the USD On Wednesday, it saw a slight decrease of -0.59%. The decline in Treasury yields on Wednesday weakened the US dollar. The lack of clarity regarding the US debt ceiling also affected the dollar after that Treasury Secretary Yellen He said the Treasury could run out of cash to pay its bills as early as June 1, unless the debt ceiling is raised. The dollar maintained a slight decline on Wednesday despite the Federal Reserve raising interest rates by 25 basis points in line with expectations, as well as economic data tilting in favor of the dollar.

ADP Employment Change for April rose to +296,000, stronger than forecast of +150,000 and the biggest gain in 9 months. The ISM Services Index for April rose +0.7 to 51.9, stronger than forecasts of 51.8.

although Federal Open Market Committee Raising the Fed funds target range by +25 basis points from 5.00% to 5.25% As expected, the post-meeting statement was dovish and bearish for the dollar. The FOMC dropped previous language that suggested more rate hikes to come, instead saying that the Fed’s assessment of monetary policy and its effects will be ongoing and that for any move forward it will look at accumulating data.

Powell said banking conditions have broadly improved since March. He predicted moderate economic growth, not a recession, though a mild recession was likely. He added that the FOMC sees inflation declining “not very quickly”. It is not yet possible to cut interest rates.

Meanwhile, the yield on the 10-year US Treasury fell below the 3.4% level, just below the one-month high of 3.6% it touched on April 19 after The Federal Reserve raised interest rates by 25 basis points as expected and indicates a possible pause in the 14-month tightening cycle.

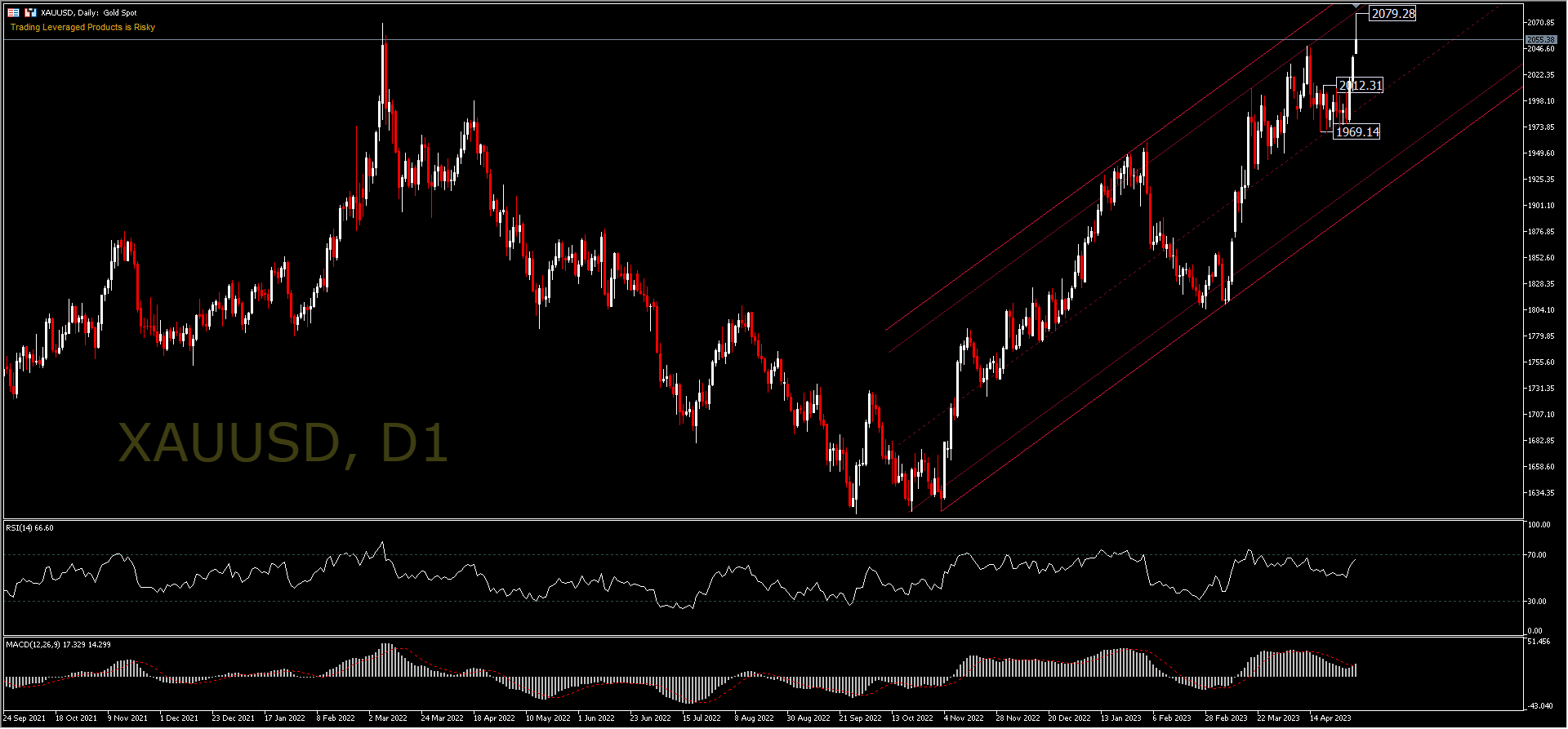

Precious metals closed slightly higher on Wednesday, with gold hitting a two-week high. The weakness of the US dollar on Wednesday supported metals prices. Additionally, yesterday’s drop in global bond yields was bullish on metals. there was Safe Harbor support Amid concerns about the health of the US banking system and with the US government on the verge of default without extending the debt ceiling. But the opening of the Asian morning session, HAUUSD It was up 2% which led to a fresh start to the year-to-date 2079.28, before returning to 2050 Range before the opening of Tokyo.

Technical review

gold Reprinted a new copy to date of 2079.28. HAUUSD March resistance invaded 2020 in 2070.24 August 2020 resistance at 2075.08 is forming Triple top. Mid-range support is currently on 1969.14 And in the short term 2012.31 The price area is still considered support. The RSI technical indicator is fluctuating in the bullish range 66, which indicates that there is no saturation yet, moreover, the MACD is giving a overbought signal again.

Further upward movement is expected for the FE100 at 2147.69 In the long run, derived from 1616.55–1959.68 And 1804.56 the prices. And at the same time lower below 1969.14 It will indicate the completion of the uptrend, and the price will enter a corrective wave.

click here To access our economic calendar

Eddie Fangisto

Market Analyst – HF Education Office – Indonesia

Disclaimer: This material is provided as general marketing communication for informational purposes only and does not constitute independent investment research. Nothing in this communication contains, or should be deemed to contain, investment advice, investment recommendation or solicitation for the purpose of buying or selling any financial instrument. All information provided is collected from reputable sources and any information containing an indication of past performance is not a guarantee or a reliable indicator of future performance. Users acknowledge that any investment in leveraged products is characterized by a certain degree of uncertainty and that any such investment involves a high level of risk for which the Users are solely responsible. We accept no liability for any loss arising from any investment made based on the information contained in this communication. This communication must not be reproduced or distributed again without our prior written permission.

Comments are closed.