S&P 500, SPX, NASDAQ 100, and NDX – Outlook:

- the Standard & Poor’s 500 The index is facing stiff resistance.

- The upward momentum is strong, however Nasdaq The 100 is looking a bit overbought at the moment.

- What’s next for the two indicators?

Recommended by Manish Grady

Trend trading basics

The S&P 500 and Nasdaq 100 are looking overbought and have encountered severe resistance, increasing the risk of a slight pullback, especially if Fed Chair Powell’s tone later on Wednesday is hawkish. However, any pullback is likely to be short-lived as bullish momentum is improving on higher time frame charts.

Markets will be looking for justification for their dovish pricing in Powell’s congressional testimony scheduled for Wednesday and Thursday. Interest rate futures currently show a 78% chance of a Fed rate hike in July, with no hike until the end of the year. In contrast, the US Federal Reserve said last week that rates may need to rise by as much as 50 basis points by the end of the year on slower-than-expected moderation in inflation and the resilience of the US economy.

The hawkish rhetoric by the Fed chair could provide an excuse to undo some long positions in stocks, which appear to be overbought.

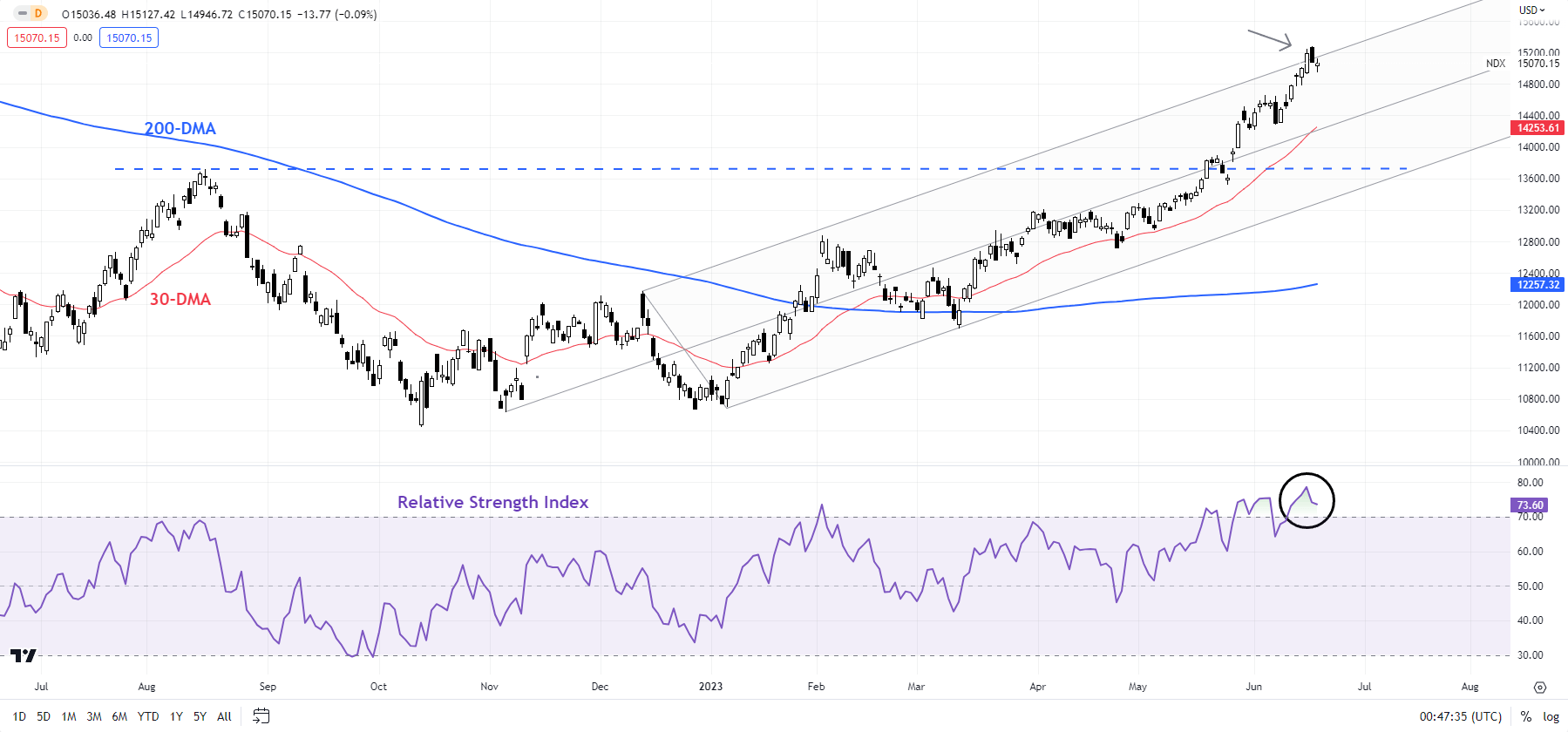

Nasdaq 100 daily chart

Chart by Manish Gradi using TradingView; Refer to the notes at the bottom of the page

NASDAQ 100: Overbought, but no sign of reversal

From a directional perspective, the trend remains bullish for the Nasdaq 100 and S&P 500, as shown by the color-coded daily candlestick charts. Moreover, in recent weeks, the uptrend has become more entrenched, given the momentum on the daily and weekly charts, thanks to the raising of the US debt ceiling and the resilience of the global economy, as highlighted by recent updates. See May 6, May 15, and May 18 updates.

Nasdaq 100 daily chart

Chart by Manish Gradi using TradingView

The Nasdaq 100 rose in May over a severe hurdle of 13,720, the high of August 2022, but is now looking to be overbought in the near term. The index is now testing a major hurdle on the upper edge of a bullish pitchfork channel from the end of 2022, near the April 2022 high of 15,265. A slight pullback cannot be ruled out. Any pullback can be contained around the 30-day moving average (now around 14,250) – the moving average has been a nice support since the beginning of the year. On the upside, the next level to watch would be the 2021 high of 16,765.

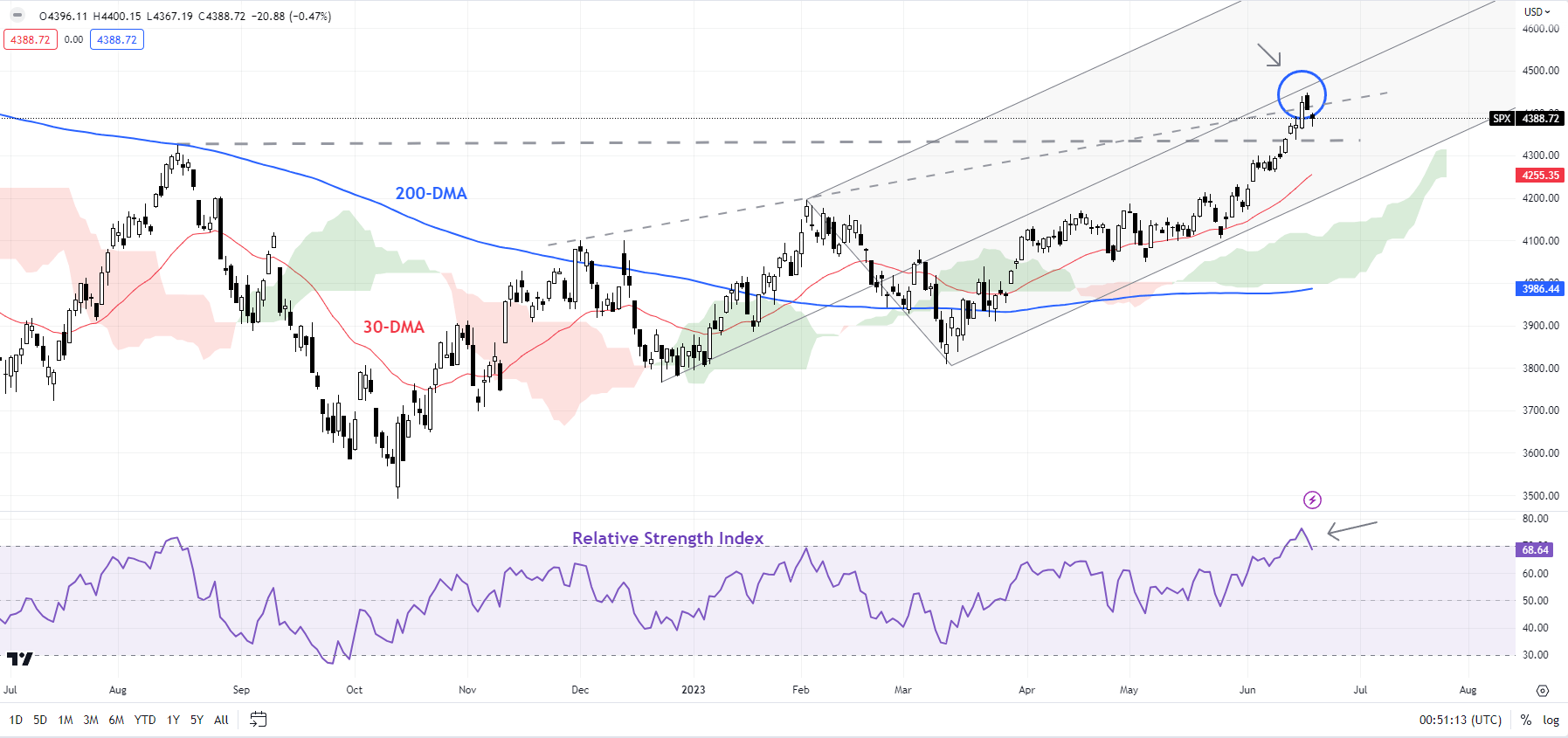

S&P 500 daily chart

Chart by Manish Gradi using TradingView

S&P 500: meeting strong resistance

The S&P 500 has faced serious hurdles recently after surging above the August high of 4325, including the upper edge of the ascending channel from December and the bullish uptrend line from the end of 2022. However, unless the index falls decisively below 30 – Daily moving average, the path of least resistance remains sideways to the upside. The next level to watch will be the April 2022 high of 4,637, and the likely 2022 high of 4,819.

Note: The above color-coded chart(s) are (are) based on trend/momentum indicators to reduce subjective biases for trend identification purposes. The blue candles represent a bullish stage. Red candles represent a bearish phase. Gray candlesticks act as consolidation phases (during a bullish or bearish phase), but they sometimes tend to form at the end of a trend. Note: Candle colors are not predictive – they only indicate the current trend. In fact, the color of the candle can change in the next bar. False patterns can occur around the 200-period moving average, around support/resistance and/or in a sideways/volatile market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

Trade Smart – Subscribe to the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to the newsletter

– Posted by Manish Grady, Strategist for DailyFX.com

Connect with Jaradi and follow her on Twitter: @JaradiManish