Japanese Yen rate, chart and analysis

- It will provide the most important data and events during the rest of the week for drivers.

- USD/JPY remains elevated and at levels last seen last November.

- Is GBP/JPY and EUR/JPY leading or more to come?

Recommended by Nick Cooley

How to trade the US dollar/Japanese yen

If you’re looking for three of the most popular Japanese yen pairs, USD/JPY, GBP/JPY, and EUR/JPY, the economic calendar is your friend this week with a wealth of data releases and high-interest events. US and Japanese inflation data, the BoE’s latest monetary policy decision, and Fed Chair Powell’s testimony will add additional volatility to markets that are already moving.

Wednesday 21st June

Thursday 22nd June

Friday 23 June

See all market-influencing data releases and economic events in real time DailyFX calendar

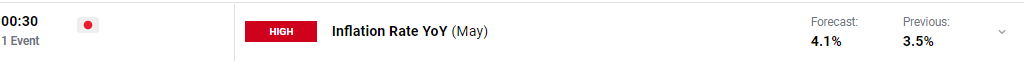

The latest push to the top in US dollar / Japanese yen It stopped in the last two sessions but there may be room to move higher. The pair might be in the early stages of forming a bullish flag, which, if completed, will leave 144.00 vulnerable. Up here 145.93 comes into focus. However, these lagging levels may soon prompt verbal intervention from the Bank of Japan (BoJ) which may look to calm the actions of the Japanese bears. The Bank of Japan may allow the Japanese yen to weaken a bit but in a more orderly way.

Bank of Japan (BoJ) – intervention in the foreign exchange market

USD/JPY daily price chart – Jun 20, 2023

|

change in |

Longs |

Shorts |

Hey |

| Daily | 0% | 1% | 1% |

| weekly | 0% | 8% | 5% |

Retail sentiment has changed little

Retail trader data shows that 31.41% of traders are net long with the ratio of short to long trades at 2.18 to 1, the number of traders are net long is 4.42% higher than yesterday and 2.07% lower than last week, while the number of traders is net short. For traders it is 0.39% higher than yesterday, and 4.04% higher than last week.

We usually take a view contrarian to crowd sentiment, and the fact that traders are short sellers suggests that USD/JPY prices could continue higher. Positioning is net less than yesterday but more net than last week. The combination of current feelings and recent changes gives us more Divergent bias in trading the US dollar against the Japanese yen.

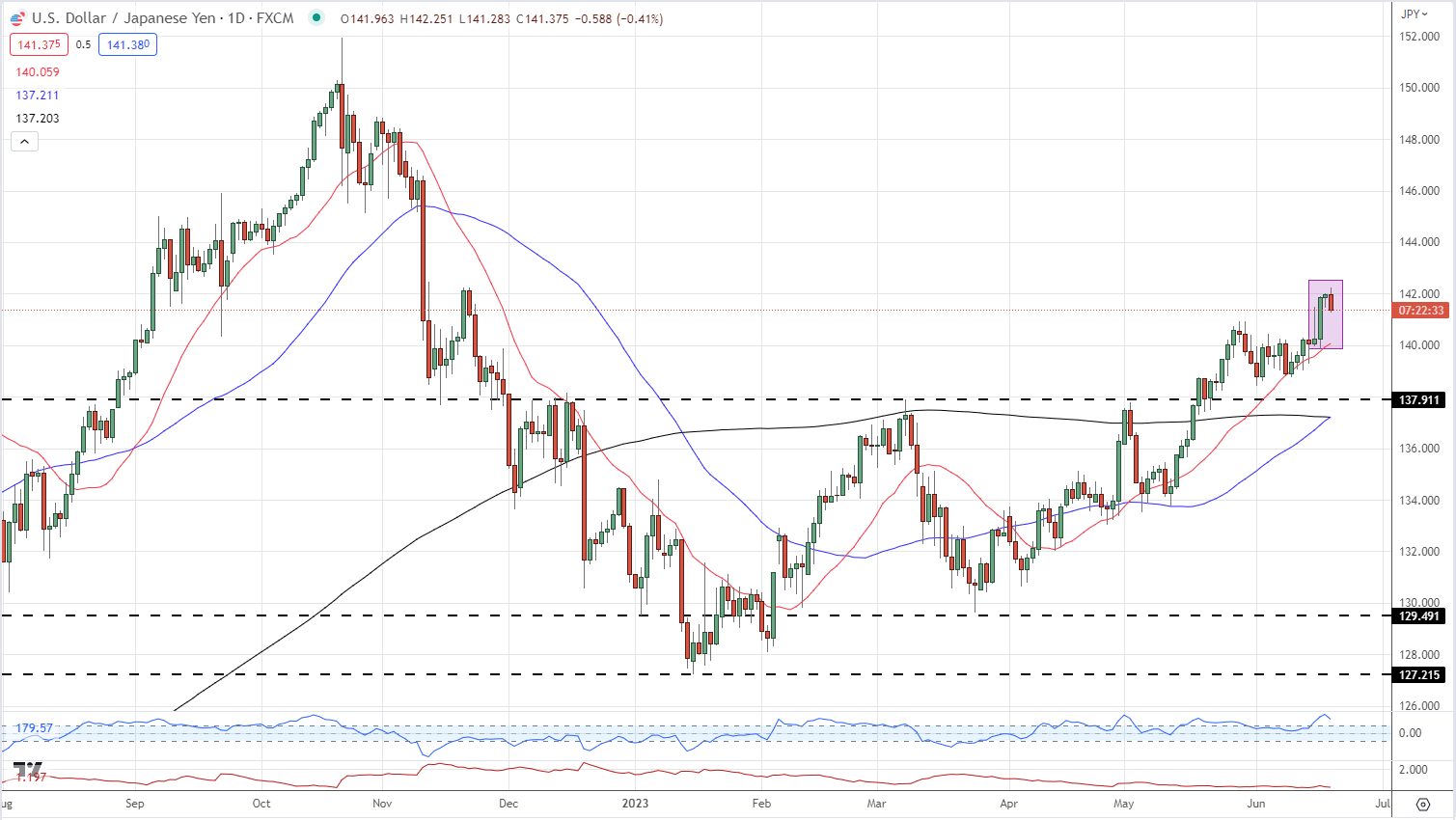

British pound / Japanese yen It started rolling since the breach above a previous resistance level (172.13) at the end of last month. The monetary background is quite different with the Bank of Japan remaining adequate while the Bank of England is expected to raise interest rates by at least 100 basis points in the coming months. This widening of the yield spread plays in favor of the Sterling. The pair made a short-term triple top just above 182, but the general technical formation still indicates more bullishness. The GBP/JPY is close to the highs last seen in January 2015, so there is little updated price data to help identify the exact resistance levels. Monthly highs from the end of 2015 at 186.35 and 188.81 may provide some help on the monthly chart.

GBP/JPY Monthly price chart – Jun 20, 2023

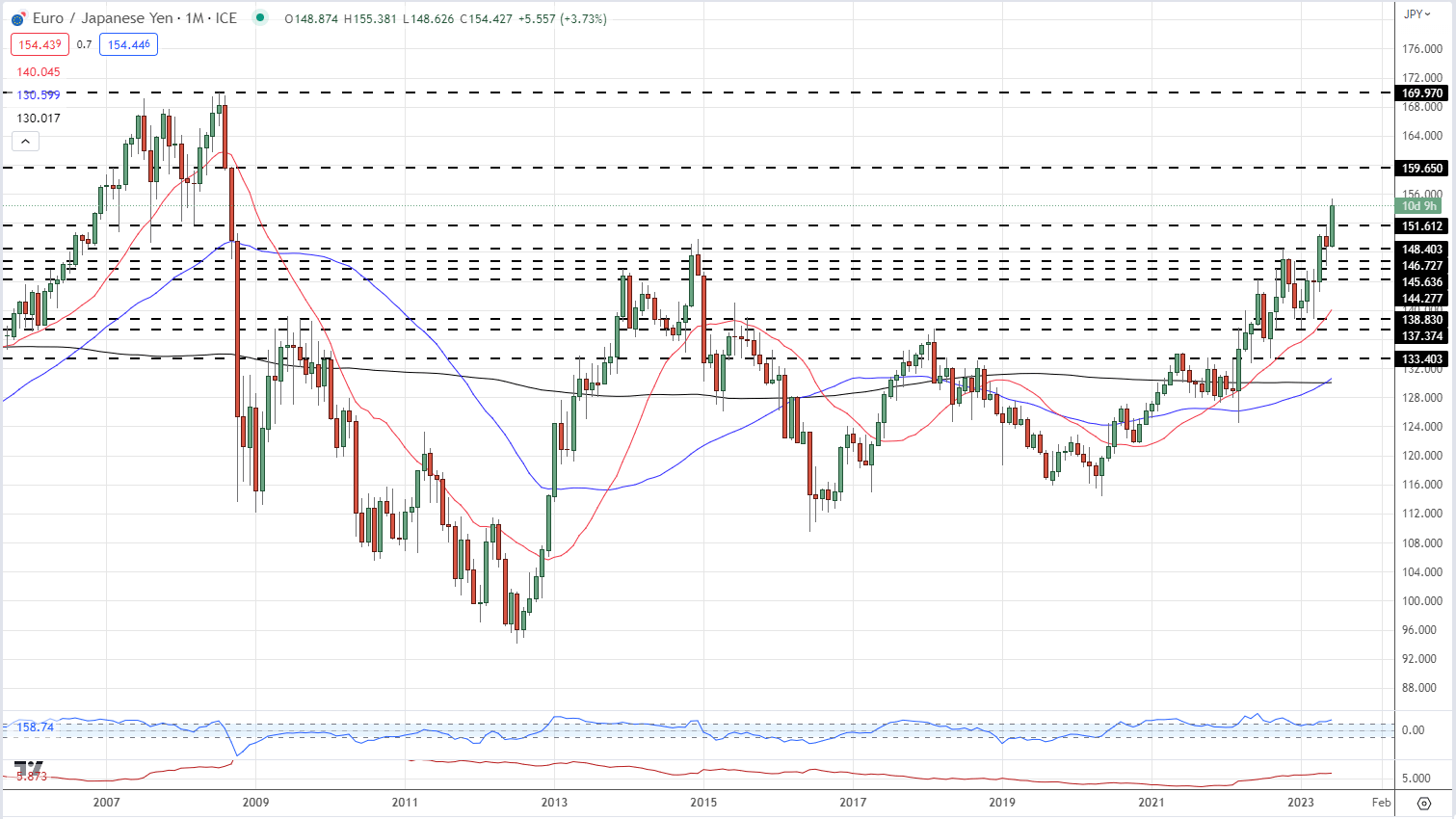

Euro / Japanese Yen Another interest rate differential game with the European Central Bank firmly in the hawkish camp looking to raise interest rates. This is the latest widening and expectations for a further widening of the rates between the two currencies, as EUR/JPY is now trading at the highs last seen in September 2008. Once again, the bias towards higher prices remains, with 159.65 as the first level of resistance but cannot A period of calm over the coming days is ruled out, especially if the Bank of Japan expresses its concerns.

EUR/JPY monthly price chart – June 20, 2023

All charts via TradingView

what is your opinion of Japanese Yen Upward or downward? You can let us know via the form at the end of this piece or you can contact the author via Twitter Hahahahaha.