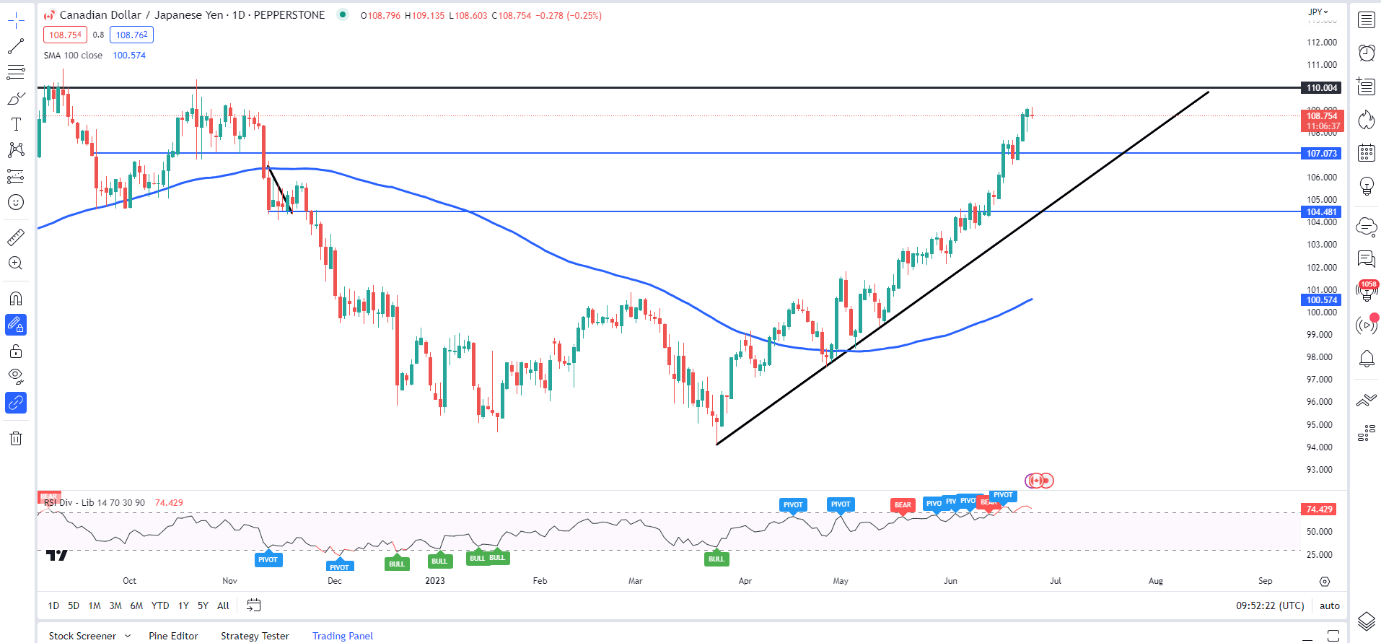

CADJPY

Canadian dollar / Japanese yen daily chart

Source: TradingView, prepared by Zain Fouda

Much like the Japanese yen crosses across the board, the Canadian dollar has enjoyed significant gains lately, with the pair now trading at levels last seen in October 2022. The Canadian dollar extended its winning streak to 6 straight weeks against the yen due to the lack of any pivotal policy from Before the Bank of Japan (BoJ) continue to influence the currency.

Just this morning we heard comments from Japanese Chief Cabinet Secretary Matsuno who confirmed that they are watching the FX markets closely as there have been sudden and unilateral moves in the FX market. The comments have sent the yen higher since then but are likely to be short-lived at this point.

Looking at the weekly chart and the 14 day RSI hovering around the overbought territory with the daily time frame tells a similar story. Not surprising given 6 weeks of consecutive gains, but whether the yen will be able to hold on to gains and push CADJPY lower remains up for debate.

Key levels to watch out for:

Support levels:

resistance levels:

- 110.00 (psychological level)

- 110.85

- 112.00

Introduction to technical analysis

Relative Strength Index (RSI)

Recommended by Zain Fouda

— Written by Zain Fouda L DailyFX.com

Connect with Zain and follow her on Twitter: @tweet