OPEC expects a decline in global oil demand in the second quarter

According to revised forecasts in OPEC’s monthly report for March, the second quarter is still likely to see lower global oil demand compared to the first quarter, although the group now sees a slight improvement of 70,000 barrels per day compared to last month’s numbers. In the second quarter, OPEC expects global oil demand to be 100.77 million bpd, down from the first quarter’s figure of 101.28 million bpd.

This article delves into the fundamental factors surrounding oil. For a full technical forecast, see our guide below

Recommended by Richard Snow

Learn about the key technical levels stored for Q2 Oil

OPEC World Oil Demand Forecast – March Update

Source: OPEC

The decline in global oil demand is less of a concern when considering that we are entering a period of seasonally less utilization as winter draws to a close and there is a significant gap before the summer driving period begins.

Supply exceeds demand as bearish factors accumulate

Continuing with OPEC’s monthly report for March, the cartel cites the fact that it’s pumping about 28.92 million bpd, which is about 300,000 bpd more than it expects will be needed in the second quarter. Moreover, the actual surplus could be larger if Russian production continues to show signs of resilience despite severe sanctions. Recent diplomatic discussions between Chinese President Xi Jingping and Russian President Vladimir Putin have strengthened ties between the two countries as China has seen its share of global oil purchases from Russia increase. The OPEC production forecast assumes a significant cut in production for the second quarter, opening the door to an even larger oversupply.

China was expected to do all the heavy lifting to boost oil demand growth

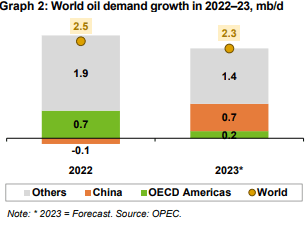

Global oil demand growth for the period 2022-2023 reveals a significant decline in non-OECD regions other than China along with a decline in OECD Americas. Global oil demand growth would almost certainly have suffered had it not been for the reopening of the Chinese economy as the anti-virus policy ended in 2022. However, even with the massive increase in Chinese demand, overall demand growth lags behind what we have seen. in 2022. So far, the impact of Chinese reopening has done little to drive up oil prices even as OPEC has implemented a planned production cut of 2 million barrels per day with mixed success. Despite this, OPEC estimates that global consumption will reach a record 101.9 million bpd this year.

Source: OPEC Monthly Report (March)

Recommended by Richard Snow

Understand the basic fundamentals of oil trading

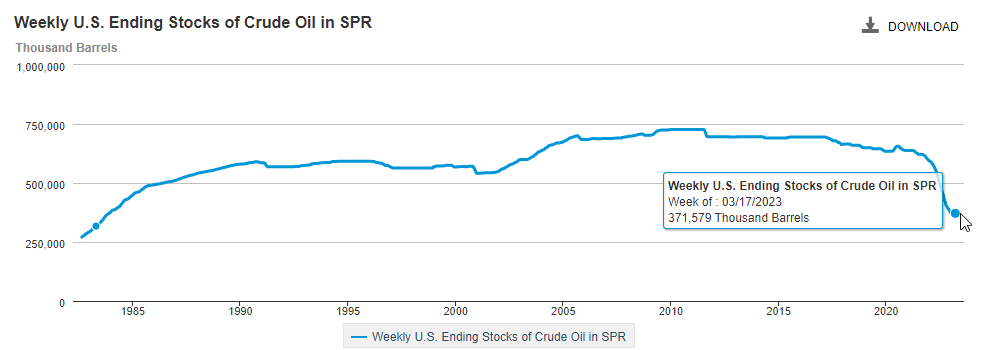

WTI put “pseudo-support” at risk when accepting the SPR recently

Energy Secretary Jennifer Granholm told US representatives at a congressional hearing that it could take years to refill the country’s Strategic Petroleum Reserves (SPR). The level required to refill greatly diminished oil reserves was said to be between $67 and $72, or when prices were seen trading below $70 for a long time. Therefore, this level held consistently whenever WTI prices fell, as markets anticipated the possibility of mass buying from the US government. This has now been removed.

Despite persuading Congress to cancel further sales of 140 million barrels between 2024 and 2027, the Department of Energy is still slated to sell 26 million barrels of Strategic Petroleum Reserve to help with the federal budget.

The chart below showing the current level of reserves appears nearly identical to the levels we saw in last quarter’s update, confirming that such large-scale purchases to replenish dwindling inventories have yet to take place.

Weekly chart of US crude oil inventories in the Strategic Petroleum Reserve

Source: here

Comments are closed.